WASHINGTON, July 15, 2015 - Despite record market prices that entice North American bison ranchers to sell every animal that’s ready for slaughter, they, like cattle operations, are slowing their selloff and retaining more heifers and cows than in several recent years in new efforts to restore shrunken herds.

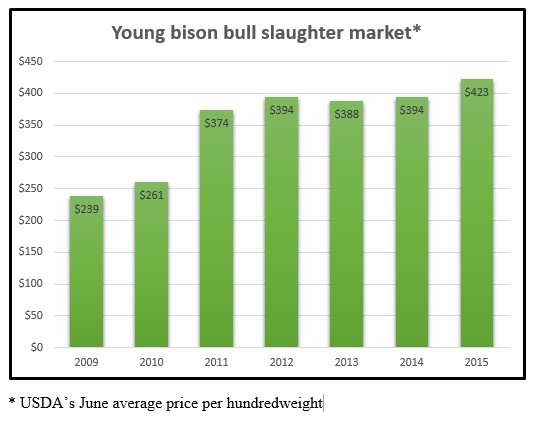

While cattle prices, too, remain very high, young bison bull carcasses averaged a record $423 a hundredweight in June – nearly twice choice beef carcass prices. But bison ranchers have already enjoyed strong profits for several years, and they don’t have enough slaughter animals to meet demand. The 60,000 bison slaughtered in commercial plants in 2014 was down 14 percent from 2013, and the June tally was a third less than for June 2014.

“The market is very, very tight,” says Dave Carter, chief executive of the National Bison Association (NBA). He explains that the bison market was dismal a decade ago, and “we were in a tough spot.” The U.S.-Canadian inventory shrank from 400,000 about a decade ago to less than 300,000 as the ranks of U.S. bison operators plunged from 5,000 in USDA’s 2002 census to just 2,564 in 2012, while those of their Canadian peers fell from nearly 1,000 to under 600.

And though bison prices recovered well after 2007, the strong prices prompted continued sell-offs: Wisconsin’s 2002 herd of 8,300 was just 4,246 in 2012, for example, USDA found. Soon after the long and deep drought in the much of the Plains and West from mid-2011 through 2013 left about 80 percent of U.S. bison production areas very short of pasture and hay. So most operators delayed expansion, or were forced to shrink their herds.

“As a result, we

are now slaughtering the drought-year calves of 2012 and 2013,” which is a

small inventory, and the bison slaughter plants and meat markets can’t nearly

keep up with demand. In an NBA meat marketers survey in May, “50 percent reported

they are having to short their customers on bison meat, and 93 percent of them

said they’re short on trim [for making burger],” Carter said.

“As a result, we

are now slaughtering the drought-year calves of 2012 and 2013,” which is a

small inventory, and the bison slaughter plants and meat markets can’t nearly

keep up with demand. In an NBA meat marketers survey in May, “50 percent reported

they are having to short their customers on bison meat, and 93 percent of them

said they’re short on trim [for making burger],” Carter said.

That short supply is despite the lofty prices consumers shell out for bison meat. Bison burger is typically $9-$10 a pound at retail, compared with an average of $6.20 for extra lean ground beef, for example, and retail prices for bison ribeye and tenderloin steaks are marked up substantially from the $11-$20 a pound wholesale prices.

Demand for bison stems from its nutritional features, including fat content just a fourth to a third that in pork, skinless chicken or lean beef. Also, Carter says that a lot of meat buyers prefer the way bison are raised: on a grass and forage diet (very little grain), and no drugs or growth hormones. Though bison and cattle are similar animals, their markets are separate: “We are not in the business to compete with the cattle market,” Carter says.

Meanwhile, slaughter reports showing the proportion of heifers versus bulls is falling is a signal that bison ranchers are taking advantage of this year’s vastly improved forage production and pasture conditions and trying to again expand herds. “When the 2017 Census [of Agriculture] comes out, I expect we’ll see a pretty good turnaround in the herd numbers,” Carter says.

In Regina, Saskatchewan, Canadian Bison Association President Mark Silzer sees a similar move by Canada’s 600 bison ranchers to retain more heifers. That is despite a drought that’s parching pastures and hay crops in much of the province as well as in Alberta and part of Manitoba, the country’s main bison grazing regions. The soaring market prices – capped by a cheap Canadian dollar that adds about 20 percent to Canadian export receipts – are a big enticement, especially because Canada supplies about 35 percent of the bison going to U.S. slaughter plants.

Canadian ranchers are also anticipating a boost in meat export sales via the Comprehensive Economic and Trade Agreement between Canada and the European Union. A phase-out of the 22 percent tariff on bison meat to the EU is to begin in 2016.

Despite the occasional tallies by USDA and the Canadian government of bison on farms, rancher groups view the estimates of herds in parks and many other public and tribal lands as potentially off the mark. Best guesses are for perhaps 340,000 head on the continent, including up to 150,000 in Canada. But note that the USDA Animal and Plant Health Inspection Service will report late this summer on a special survey of U.S. bison health, vaccines, locations, herd size and more -- perhaps improving on the U.S. count. By comparison, the U.S. cattle inventory at the start the year totaled almost 90 million head.

#30

For more news go to: www.Agri-Pulse.com