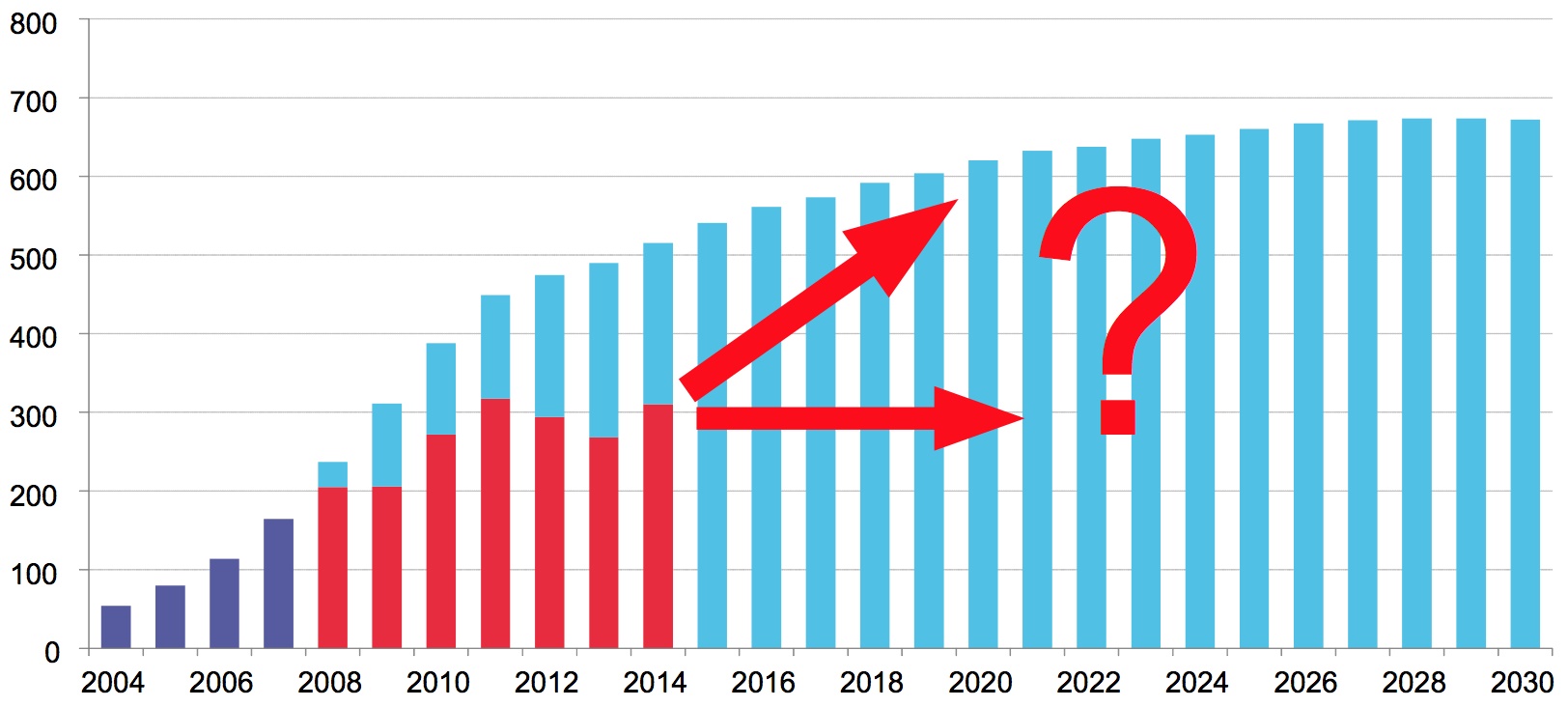

Bloomberg New Energy Finance explains that “The blue lines are what’s needed, in billion$ per year; the red lines show what’s actually being spent. Since the financial crisis, funding has fallen well short of the target.” Source: Bloomberg New Energy Finance

Source: Bloomberg New Energy Finance

Pledging to work with the United Nations to address climate change, the six said that for them to increase their existing efforts to reduce carbon emissions, “we need governments across the world to provide us with clear, stable, long-term, ambitious policy frameworks” in order to “help stimulate investments in the right low-carbon technologies.” The oil majors agreed that “a price on carbon should be a key element of these frameworks.”

Senate Environment and Public Works Committee (EPW) Chairman Jim Inhofe, R-Okla., sees no need for reining in fossil fuels. Commenting on the IEA’s climate report, he tells Agri-Pulse that “IEA’s report includes unrealistic conclusions devoid of merit and substance. They would pare back the technological advancements and economic developments made throughout the last century while harming the most vulnerable members of our society by making energy more expensive and less accessible.”

Research Fellow H. Sterling Burnett at the Heartland Institute, a Chicago-based conservative think tank, also rejected the IEA plan.

“Even if there was a startling breakthrough in technology today that would, for example, allow the world to store power generated by wind and solar generating units for release when the wind isn’t blowing or the sun not shining, it would be decades before this technology substantially replaced fossil fuels,” he tells Agri-Pulse. “Even with a breakthrough, he added, “disruptive technologies always come at great costs.”

Responding to the IEA’s contention that the countries and companies “that do not anticipate stronger energy and climate policies risk being at a competitive disadvantage,” Burnett warns that countries that switch from fossil fuels to “less reliable, more expensive forms of energy” will be “at greatest risk of seeing their economies falter and be placed at a competitive disadvantage.”

“Absent government support, renewable energy sources would all but disappear in the U.S.,” Burnett said. He acknowledges China and India are investing in renewables but contends that “they are developing fossil fuel sources, fossil fuel power plants, and trading relations with countries with access to fossil fuels at an even faster pace.”

#30

For more news, go to www.agri-pulse.com.