WASHINGTON, Jan. 11, 2017 - In the U.S. farmland cash rent arena, landlords may see further erosion on their returns while tenants should expect mostly stable to moderately falling rates.

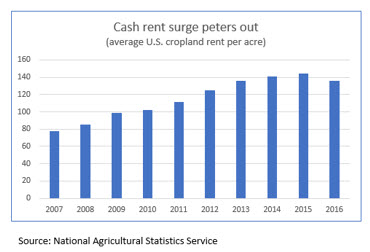

Farmers/operators renting land are, of course, painfully aware of the swift run-up in cropland rents. On average, 2016 cash rents were up 70 percent since 2006 nationally (see graph). Across the Corn Belt, the average rose similarly and peaked in 2014 at $212 per acre. The spike in Northern Plains rents was even sharper: up 113 percent, to $114, from 2006 to 2015.

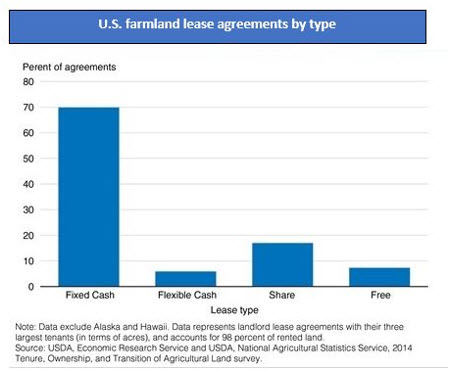

Yet, when looking at the economic drivers and long-term trends, farmland rents are actually at historically soft levels, and experts advise they aren’t likely to stiffen soon. That’s a big deal in the farm economy: With about 40 percent of farmland in the lower 48 states rented, and about 70 percent of those acres leased on fixed-dollar rates, cash rents are a big slice in crop production budgets.

Fortunately for tenants, the rates on both cropland (see

graph) and pastureland have finally receded in the past year or two in most

regions after a steep, steady climb for about a decade. USDA’s national

estimate of net cash rent, which reflects both reduced rates and fewer acres

rented, peaked in 2014 and has fallen 13 percent since.

Fortunately for tenants, the rates on both cropland (see

graph) and pastureland have finally receded in the past year or two in most

regions after a steep, steady climb for about a decade. USDA’s national

estimate of net cash rent, which reflects both reduced rates and fewer acres

rented, peaked in 2014 and has fallen 13 percent since.

“What is driving cash rental rates is the return that farms can generate – the budgeted figures given the costs and the yields and the market prices currently out there,” says Gary Schnitkey, agricultural economics professor at the University of Illinois. But farm income has fallen significantly since its robust levels of 2012 and 2013, squeezing the amounts available for rent in the crop budgets. “That is what’s bringing the cash rents down,” he says.

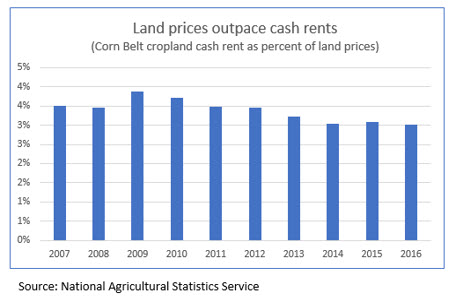

That squeeze on crop budgets has reined in the usual

relationship between the rental rates and farmland prices. The owners of about

80 percent of rented farmland are absentee landlords, not farm operators, and

most of them expect an annual financial return on their land in addition to

whatever appreciation may accrue in the land’s value. The return, measured by

dividing the rental rate by the land’s value, has eroded over recent decades:

from more than 5 percent, on average, for U.S. cropland two decades ago to 3.3

percent in 2016, according to USDA surveys. For the Corn Belt, that percentage

slipped from 3.7 percent in 2010 to 3.0 percent in 2016 because increases in

rental rates were slower than the steep climb in average cropland values, which

doubled in seven years to $7,000 per acre in 2014.

That squeeze on crop budgets has reined in the usual

relationship between the rental rates and farmland prices. The owners of about

80 percent of rented farmland are absentee landlords, not farm operators, and

most of them expect an annual financial return on their land in addition to

whatever appreciation may accrue in the land’s value. The return, measured by

dividing the rental rate by the land’s value, has eroded over recent decades:

from more than 5 percent, on average, for U.S. cropland two decades ago to 3.3

percent in 2016, according to USDA surveys. For the Corn Belt, that percentage

slipped from 3.7 percent in 2010 to 3.0 percent in 2016 because increases in

rental rates were slower than the steep climb in average cropland values, which

doubled in seven years to $7,000 per acre in 2014.

Cash rents would have fallen faster, except for “what we call the lag effect with cash rents,” says Michael Downey, accredited farm manager with Hertz Farm Management Inc. in Mount Vernon, Iowa. “That is the challenge we find with cash rents: They tend to lag behind [changes in] commodity prices and farm incomes,” he says.

Downey notes that annual cash rents are typically set several months before the start of a new crop season, and he believes “cash rent definitely had a target on its back a year ago.” So, he says, “Cash rents need to start coming down to adjust for lower commodity prices and farm income.” USDA surveys show that 2015 cropland rents in Iowa were down 4 percent, and down 6 percent for 2016. Last year, for the farm accounts he manages, he says, “generally, I lowered rents 5 to 10 percent, and I’m doing that again for 2017.”

Downey and another professional farm manager, Dennis Reyman, with Stalcup Ag Service in Storm Lake, Iowa, point to the 2016’s bin-busting harvests and the opportunities to hedge some of the harvest at moderately good prices last year, plus last fall’s arrival of USDA payments on 2015 crops. Owing also to friendlier input prices (fertilizer, fuel, credit, etc.), they report that most farms under their watch earned profits for 2016, despite dismal market prices for most of the year.

“The last two years have had great yields. The income [for soybeans] was at least $100 more per acre than we planned on a year ago. Corn was $50 better than expected,” Reyman said. Nonetheless, like Downey, Reyman cut rental rates as much as 10 percent on most accounts for 2016 crops, and “for 2017, perhaps 5 percent to 10 percent is typical.” Now, he says, “I think we are pretty close to stabilization” of cash rental rates, considering that 2016 produced better-than-expected results.

Kevin Patrick, USDA Economic Research Service farm finances analyst, says further dips in cash rent are likely wherever the outlook for profitable crop production is poor. “If there is the expectation that farm income is going to decline or remain at the same low level, that will have an impact on what people are willing to spend to either purchase or rent land,” he says.

Cortney Cowley, economist at the Omaha branch of the Federal Reserve Bank of Kansas City, says bankers in the seven states of the Plains and West served by her bank also typically expect further cash rent erosion. “On the average, going into 2017, we still see rents going down anywhere between 5 and 10 percent,” she says, although “we still see a lot of variability in both farmland values and cash rental rates.” She notes that, for example, landlords hit with property tax hikes more often resist reduction in the rent.

Another major factor restraining farmland cash rent increases is prevailing interest rates on long-term financial investments. That happens because the financial market rates compete for investors against the 3 to 4 percent return on farmland rent. Low interest rates in the financial market reduce the capital cost of buying farmland (low land mortgage rates), thus increasing the value of land and profitability of owning it.

But the reduced interest costs in buying farmland also

benefit the tenants because less money is needed from the tenant to pay off

interest on the mortgage. As a result, although falling interest rates drive up

land prices, cash rents don’t go up as fast as the land prices. Thus, low

interest rates are generally associated with soft cash rental rates.

But the reduced interest costs in buying farmland also

benefit the tenants because less money is needed from the tenant to pay off

interest on the mortgage. As a result, although falling interest rates drive up

land prices, cash rents don’t go up as fast as the land prices. Thus, low

interest rates are generally associated with soft cash rental rates.

Schnitkey illustrated that relationship by comparing the interest rate paid on a 10-year U.S. Treasury note with the ratio of Illinois cropland rental rates to Illinois cropland prices. Both were at around 6 percent 20 years ago, and the Treasury note has since declined to about 2 percent while the land rent/value ratio has fallen to 3 percent. He points out that the Treasury note’s yield has fallen more than the land rent/value ratio, and he thinks that leaves room for further erosion of farmland cash rents. At least, he says, interest rates are not going to encourage higher cash rents unless interest rates jump a lot.

Patrick agrees: “I think there will be some minor interest rates increases over the next year or two. But interest rates are so low . . . that I just don’t think a small change in interest rates is going to affect cash rents.”

#30

For more news, go to: www.Agri-Pulse.com