WASHINGTON, Feb. 19, 2014 - Now that the farm bill is finalized… get ready for lots of decisions

A consistent theme heard from farmers throughout development of the new farm bill centered on “choice” in the commodity title. But now, the plethora of choices available - including potential interactions between the commodity title and crop insurance - has some growers wondering if they’ve actually gotten too much of a good thing.

“Producers wanted options and this bill delivers plenty of them,” says Texas A&M Extension Ag Economist Joe Outlaw explained during the Crop Insurance Industry convention last week, “But this could be the most complicated set of decisions they’ve ever seen.” Further complicating the process is the fact that growers may be asked to make some decisions in 2014, even though some details may not be available until 2015.

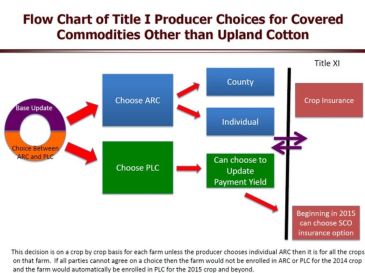

Here’s a sampling of the decisions that the typical grower of basic commodity crops will have to make on a crop by crop basis for each farm – unless he or she selects individual Agricultural Risk Coverage (ARC), which applies to all crops on the farm. Outlaw also outlined part of the decision-making process in the graphic below:

Should I reallocate base acres?

Should I select ARC at the county or individual level, or Price Loss Coverage (PLC)?

If I select PLC, should I update payment yields?

Should I select the Stacked Income Protection Program (STAX) or the Supplemental Coverage Option (SCO) for cotton?

If I also buy crop insurance, should I select an enterprise or individual unit?

What type of insurance policy should I buy and what coverage level?

Should I select trend adjusted yields or not?

Should I buy SCO with PLC or not?

Outlaw is one of several land grant university experts who hope to develop a set of decision-making tools and educational materials before USDA starts to offer commodity program signup later this year. In addition, several commodity groups are ramping up their education efforts. But still, producers will need to do plenty of homework before enrolling in these new programs. After all, it’s not like you can opt in or out if you make a bad decision one year. The choice between revenue protection in ARC and price protection in PLC is a one-time decision that lasts the life of the five-year farm bill.

Within the revenue protection option of the commodity title, growers have an option to choose between a county-level ARC program that is allocated crop by crop or a whole-farm ARC program that is allocated for all crops on the farm. Producers may instead choose the PLC target price program, in which case they can also participate in the Supplemental Coverage Option (SCO) crop insurance program. The Risk Management Agency hopes to have SCO ready this summer for fall planted crops, but some sources worry that program information may be delayed.

Brad Lubben, assistant professor and extension public policy specialist at the University of Nebraska-Lincoln, said implementing PLC and county ARC should be relatively simple for USDA, because the methods are already in place. However, he noted that individual ARC will be more complicated and “will mean more paperwork” at the Farm Service Agency (FSA).”

In an interview last week with Agri-Pulse, Lubben noted that “decision tools will be critical” for producers this summer. The farm bill provides $3 million in funding for education efforts and a competitive grant for an online decision-making tool.

Lubben said a June sign-up is an optimistic timeline, but decision tools being developed to analyze the programs should be available shortly after USDA finalizes the program rules.

Most producers, particularly in the Midwest, will likely weigh the benefits of county ARC versus PLC paired with SCO. The decision largely depends on whether a producer is more worried about prices falling below target level or revenue within the next five years, Lubben said.

With corn at $4.25, producers will be asking themselves, “How many years until it hits $3.70? [The 2014 corn target price per bushel]”

With lower market prices, “PLC has become more relevant for corn than soybeans at the moment, although ARC still starts with a higher effective guarantee and could protect more revenue for the life of the farm bill,” he noted. “Farm ARC could also prove beneficial for producers, although changes in the provisions in the final bill appear to make it more complicated and less effective for individual producers compared to the original Senate proposal.”

American Farm Bureau Federation (AFBF) Economist Matt Erickson briefed a small group of young farmers on the new programs within the farm bill during the AFBF Young Farmers and Ranchers Conference earlier this month. He said the individual or whole-farm ARC program could accommodate those with yields outside the county average.

Producers should also consider how to best cover the gap between their personal crop insurance level and their farm program coverage level. Lubben emphasized that producers should analyze their entire farm and risk management “portfolio,” which includes farm payments, crop insurance and revenue.

“It should be a decision about how to adopt the most effective safety net, versus getting the biggest government payment,” he said, noting that comparisons of the old ACRE and DCP programs tended to encourage focus on the latter. He also noted that it’s more obvious in this farm bill that those decisions significantly affect each other.

“Too many producers make a farm program decision, then a crop insurance coverage decision, then a marketing decision,” he said. “They all need to be in the portfolio.”

To assist farmers, students and policy experts on the new crop insurance policies within the farm bill, the National Crop Insurance Services is providing an updated version of the online resource Crop Insurance: Just the Facts. The resource offers details on the introduction of SCO and the STAX program for cotton, as well as the conservation compliance provision for crop insurance.

"The 2014 Farm Bill is a turning point in federal policy towards agriculture, pivoting away from the traditional support mechanism paradigm of the past and into a risk management model that features crop insurance as farmers' primary - or only - risk management tool," noted Tom Zacharias, president of National Crop Insurance Services.

#30

For more information, go to www.agri-pulse.com.