WASHINGTON, April 5, 2016 - Norway’s giant oil and gas company Statoil says it is determined to “build a profitable renewables business” as part of “transforming the oil and gas industry” and “providing energy for a low-carbon future” in the U.S. and around the globe.

As

the largest North Sea offshore oil operator, a major player in U.S. oil fields

including Marcellus, Bakken, Eagle

Ford and the Gulf of Mexico, and operating in 37 countries, Statoil

sees itself continuing

to find, transport, and sell vast quantities of oil and natural gas around the

world.

As

the largest North Sea offshore oil operator, a major player in U.S. oil fields

including Marcellus, Bakken, Eagle

Ford and the Gulf of Mexico, and operating in 37 countries, Statoil

sees itself continuing

to find, transport, and sell vast quantities of oil and natural gas around the

world.

The company also says it expects to continue aggressively researching, developing, and marketing renewable energy including wind, solar, and geothermal energy. This focus on renewables has already resulted in Statoil operating the world’s first floating offshore wind turbines with a unique control system that compensates for wind and wave movements. Now that its floating turbines are operating successfully off Britain’s coastline, Statoil is adding onshore battery storage and hopes to bring this new technology to U.S. waters soon.

While 63 percent of Statoil’s 1.97 million barrels of oil equivalent per day comes from deep-water platforms off Norway’s coast, the company is producing oil and natural gas in Algeria, Angola, Azerbaijan, Brazil, Canada, Ireland, Nigeria, Russia, the UK, the U.S., and Venezuela. Statoil also operates two refineries, two natural gas processing plants, and one LNG plant.

Between meetings with Washington policymakers, Statoil Executive VP Irene Rummelhoff told a Center for Strategic & International Studies (CSIS) forum last week that Statoil has a solid profit incentive to invest in renewable energy.

This week in New York, Rummelhoff joins Secretary of State John Kerry as a featured speaker at the Bloomberg New Energy Finance “Future of Energy Summit” to deliver her message that renewables provide a growth opportunity for major oil companies like Statoil.

Rummelhoff, a petroleum geoscientist who has worked for Statoil since 1991, including a stint in Houston from 2010 to 2014, now heads Statoil’s New Energy Solutions division which is responsible for wind parks, carbon capture and storage (CCS) projects, battery storage, and other renewable energy and low-carbon energy investments.

Rummelhoff sees renewables like wind, solar and geothermal as a natural fit for a major oil company. She explains that tapping the full potential of renewables requires Statoil’s proven assets: its expertise in planning and operating immense projects which involve high risk, high entry barriers, huge costs, hostile weather conditions, disruptive technology, and “double-digit returns and far beyond that.” She told the CSIS forum: “If you want to build a real business and a profitable business within the next three to five years, it comes down to solar and wind.”

Addressing climate change, Rummelhoff says Statoil’s 10,000 scientists “don’t argue climate change. The evidence is overwhelming.” Along with accepting that climate change is real, she says Statoil acknowledges that “the oil and gas industry is one of the biggest emitters, we are part of the problem, and we also need to be part of the solution.” She adds that fortunately the solution of shifting toward renewable energy offers “very intriguing opportunities” for oil majors like Statoil.

Rummelhoff explains that even if climate change turned out to be a myth, it still would make business sense to invest in renewables. She says government regulations launched the shift to renewables but says now, “there is one thing and one thing only that is driving this, and that’s the cost.”

Compared to traditional fossil fuels,

Rummelhoff says “onshore wind is already competitive in most markets without

any subsidies.” Citing the rapid growth of wind energy in Texas, she says

“They’re not doing that in Texas to save the planet, they’re doing it because

it makes commercial sense.”

Compared to traditional fossil fuels,

Rummelhoff says “onshore wind is already competitive in most markets without

any subsidies.” Citing the rapid growth of wind energy in Texas, she says

“They’re not doing that in Texas to save the planet, they’re doing it because

it makes commercial sense.”

In his 2015 Annual Report letter to shareholders, Statoil President and CEO Eldar Sætre noted the challenges created by current low oil prices and said Statoil has responded by cutting costs and by launching its New Energy Solutions (NES) division to “pursue profitable business opportunities within renewable energy, building on existing capabilities and our position in offshore wind.”

After creating NES last year, Statoil followed up in February by providing $200 million for its new Statoil Energy Ventures fund to invest in renewable energy projects including offshore and onshore wind, solar energy, energy storage, transportation, energy efficiency, and smart grids.

The fund’s first investment, announced in March, was in United Wind, a New York-based startup that Rummelhoff hopes will “do for distributed wind what Solar City has done for distributed solar.” United Wind offers what it calls “the first ever little-to-no money down leasing option to small wind customers” primarily in the U.S. Midwest, to deliver “an affordable and sustainable energy future in rural communities.”

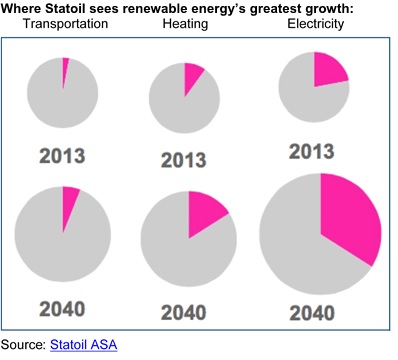

Statoil sees electricity generation as the greatest growth opportunity in the energy sector. Rummelhoff expects that most of this electricity growth will be captured by renewables.

Along with investing in renewables as a very profitable growth opportunity, Rummelhoff said at the CSIS forum that this new focus is needed because “We don’t want to have a Kodak moment happen to us.”

#30

For more news, go to: www.Agri-Pulse.com