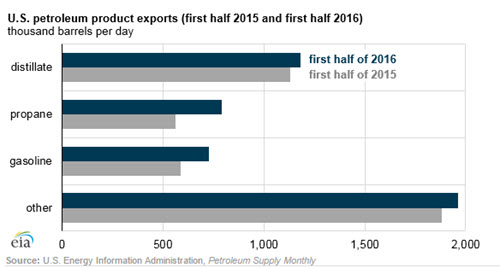

WASHINGTON, Oct. 6, 2016 - U.S. propane exports increased by more than 230,000 barrels per day (b/d) in the first half of 2016, over the same period a year earlier, totaling 730,000 b/d, according to a report from DOE’s Energy Information Administration (EIA). The total shipments surpassed motor gasoline to become the second-largest U.S. petroleum product export, after distillate.

Exports to Asia and Oceania led the growth, accounting for 94 percent of the total.

In the first half of 2016, the U.S. exported 4.7 million b/d of petroleum products, up 500,000 b/d and almost 10 times the crude oil export volume, EIA data show.

Japan imported the most U.S. propane at 159,000 b/d in the first half of 2016, an increase of 111,000 b/d from 48,000 b/d in the same period of 2015. EIA notes that U.S. exports of propane to Panama fell from 41,000 b/d in the first half of 2015 to 7,000 b/d in the first half of 2016.

The large increases in propane exports to Japan and decreases in propane exports to Panama could be a result of reduced ship-to-ship transfer activity, EIA says. Some U.S. propane exports that undergo ship-to-ship transfers cite the location of the transfer, not the final destination of the propane.

“This often results in larger-than-actual export numbers for

the countries where the ship-to-ship transfers take place and in

less-than-actual numbers for some final destinations,” EIA says.

Distillate exports averaged 1.2 million b/d in the first half of 2016, an increase of 50,000 b/d from the same period of 2015, according to EIA.

The largest share of U.S. distillate exports went to Central and South America, EIA says, averaging more than 620,000 b/d in the first half of 2016, an increase of more than 30,000 b/d. from the same period of 2015

The largest single destination overall for U.S. distillate exports was Mexico, which averaged 147,000 b/d in the first half of 2016.

Gasoline exports increased 138,000 b/d in the first half of 2016. Canada and Mexico accounted for most of the growth. Similar to U.S. distillate fuel exports, the data show that Mexico was the largest single recipient of U.S. gasoline exports, accounting for 363,000 b/d in the first half of 2016, an increase of 283,000 b/d in the first half of 2015.

EIA notes that Mexico began to allow companies besides state company Petroléos Mexicanos (Pemex) to import fuels in January 2016, which resulted in increased exports from nearby refineries along the U.S. Gulf Coast.

Canada was the second-largest recipient of U.S. gasoline at 66,000 b/d in the first half of 2016, up from 55,000 b/d in the first half of 2015.

Do you find the information on Agri-Pulse helpful? See even more ag, rural policy and energy news when you sign up for a four-week free trial Agri-Pulse subscription.

While total U.S. petroleum product exports grew, EIA data shows that export destinations remained largely unchanged.

U.S. petroleum products tend to stay in the Western Hemisphere, EIA says. In 2015, about 60 percent of total petroleum product exports remained within the Western Hemisphere, down slightly from 65 percent in 2005.

Mexico, Canada and the Netherlands received the greatest volumes of U.S. petroleum products in the first half of 2016, EIA says, importing 775,000 b/d, 579,000 b/d, and 271,000 b/d, respectively.

#30

For more news, go to: www.Agri-Pulse.com