WASHINGTON, Oct. 6, 2015 -- The U.S. EPA will finalize its controversial Renewable Fuel Standard (RFS) volume requirements for biomass-based diesel by Nov. 30. The latest EPA proposal set levels at 1.63 billion gallons for 2014, 1.70 billion for 2015, 1.80 billion or 2015 and 1.90 billion for 2017. Those levels compare to 1.8 billion gallons of biodiesel actually used in 2013 and 2014 in the U.S.

A bipartisan group of 36 U.S. senators from 24 states, led by Chuck Grassley, R-Iowa; Patty Murray, D-Wash.; Roy Blunt, R-Mo.; and Heidi Heitkamp, D-N.D., is urging the Obama administration instead to mandate “at least 2 billion gallons in 2016 and at least 2.3 billion gallons in 2017.” The senators charge that EPA’s “proposed biodiesel volumes for 2016 and 2017 fail to adequately recognize the domestic biodiesel industry’s production capacity and its ability to increase production.”

The National Biodiesel Board (NBB) calls for raising the biodiesel volume requirement even further to 2.7 billion gallons for 2017. NBB Chief Operating Officer Donnell Rehagen tells Agri-Pulse that based on the federal Energy Information Administration’s own forecasts for increased diesel demand, “biodiesel as well as renewable diesel will be big players in providing that increased production capacity that is going to be needed.”

“We need more transportation fuels in the United States,” Rehagen says. Increasing biodiesel and renewable diesel use offers the best way to respond to rising demand, recurrent petroleum diesel price spikes and to petroleum diesel refineries running at nearly full capacity, he says. More biodiesel, he adds, would also provide “relief from the petroleum process,” wherein large refineries produce pollution often far from the markets where the fuel is used. He also noted that biodiesel now is produced in every state, using renewable domestic feedstocks.

Before moving to NBB, Rehagen himself responded to petroleum diesel challenges when he was the fleet administrator for the Missouri Department of Transportation’s program to fuel its vehicles with B20, a 20 percent biodiesel mix. The result today, he says, is that the state’s diesel fleet runs on biodiesel “produced within Missouri, a home-state product, with Missouri’s soybean farmers supplying the feedstock going to the biodiesel plants here in Missouri.”

And it’s not just Missouri. Switching to “green” diesel has become popular across the country and may gain even more support now that the California Air Resources Board’s final Low Carbon Fuels Standard (LCFS) released last week gave biodiesel and renewable diesel top scores for carbon emissions reduction. Another boost for phasing out petroleum diesel is expected following the administration’s decision last week to tighten the federal ozone standard.

San Francisco, for instance, plans to finalize its shift from B20 to 100 percent renewable diesel in all city vehicles by the end of this year. And Walnut Creek, California, already touts itself as the first U.S. city to have made the switch to 100 percent renewable biodiesel.

Biodiesel and renewable diesel can be made from the same vegetable oil, animal fat and waste oil feedstocks, but by a different process: transesterification versus hydrocracking. As a result, renewable diesel is a “drop-in” fuel that is chemically identical to petroleum diesel and can use existing diesel infrastructure. NBB has both biodiesel and renewable diesel producer members.

Lux Research, a technology research and advisory firm headquartered in Boston, explains “While traditional alternative fuels such as ethanol and biodiesel face strict blend wall limits because they are not fully compatible with engines built for traditional fuels, some next-generation fuels have no such limitations.”

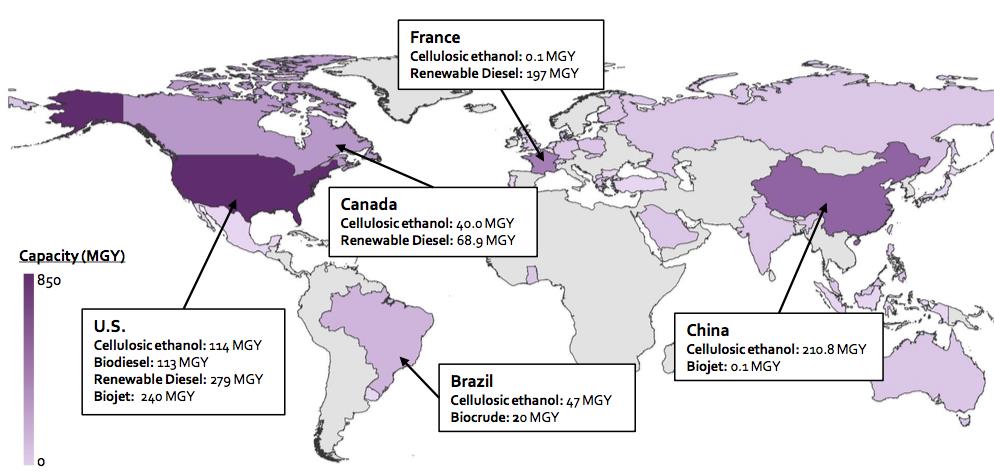

Lux says global capacity for these “novel fuels” is projected to grow annually by 17.2 percent, reaching 2.3 billion gallons per year (BGY) in 2018. Renewable diesel, a true drop-in replacement to diesel, leads novel fuels growth with an expected 1.6 BGY (worldwide) capacity by 2018, driven by major players Neste and Diamond Green Diesel, it says.

Of that expected worldwide renewable diesel capacity, Lux expects more than 500 million gallons of capacity to be in the U.S. by 2018, up sharply from 248 million gallons for 2015. For the same period, Lux forecasts that U.S. biodiesel capacity will grow from 3.3 BGY to 3.6 BGY.

U.S. dominates Capacity Expansion for Next-generation Biofuels from 2015 to 2018

Source: From Lux Research report on “Biofuels Outlook 2018: Highlighting emerging producers and next-generation biofuels.”

Victor Oh, a research associate with Lux, tells Agri-Pulse that renewable diesel will be “one of the most aggressively growing fuels.” According to his analysis, renewable diesel and other next-generation biofuels “will drive long-term biofuel capacity expansion.”

As part of the bipartisan effort to make sure this expansion happens as fully and fast as possible, concerned senators met with White House Chief of Staff Denis McDonough last week. They made the case that the EPA’s latest Renewable Fuel Standard proposal underestimates the capacity for farmers and ethanol and biodiesel producers to generate enough renewable fuel to meet higher goals.

Commenting on the meeting, Grassley said “By hurting biofuels like ethanol and biodiesel, the EPA is hurting agriculture markets, rural economies, lower prices for consumers at the pump, reduced emissions, and national security through dependence on foreign oil. The EPA needs to revise and improve the rule, and President Obama needs to make it a priority.”

#30

For more news, go to: www.Agri-Pulse.com