WASHINGTON, July 28, 2015 - A moderately big U.S. corn crop on the way, combined with soaring gasoline demand, spells an economically steady year ahead for U.S. ethanol plants.

A weather market spurred by excessive rain and flooding in parts of Illinois, Indiana, Missouri and Ohio spiked nearby futures prices for corn, the predominant ethanol feedstock, to as high as $4.40 a bushel this month, leaving ethanol producers “a bit squeezed,” says Geoff Cooper, top analyst for the Renewable Fuels Association.

But corn has already sunk back to near $3.80. So, while public policy debate rages in Congress over the size of the mandated U.S. ethanol blending quota and renewal of biofuel tax incentives, the economic factors that the 212 U.S. ethanol plants face in the year ahead look moderately favorable. USDA projects this fall’s corn crop to be the third largest ever and about 95 percent of 2014’s record – big enough retain the market price in a tame $3.50-$4 range.

Cooper summarizes his outlook for ethanol profitability like this:

-Corn will average about $3.75 a bushel for the 2015 crop, the midpoint of USDA’s projections. Some plants have already hedged part of their supply needs this summer when corn was under $3.70.

-Natural gas, the main fuel used to fire ethanol plant boilers, will average a relatively cheap $2.80 per million British thermal units,

-Crude oil will be near the Energy Department’s projected $55 a barrel average for 2015, which implies gasoline, a major determinate of ethanol prices, will be a little over $2 to $2.20 a gallon wholesale (a little higher than currently).

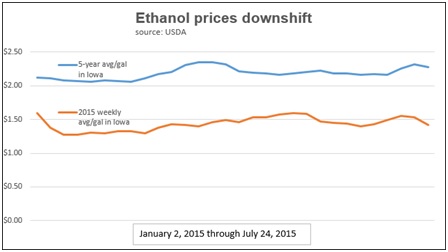

-Wholesale ethanol prices at Midwest plants will average $1.55 a gallon or so, and prices for dried distillers’ grains, the main ethanol coproduct (now around $150 a ton) will tend to equal the price of corn on a per pound basis.

This scenario would produce “not a razor thin margin, but a bit of comfort,” even for small ethanol plants, Cooper expects. While $1.55 is a lower price than ethanol has ordinarily been in recent years, corn and natural gas prices are also expected to be much lower.

Meanwhile, domestic demand for ethanol is rising briskly, and will likely exceed the Energy Department’s expected 13.7 billion gallons, largely because Americans are buying more gas-guzzler vehicles and hitting the roads. The most recent reported week of consumption was the second highest the Department has ever reported, Cooper notes, and such a pace adds to demand for ethanol to blend into the fuel. What’s more, ethanol exports are up so far versus 2014, edging toward the 1-billion-gallon mark. So it’s likely that what U.S. plants produce and market domestically and abroad – probably 14.7 billion gallons or more – will exceed what the Environmental Protection Agency proposes to mandate for this year.

Note, too, that Valero, a big oil refiner and third-largest U.S. ethanol producer, announced this month it will begin selling ethanol for export, adding to demand while shaving the domestic supply.

Meanwhile, in the corn arena, experts anticipate a highly variable corn harvest across the country this fall. Steve Freed, vice president for research at ADM Investor Services, says record yields are likely in Iowa, Minnesota and South Dakota, but subpar ones in drenched parts of Missouri, southern Illinois, and the eastern Corn Belt. Still, he projects a 164-bushel national yield, a bit less than  USDA’s, but believes “that is not low enough to push corn prices a lot higher.”

USDA’s, but believes “that is not low enough to push corn prices a lot higher.”

Paul Bertels, National Corn Growers Association vice president, assesses the upcoming crop similarly, and notes that USDA’s Aug. 12 crop production report, the season’s first to base yield estimates on field surveys, will be highly watched and could hatch a surprise.

Freed also points to demand factors that will help keep corn stocks plentiful and a ceiling on grain prices in the year ahead. He notes “some great pasture conditions out in the West,” which are trimming corn demand because cows will spend more of the year on grass. The cattle and hog markets, too, have softened, which will mean fewer animals in feedlots and hog barns, especially since pork supplies are excessive and production slowdown awaits. On top of that, he points out, the Corn Belt and East will produce plentiful supplies of feed-quality soft red winter wheat to compete with corn.

What’s more, he views U.S. corn exports as somewhat overpriced, so sales abroad may slow a little, leaving stocks in the year ahead similar to this year’s.

#30

For more news go to: www.Agri-Pulse.com