WASHINGTON, Nov. 3, 2016 - Next week, voters in Washington State will decide whether to implement the first-ever statewide carbon tax.

Initiative 732 would establish a tax on carbon emissions, which would increase yearly – starting at $15 per metric ton of emissions in July 2017 and moving to $25 in July 2018 and then 3.5 percent plus inflation each year until the tax reaches $100 per metric ton.

High profile endorsers for the carbon tax include Actor Leonardo DiCaprio, Steven Chu, U.S. Secretary of Energy (2009-2013) and winner of the 1997 Nobel Prize in Physics, and Howard Behar, former President of Starbucks North America.

DiCaprio tweeted last week that “I-732 is a chance to create a clean energy future. Join @CarbonWA and @AudubonWA and vote #Yeson732.”

Dozens of opponents, including the Association of Washington Business, the Washington Farm Bureau, Washington State Council of Farmer Cooperatives, Washington Association of Wheat Growers, Washington State Tree Fruit Association, Washington Potato & Onion Association, Washington State Dairy Federation, and Washington Cattlemen’s Association, have all joined the “No on 732” campaign. But the reasons for opposing the measure vary. In general, farmers and business groups opposed the tax because it will increase energy and operating costs.

“Driving up the price of gasoline by $.25 per gallon and natural gas by 15 percent will make farms much harder to operate,” said Mike LaPlant, president of the Washington Farm Bureau. “It also makes it harder for our customers, such as food processors, to locate in Washington. If food processors left or stopped locating here that would devastate farm income and rural communities.”

But some environmental groups have also come out swinging in opposition. For example,

Food & Water Watch also weighed in against the proposed initiative, asserting that a tax on carbon emissions is not the answer to addressing climate change.

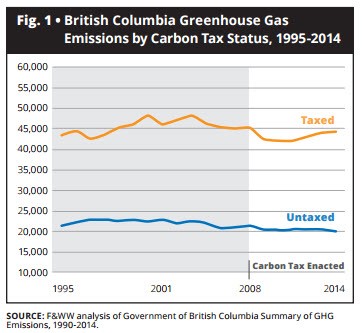

Food and Water Watch presented evidence from the group’s recent analysis of the carbon tax implemented in British Columbia in 2008 to show that the tax is largely ineffectual, having failed to reduce carbon emissions, fossil fuel consumption or vehicle travel as intended.

Food and Water Watch also claims that the tax jeopardizes “meaningful action” to reduce greenhouse gas emissions.

“The political capital and institutional engagement wasted in pursuing carbon taxes are a distraction from what is really needed: mandatory pollution reductions,” the report states.

Food and Water Watch says that proponents of the British Columbia carbon tax often look to emissions reductions that occurred after the tax was passed, but data show that most of the modest and short-term emissions reductions seem to be related primarily to the 2008 global recession, not the tax. More recently, British Columbia’s emissions have resumed their rise, the organization says.

“Scrutiny of this program shows that carbon taxes don’t actually reduce emissions, but instead provide cover to keep spewing climate-altering pollution,” says Wenonah Hauter, executive director of Food & Water Watch.

According to the

report:

- From 2009 to 2014, greenhouse gas emissions from taxed sources rose by a total of 4.3 percent. During this same period, emissions from non-taxed sources fell by a total of 2.1 percent.

- The average annual year-to-year rise or fall in taxed greenhouse gas emissions changed very little after the carbon tax went into effect, and the one-time drop in emissions from 2008 to 2009 does not appear to be driven by the carbon tax.

- From 2011 to 2014, the total taxed greenhouse gas emissions rose by 5.3 percent. Total untaxed emissions decreased by 2.5 percent. The annual average growth for taxed emissions rose by 1.7 percent annually, exceeding untaxed emissions.

- Canada projects that British Columbia’s total greenhouse gas emissions will increase over coming years even with the tax in place.

The group suggests that, instead of a carbon tax, or other “market-based approaches,” the regulation of carbon emissions should be modeled on the success of the Clean Air Act, which FWW says successfully stopped or reduced many forms of air pollution by establishing limits on industrial pollutants and regulating polluting industries.

Do you find the information on Agri-Pulse helpful? See even more ag, rural policy and energy news when you sign up for a four-week free trial Agri-Pulse subscription.

“The solution to addressing climate change, in earnest, is not complicated: The amount of carbon dioxide entering the atmosphere and water must decrease significantly and rapidly,” the report states. “Incremental, gentle, polluter-friendly approaches, such as carbon taxes, will never bring about a stable and sustainable future.”

Instead of implementing a carbon tax, recommendations from the FWW report include:

- Transition to 100 percent clean, renewable energy by 2035. Transition electric power generation away from all fossil fuels, with priority given to renewable energy sources such as solar and wind.

- “Aggressively invest” in energy efficiency programs to reduce overall energy needs and to create jobs.

- Implement and enforce mandatory pollution control measures, “not weak pricing mechanisms.”

To read the full report, click here.

#30

For more news, go to: www.Agri-Pulse.com