WASHINGTON, Oct. 14, 2015 - After watching U.S. wheat acreage and production slide steadily for 18 years, the National Association of Wheat Growers has had quite enough and is coming out swinging.

The counteroffensive, called simply the Wheat Action Plan, “right now is conceptual,” says NAWG President Brett Blankenship, a grower in eastern Washington State. “We’re reaching out to all parts of the industry,” he says. “The idea is . . . to raise productivity so that wheat no longer loses acreage to corn and soybeans.”

Blankenship points to world-renowned biologist Norman Borlaug’s work in the mid-20th Century to improve wheat yield and disease resistance. “We had the first Green Revolution, and it revolutionized the production of wheat. We need another one. We need another step forward, and the Wheat Action Plan is the attempt to invigorate the investment we need . . . to go to the next level for wheat.”

That task is broad, but he says it means, first, improving on-farm productivity so that wheat is a more attractive crop economically. Then, “we need to double down on research . . . and we will elicit private technology companies to take a look at wheat and bring all technology to bear.”

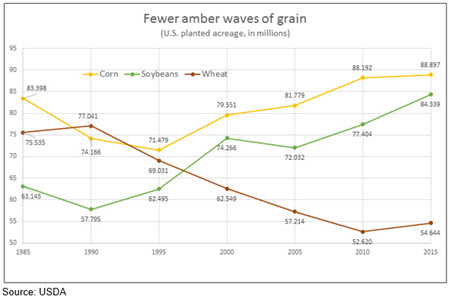

USDA crop data shows that average

annual yields of other major crops have risen smartly over the decades. This

year’s expected U.S. wheat yield (43.6 bushels per acre) is just 16 percent

more than in 1985, while that for corn is up 42 percent; soybeans, 38 percent;

long-grain rice, 43 percent, upland cotton, 24 percent, and sugar beets, 48

percent.

USDA crop data shows that average

annual yields of other major crops have risen smartly over the decades. This

year’s expected U.S. wheat yield (43.6 bushels per acre) is just 16 percent

more than in 1985, while that for corn is up 42 percent; soybeans, 38 percent;

long-grain rice, 43 percent, upland cotton, 24 percent, and sugar beets, 48

percent.

Though the work of wheat researchers and others has improved wheat’s disease resistance and yields over the decades, NAWG calculates that for every $10 spent on public and private industry corn research in 2014, only 70 cents went into wheat research. “The technology train has left the station and left wheat behind,” Blankenship says.Steve Joehl, NAWG director of research, says that wheat used to dominate acreage in the eastern Great Plains, but varietal advances for corn and soybeans have now made those the top crops in that region. “The first state that really adopted biotechnology in corn was [eastern] South Dakota,” he said. “That happened because the Bt gene for corn borer control was so effective . . . and the borer was killing farmers there on yield.” But as the 20th Century ended, growers there started seeding varieties with YieldGard borer control and saw their acreage and productivity soar as yields shot up, he said.

Recently, he says, Dupont, Monsanto and others announced heavy investment in 70- to 80-day corn varieties that will yield well in southern Canada as well as in northern areas of the U.S., Russia, Hungary and elsewhere. The new corn genetics “will take away wheat acreage,” he says.

Needed genetic improvements for wheat are countless, but developing strong resistance to fusarium head blight, called scab, could be a huge gain because the disease hurts wheat coast to coast, Joehl says. Coming up, he notes, is an update by North Dakota State University on the fight against scab, to be presented to grower groups, researchers, millers, food processors and others who will focus on the scab problem at a national forum in St. Louis in December.

Blankenship says that for his own low-rainfall farming area, “improved rust resistance in the high moisture years, drought tolerance and a breakthrough in yield” are at the top of his wish list. “Our yields have been rather stagnant my entire career,” he says.

He says boosting research investment by private industry, Congress and state legislatures will be a challenge, “but one of the collateral problems for loss of wheat production is the way wheat pays for research through the state-by-state patchwork of commissions” that oversee the wheat checkoff programs. “When production falls, you have less funds to invest in research,” he notes.

NAWG will also support the political fight to secure Congress’ OK for the newly inked Trans Pacific Partnership, a 12-nation trade pact that is supported by large farm commodity groups, who expect to see reduced obstacles to sales in TPP countries. Blankenship notes that 85 percent of wheat grown in the U.S. Pacific Northwest is exported, so any reduced barriers mean extra demand for his crop.

But William Chambers, wheat expert for USDA’s World Outlook Board, says that while TPP may hold some promise for U.S. exports, growers face a tough headwind in foreign markets.

U.S. wheat exports fell by a fourth in the marketing year that ended May 31, and the board this month dropped its projected volume for the current marketing year even lower. The dollar’s strong exchange rate creates a high hurdle for the exports, he says. What’s more, he says, world wheat stocks are at record levels, and major exporters – the European Union, Russia and Ukraine – are closer to many markets in Asia, the Middle East, and northern Africa, and are easily underpricing U.S. wheat. Those disadvantages won’t disappear quickly, he says.

#30

For more news, go to www.agri-pulse.com