(Editor’s note: This is the first in a new series of Agri-Pulse in-depth stories, “Export or Bust,” dealing with the challenges and opportunities for U.S. agriculture when it comes to selling more commodities and value-added products to overseas customers. Part one looks at the importance of international markets for a wide variety of farmers, ranchers and value-added producers.)

Agriculture Secretary Sonny Perdue likes to tell people that he’s a "grow it and sell it kind of guy" who is always on the lookout for opportunities to do so. Increasingly, that means understanding world population and demand growth – outside of U.S. borders.

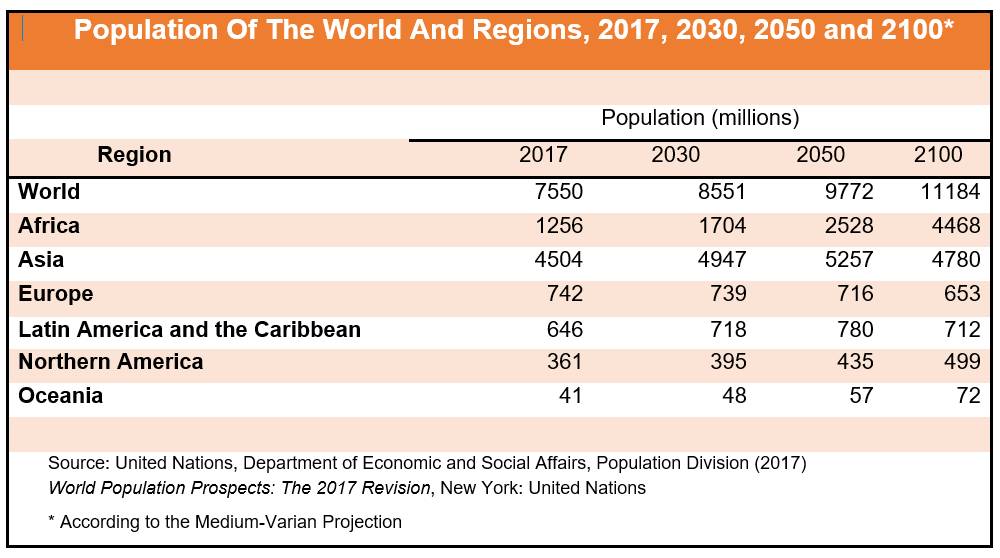

That’s because the U.S. population, at roughly 326 million strong, pales in comparison to China, with 1.4 billion hungry mouths to feed and India, with 1.35 billion people. By 2024, India is projected to overtake China as the world’s most populous country. By 2050, Nigeria may pass the United States in population size to become the world’s third largest country, according to United Nations’ population projections last year.

That’s because the U.S. population, at roughly 326 million strong, pales in comparison to China, with 1.4 billion hungry mouths to feed and India, with 1.35 billion people. By 2024, India is projected to overtake China as the world’s most populous country. By 2050, Nigeria may pass the United States in population size to become the world’s third largest country, according to United Nations’ population projections last year.

From 2017 to 2050, the United Nations expects that half of the world’s population growth will be concentrated in just nine countries: India, Nigeria, Democratic Republic of the Congo, Pakistan, Ethiopia, the United Republic of Tanzania, the United States of America, Uganda and Indonesia (ordered by their expected contribution to total growth).

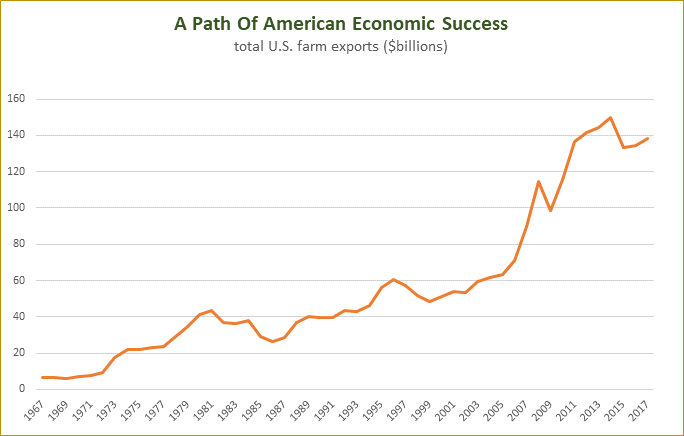

For American farmers and ranchers, selling their products into foreign markets is becoming an ever-larger slice of their businesses – with almost continual robust growth in the past half century.

“Agriculture’s business plan doesn’t have as many facets to it as perhaps other industries,” said Chuck Conner, president of the National Council of Farmer Cooperatives. “Our sole business plan for the future of American agriculture is expanding trade.”

Deputy Agriculture Secretary Steve Censky recently tried to quantify the significance of exports in the agricultural economy.

“Twenty percent of farmers’ income is from trade,” he said, and each billion dollars in annual U.S. farm exports (about $140 billion in 2017) supports 8,000 American jobs, he said.

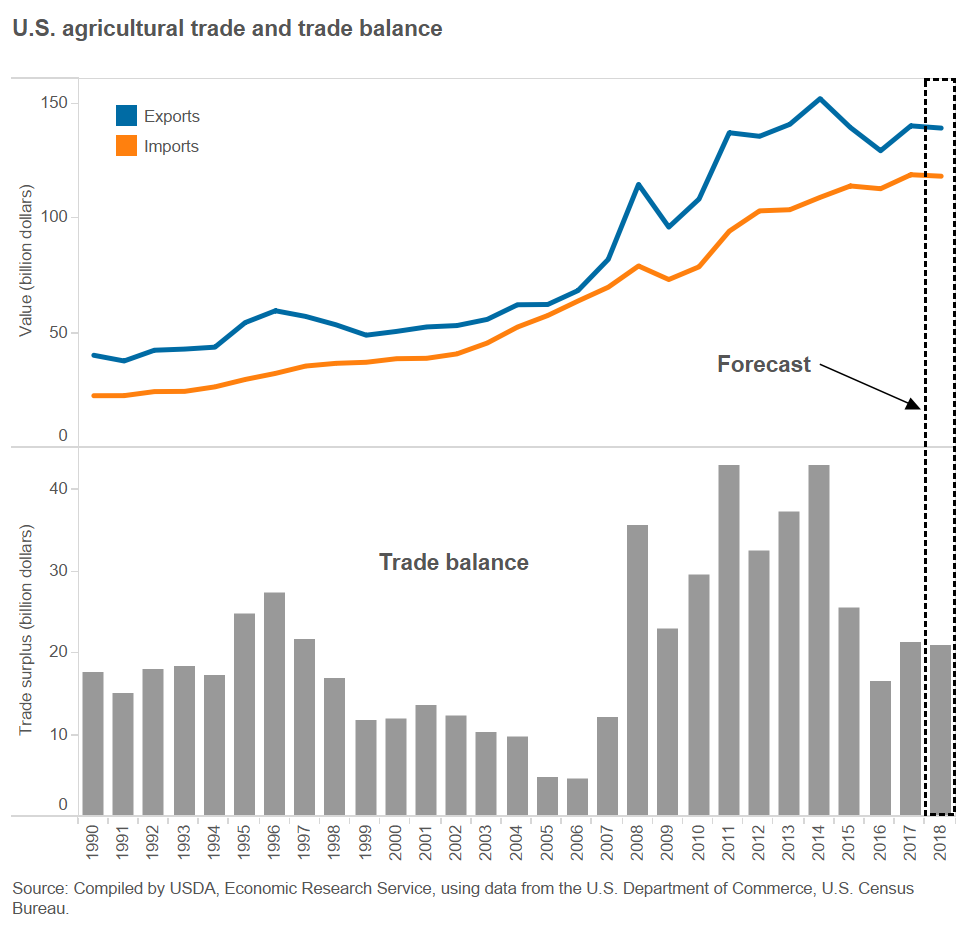

The growth, however, has slowed recently. U.S. farm export tallies have leveled off at around $140 billion in recent years, and with uncertainty over a potential $150 billion in tariffs being placed by China, the North American Free Trade Agreement being renegotiated and other potential trade conflicts, there’s a lot of marketplace uncertainty.

USDA economists project the 2018 total to come in slightly below recent levels at $139.5 billion. Projections for U.S. agricultural exports in fiscal 2018 were lowered $500 million from the November forecast, and $1.0 billion below the previous year's exports

The U.S. agricultural trade balance is expected to narrow slightly, as well. The U.S. agricultural trade surplus is forecast at $21.0 billion in FY 2018, just below the $21.3 billion in FY 2017.

U.S. agricultural imports are forecast at $600 million below fiscal 2017, but $1.5 billion above USDA’s previous fiscal 2018 projection.

Nonetheless, a bevy of factors point to strong domestic and international demand for U.S. farm products, despite some potential emerging obstacles to U.S. trade expansion. (A topic for a later story in this series.)

- Global economic growth continues to strengthen. The International Monetary Fund put 2017 growth in gross domestic product (GDP) at 3.7 percent and projects 3.9 percent for 2018.

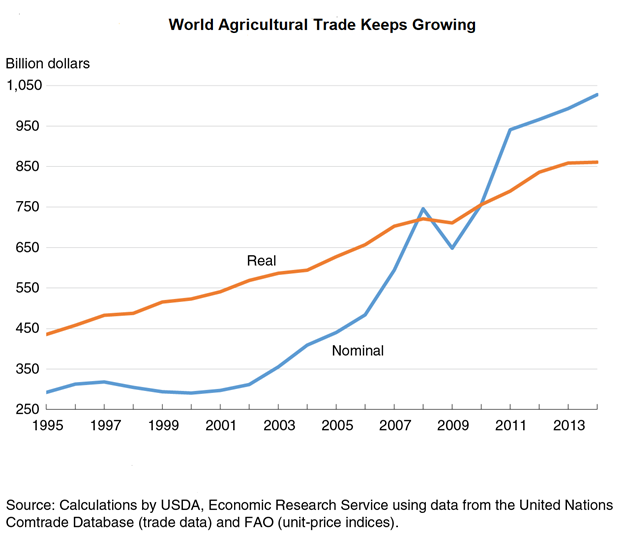

- World agricultural trade keeps expanding along with the economy and population. USDA estimates world agricultural trade nearly doubled in real terms (adjusted for inflation) from 1995 to 2014, driven by a 25 percent increase in world population and 75 percent increase in the world economy. The growth rate was higher in developing countries, which spurs greater food consumption especially.

- Continued advances in agricultural production methods, transportation infrastructure and shipping capacity, and the advance of international electronic financial transactions all enhance international trade.

- Also, the U.S. dollar exchange rate against currencies of many U.S. trade competitors has softened lately, making U.S. farm products cheaper abroad.

- What’s more, reducing trade barriers through many existing trade agreements has helped a lot. USDA Chief Economist Rob Johansson says U.S. partners in free trade agreements – Canada, Mexico, South Korea, Chile, Colombia and other countries – account for nearly 45 percent of U.S. agricultural exports.

Thoroughfare across the Pacific

Geographically and demographically, the biggest growth markets, and probably best growth opportunities, lie across the Pacific, and U.S. agriculture has been beating a path across that ocean.

David Salmonsen, senior congressional relations director for the American Farm Bureau Federation, explains why: “You look at all the numbers, you look at where the GDP growth is, where the trade growth is, and it’s all east Asia, Southeast Asia . . . led by China, of course, and other countries in that region that are the growth markets.”

USDA data show agricultural exports, in nominal value, to East Asia, Southeast Asia and Oceania, combined, have tripled since 2000 and account for more than 43 percent of the national total.

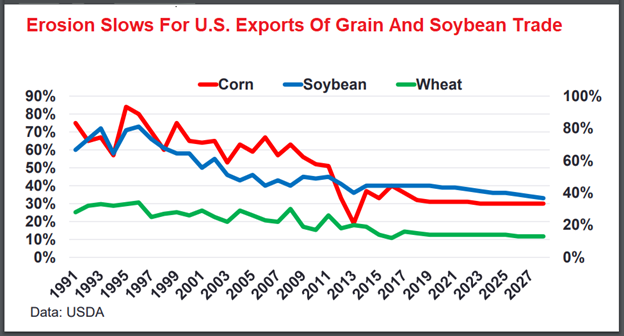

U.S. farmers still sell a lot of grain, cotton and other bulk commodities into the Pacific Rim region, of course, even though the global grain glut continues, and the wheat juggernaut in the Black Sea region captures more of the wheat market.

The Russian wheat crop last year was even bigger than expected and that’s going to push the country’s exports into uncharted territory, according to USDA economist Seth Meyer.

Russia, now unchallenged as the world’s largest wheat exporter, is expected to sell 38.5 million metric tons of the grain to international buyers this year. That’s 10 million tons more than last year and 13.5 million tons more than the U.S. is forecast to export this year.

“Yields have been off the chart,” Meyer said in a USDA audio posting about Russia’s harvest. Russia produced 85 million tons of wheat in 2017, up from 72.5 million tons in 2016 and 61 million tons in 2015.

In addition to bulk commodities, the U.S. is becoming more focused on animal and aquaculture feed, high-protein foods, fruits, vegetables and other specialty crops.

Shipments of U.S. soybeans and soymeal to East and Southeast Asia, for example, have doubled in the past decade to 44 million metric tons in 2017. While food uses of beans are increasing, most of the meal is used to feed those regions’ poultry and swine so they can produce more of their own protein.

Exporters are also aiming American soymeal at aquaculture in those regions, said Jim Sutter, chief executive of the U.S. Soybean Export Council. “Aquaculture is the most rapidly growing consumer protein (industry),” Sutter said. “There is more farmed fish raised worldwide than there is beef production.”

The biggest target, he said, is China, “the single largest aquaculture producer . . . (with) about half the aquaculture in the world.” Already, 15-20 percent of China’s soybean imports are used as soymeal in fish farms, he said.

Protein sells

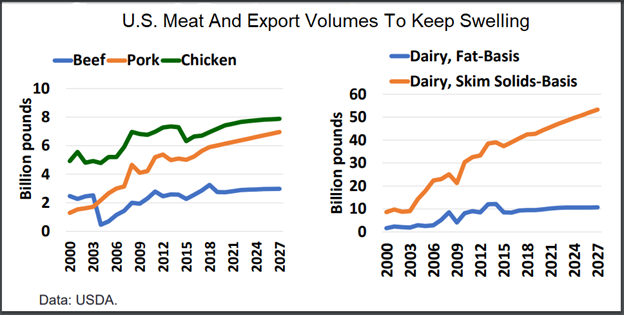

To a large extent, U.S. agricultural exports are a story of producing protein for the rest of the world. For more than two decades, the U.S. pork, beef and poultry industries have been expanding exports rapidly so that 11 percent of U.S.-produced beef is now sold abroad, as is 16 percent of chicken meat, 10 percent of turkey, 19 percent of dairy products, and 22 percent of pork.

In fact, the share for pork is 27 percent if internal organ and other “variety meats” are included, says Dan Halstrom, president of the U.S. Meat Export Federation.

“From a supply and demand standpoint and the way it shapes up, the U.S. is positioned very well,” Halstrom says. American farmers and ranchers are “increasing production and . . . are set up to expand going forward,” he says.”

Mexico and Canada continue as leading customers for U.S. pork and beef, accounting for around a third of red meat exports every year, and Mexico has long been the biggest importer of U.S. pork by far.

U.S. pork export tonnage was a record in 2017, Halstrom notes, and he expects continued regular growth because incomes are rising worldwide, coaxing up per capita consumption. That’s why he expects slow, steady sales growth to Colombia, Peru, Chile, Panama and other Latin American markets “as their spending power increases.”

Additional good news arrived last week, when USDA announced that the U.S. will start exporting pork to Argentina for the first time in more than 25 years - now that the technical requirements have been completed on a deal first announced last summer by the Trump administration.

USDA estimates that, in the near-term, Argentina will buy about $10 million worth of U.S. pork annually, but stresses that there are “significant growth opportunities.”

Halstrom ascribes the same demand drivers to expected pork-sales growth in South Korea, Japan, Australia and other Pacific Rim markets where household incomes are rising and urbanization is accelerating.

Meanwhile, despite export competition from Brazil, the European Union and Australia, last year’s U.S. beef exports were also record, by value, led by market growth in sales to Japan, South Korea, Taiwan, Hong Kong, Vietnam and Indonesia. “Almost everywhere was up last year on beef (exports). We’re pretty upbeat on the beef side,” Halstrom said.

Poultry, like red meats, increases in the diets of consumers whose incomes are rising, and James Sumner, president of the USA Poultry & Egg Export Council, says chicken meat is on the front line of that advance. “Our primary markets are in undeveloped and developing countries because our chicken leg quarters are the lowest-priced meat protein available,” he says.

Poultry meat exporters can sell leg quarters into poor countries at “very favorable prices,” he says, and that is largely because most Americans prefer the white meat, leaving the legs in surplus domestically. Thus, the leading foreign markets for chicken are Mexico (by a mile for both chicken leg quarters and turkey meat) and Cuba. Other big Latin American markets are Haiti, Dominican Republic, Colombia, Guatemala, and Chile. U.S. chicken also has significant markets in Africa (Congo, Angola, Benin, Ghana, South Africa) and the Pacific Rim (Taiwan, Philippines, Vietnam).

China is a separate matter. Up until 2014, it was a major buyer of chicken, especially chicken feet (called “paws” in the trade), and a growing market for U.S. turkey. So, some may be surprised that poultry operators aren’t too concerned about China’s recent moves to slap new 15-25 percent tariffs on farm products from the U.S.

“There is a reason for that – we don’t have access anyway,” Sumner points out. Though Hong Kong, officially a separate market from the rest of China, continues as a leading buyer, “for the past three years, we’ve been banned from exporting any poultry to China because a wild falcon (with avian flu) was found in Oregon.” (Sumner says world trade rules don’t allow such incidents with wild birds to justify the kind of import ban that China imposed.)

Since 2014, “Brazil has been doing its best to take our place (selling chicken paws) and has done pretty well at it,” he said.

A new focus on India

But, along with that market loss, chalk up an imminent win for American poultry. The U.S. challenged India’s barriers to chicken and turkey imports in a World Trade Organization action and won. Even though 50-60 percent of Indian consumers are vegetarian, and though India will still impose a 100 percent tariff on chicken meat, 30 percent on whole chickens, and 30 percent on turkey meat, Sumner said, India poses “a huge opportunity for our industry, and we’re just at the cusp of getting our first shipments into India.”

Despite the inherent and imposed limits, Sumner explains that there is little commercial poultry processing in India and most birds are traded live. Thus, there is opportunity for exporting to restaurants and fast-food services there.

What’s more, he said, “there is a sort of trend with vegetarians switching over and becoming what they call ‘chickentarians.’ Chicken is the first alternative to strict vegetarianism that they’re turning to,” he said.

India’s sturdy borders against most food imports have long kept that market out of sight and out of mind for many U.S. exporters. Now, poultry processors aren’t the only Americans taking a new look at the huge country, home to a sixth of the world’s consumers.

Here's one reason for that. USDA’s Johansson says while the number of Chinese households rising into the middle-class are projected to double by 2026, they’ll nearly triple in India by that year.

U.S. exporters and the Trump administration are now giving farm export sales to India a lot of attention. President Trump, intent on striking new bilateral trade agreements, is eager to expand trade with India. USDA Undersecretary for Trade and Foreign Agricultural Affairs Ted McKinney has been on the job for about six months and he’s already been to India twice.

What’s more, “I’m going to go back,” McKinney declared at the recent Agri-Pulse Ag & Food Policy Summit in Washington. But, he said, “It’s going to be a bear to do business there. Every time somebody (in India) squeals, a tariff goes up. But guess what? Every journey . . . begins with a single step. How many remember watching TV when Air Force One landed, of all places, in China (for former President Nixon’s famous 1972 Beijing visit).” The U.S. had virtually no agricultural trade with China back then, he pointed out.

Salmonsen, of AFBF, agrees India will be a hard nut to crack. So many in India are involved in farming and are sensitive about imports, “and new access is always a political problem. We’ll just have to keep working with them,” he says.

Sutter, too, has India in his sights. “In terms of developing markets for the future, we want to be looking at where are the large population centers . . . and where is there likely to be growth in demand. The Asian subcontinent . . . India, Pakistan, Bangladesh . . . we think that area has real potential for demand growth.”

To facilitate demand in that region, he says, “it gets back to what we were doing in China 20 years ago. Teaching people how to process soybeans . . . how to better feed chickens . . . how to do aquaculture . . . doing risk management courses . . . pairing best practices with our customers.” His organization is looking at Nigeria in much the same way. It is “a young basic market” with “a lot of income, a lot of people.”

Apples excel in foreign markets

Meanwhile, some Americans are already making headway in India. In fact, for apple exports, after Mexico and Canada, the two top foreign destinations, India joins the leading markets of Taiwan, Hong Kong (and mainland China), and United Arab Emirates, says Todd Fryhover, president of the Washington Apple Commission.

USDA trade data shows apple shipments to India tripled from 2007 to 2017, to 102,000 metric tons, and Fryhover expects sales there will keep rising in the next few years. They like Red Delicious, and while India’s orchards grow a lot of that variety, he says they want more.

Apples, in fact, have become a star on the U.S. fresh fruit exporting stage. Fresh apple exports have risen by more than 40 percent in the past decade, to 907,000 metric tons in 2017, and the increases seem to slow only when the U.S. has a short crop. Washington, the top apple producing and exporting state, ships about a third of its fresh apple harvest abroad, Fryhover says. The state accounts for about a fourth of U.S. apple exports, the U.S. Apple Association says.

The hot apple export trend compares with the total foreign sales of fresh fruit, and of fruit and vegetables overall, which have receded somewhat in both volume and value from a peak a few years ago.

Almost nutty success in nut exports

Tree nuts, meanwhile, are a standout. Exports have been soaring at an almost (excuse our adjective) nutty pace. Including peanuts, they’ve nearly doubled in the past decade, to 3.7 million metric tons in 2017, adding an astounding $18 billion to last year’s US farm exports tally.

More than 40 percent of the volume of nut exports are almonds from California, which produces 80 percent of the world’s commercial almond crop. Almonds have long dominated that export arena and last year accounted for half of the total value of nut exports.

And while the tonnage of almond exports has grown a robust 90 percent in the past decade, the growth rates of foreign sales of walnuts and pistachios have nearly doubled that of almonds in the same period: both up about 175 percent. Pecan exports have jumped 116 percent since 2007.

“People are wanting healthier, more natural foods,” says California Walnut Commission Executive Director Michelle McNeil Connelly, and she adds, in many places in the world, they now have the income to buy them at retail.

She says two-thirds of California walnuts were exported last year, and their popularity is “partly lifestyle. The whole nut category has increased pretty significantly in Europe and Japan because of the trend to more healthy eating.”

Even though China and Turkey both have huge walnut crops, they are also leading importers of American walnuts (especially Hong Kong) because that nut is in the traditional diet and consumers want more of them, Connelly said.

She’s also another exporter that hopes to expand sales in India. “Walnuts are the highest among all tree nuts in Omega 3 fatty acids,” which makes that largely vegan nation a good place to sell walnuts.

Richard Matoian, executive director of the American Pistachio Growers, also ascribes his producers’ soaring export market to consumer demand for a healthful snack – high in both fiber and protein, and with about the same level of potassium as a banana per serving. In Hong Kong, “it’s a favorite nut given out during the Chinese New Year. In fact, it’s considered a prize nut in gifts of nuts.”

Europe and China are leading pistachio export markets, Matoian points out, even though Europe has its own big harvest, and China gets much of its supply cheaply from the nearby Iranian crop.

Will retaliation stall momentum?

With so many export success stories contributing to farm profitability and U.S. jobs, there is little wonder then, that a long list of trade organizations hope the Trump Administration will “do no harm” to existing export markets and continue to find new market opportunities.

However, as the Trump Administration rolls forward, farmers and ranchers have watched nervously as the president has bailed out of U.S. trade agreements, hit China with new tariffs on washing machines, steel, aluminum and more, and now they’re bracing as China hits back, landing punches into the face of American agriculture. Such direction in U.S. trade policy is the focus of the second story in our series, next Monday.

For more news, go to: www.Agri-Pulse.com

(Look for part two of our series, "Export or Bust, " next Monday)