(Editor’s note: This is the second in a new series of Agri-Pulse in-depth stories, “Export or Bust,” dealing with the challenges and opportunities for U.S. agriculture when it comes to selling more commodities and value-added products to overseas customers.)

President Donald Trump, to say the least, has American farmers and ranchers variously worried and bewildered about his intentions and the direction of U.S. trade policy.

The president’s main foreign trade actions so far were telegraphed repeatedly on the campaign trail: Severing the U.S. from the Trans-Pacific Trade Partnership, its biggest multilateral trade deal in a quarter century, and plunging the big multi-lateral one with U.S. neighbors – the North American Free Trade Agreement of 1993 – into limbo with renegotiations.

Trump’s latest assault on the trade front, however, is unilateral punitive tariffs on Chinese exports. He started more modestly in January by slapping tariffs on imported washing machines, solar cells and modules, which incited China into initiating an antidumping investigation on U.S. sorghum exports. He later declared a 25 percent tariff, aimed mostly at China, on steel imports, and recently followed up with two separate proposals for punitive duties of $50 billion and $100 billion a year on a long list of Chinese exports.

It’s not as though U.S.-China trade hasn’t been contentious and fraught with blocks against American farm products since the late President Nixon went to Beijing and began opening China’s isolated economy 46 years ago.

It’s not as though U.S.-China trade hasn’t been contentious and fraught with blocks against American farm products since the late President Nixon went to Beijing and began opening China’s isolated economy 46 years ago.

“We could fill this room with trade complaints about China . . . but the simple fact is they do continue to buy,” said Chuck Conner, president of the National Council of Farmer Cooperatives (NCFC) and former deputy secretary of agriculture, at the recent Agri-Pulse Ag & Food Policy Summit.

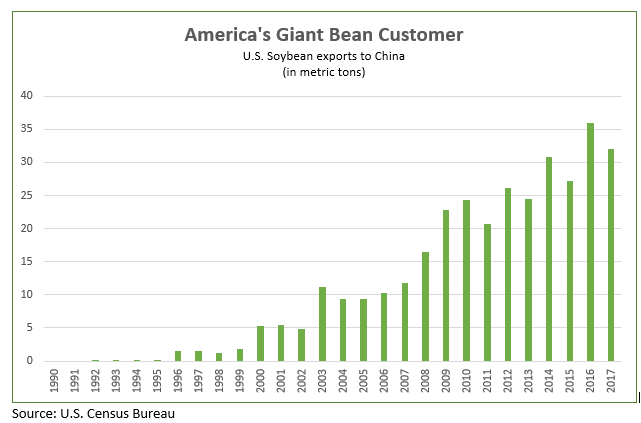

Yet, the total has receded more than 20 percent in the past five years as exports of soybeans, cotton, corn, milk powder and other products have slipped somewhat. Plus, China has banned all poultry since 2014, and it shut out U.S. beef for 14 years (until last June) because of mad cow disease. (Note that agricultural imports from China have expanded gradually, to $10.7 billion last year.)

Indeed, agricultural trade with China has matured in recent decades into a jewel of U.S. foreign commerce. Growth in farm exports to China since 2000 have multiplied more than eight-fold and totaled $21.5 billion by value last year –15 percent of U.S. ag exports.

Chuck Conner, President NCFC

So, like countless other Americans in agribusiness, former Sen. Max Baucus, D-Mont., who now co-chairs a broad agricultural coalition called Farmers for Free Trade, hit the fire alarm when the president announced his first long list of penal tariffs against China.

“Farmers are going to get squeezed by this decision from all sides. First, the (steel and aluminum) tariffs the U.S. announced . . . will make the ag equipment and inputs they rely on more expensive. Then they’ll face new tariffs … (because) China is more than willing to target American farmers with retaliatory tariffs on our ag exports,” he said.

China has done so and quickly, initially declaring 25 percent duties on American pork (already being collected on some shipments, hoisting its total import tax now to 37 percent) plus other items plus 15 percent on fruit and 120 types of commodities. Beijing soon followed with 25 percent tariffs on U.S. soybeans, aircraft, some beef items and 100 other products. Little wonder then, that the American Soybean Association is encouraging its members to write lawmakers and governors in an attempt to stop the Chinese retaliation.

Members of the U.S. House of Representatives recently wrote their own letter to the President, asking him to address China's trade practices in a way that avoids retaliation and helps "return our agriculture industry to a state of certainty and back on the road to prosperity."

However, in the ag arena, the battle is escalating. China’s Commerce Ministry announced last week a preliminary anti-dumping ruling, imposing a 178.6 percent tariff on U.S. sorghum. In addition, China announced a possible future retaliatory 25 percent tariff on imported U.S. sorghum. Its action on sorghum is also seen as part of its efforts to block grain imports and reduce its domestic corn surplus.

China only began accepting sorghum imports in 2013. Since then, U.S. growers, mostly in the southern Great Plains, have had exceptional success in China. They’ve sold 39 percent to 46 percent of the entire U.S. crop in recent years to that market – at a value of about $2.1 billion, for example, in 2015 alone.

So, it’s hardly surprising that China would aim its sky-high sorghum tariff at a farming region of solid Trump voters. And it’s no surprise that news of the tariff has depressed sorghum cash prices even though the announced duties aren’t yet being collected. USDA had projected the average 2017-18 crop year price at about $3 to $3.30 a bushel, and the market has already been down, “as much as 70 cents a bushel,” said Jennifer Blackburn, external affairs director for the National Sorghum Producers (NSP). With such a threat over the sorghum market, growers don’t know if they dare plant that crop this year.

China’s 179 percent tariff “reflects a broader trade fight in which U.S. sorghum farmers are the victim, not the cause, and U.S. sorghum farmers should not be paying the price for this larger fight,” NSP said in a statement.

Farmers in the line of fire

Zippy Duvall, AFBF

It’s not a new story. AFBF President Zippy Duvall told Agri-Pulse that the Trump trade actions make him increasingly nervous. “When (negotiators) start talking about trade tariffs, we can look back in history and know that agriculture is the first segment of our economy to get hit,” and China’s recent pushback demonstrates the point, he said.

China’s tariff announcements upset U.S. farmers, who depend on foreign trade for 20 percent of their income, which is hit immediately when even the threat of new trade barriers arises, depressing crop and livestock markets.

What’s more, says Zack Clark, National Farmers Union manager of government relations, if China proceeds to implement its new tariffs on U.S. grain and other commodities, “it would exacerbate current stocks, which are already hanging over the market, keeping prices low,” and such stocks could continue to affect prices for another marketing year or two.

Zack Clark, National Farmers Union

Meanwhile, Larry Kudlow, Trump’s new National Economic Council director, told CNN recently, “we are talking to (farmers, and) there has been a bump-down in farm commodity prices . . . (But) this process may turn out to be very benign. OK? You have to take certain risks as you go in. We are taking them. We are making our case. Nothing has happened so far . . . maybe China will want to come around and talk in earnest.”

Trump administration officials say they get the point. U.S. Trade Representative Robert Lighthizer, under bombardment from both Republicans and Democrats at a U.S. Senate Finance Committee hearing about the emerging trade war’s threat to farm income, argued, “We have trade rights that we have to defend.” He acknowledged that, “too often farmers get the short end of the stick,” and suggested, “we have to balance this” by somehow supporting farmers.

Trumpian style trade policy

Asked in a phone call last week about his confidence in the president’s offensives on China and NAFTA, Sen. Chuck Grassley, R-Iowa, a farmer, said “it’s so little…” However, Grassley went on to say things aren’t all gloomy.

“I do feel a little bit better when China, without giving Trump and his brinksmanship credit … is going to reduce the tariff on cars coming in from 25 percent down to 2 ½ percent … Korea (is) offering (to take) more American cars.” Even with some tentative good news also coming out of NAFTA negotiations, he said, “I am still very nervous about it … because if the brinksmanship doesn’t work, agriculture is the first that is retaliated against.”

Conner, of NCFC, took a similar guarded, hopeful view at the recent Agri-Pulse Ag & Food Policy Summit. “We all have to admit that the style of this administration makes us nervous. But the point is, there are (trade) problems out there, and I think we’ve got an administration that’s determined to address some of those problems . . . (though) going after those problems comes at some high risk.”

U.S. government trade policy “clearly has changed,” Conner said. He said that free trade has long been an article of faith for most Republicans lawmakers, who were counted on to lead the approval of trade deals. But Trump, “with his different view on trade, defeated many Republican candidates who were considered the rock stars of the Republican Party – the president mopped the floor with them,” he said, and the party has shifted in response.

Conner’s observation is illustrated in a letter that Rep. Kristi Noem, R-S.D., and 45 other farm-state GOP House members sent to Trump last week pleading for unspecified economic protection for farmers from China’s trade retaliation. They had good reason to write: The top five agriculture products in Noem’s own state, for example – beef, corn, soybeans, wheat, and hogs – are all targeted by China’s punitive duties.

But the letter did not challenge Trump’s hardline style. It praised him repeatedly for supporting farmers, blamed China solely for “threatening retaliation against American farmers,” while encouraging the president to negotiate with China “in a manner that will avoid retaliation.”

Senate Agriculture Committee Chairman Pat Roberts, R-Kan., told the PBS News Hour he was hopeful that farm state lawmakers did impress on Trump in a White House meeting that his unilateral actions against China “is the wrong approach” and threatens U.S. farmers economically. Roberts said lawmakers want to support legal challenges against China’s extensive violations of copyright and other WTO rules. But, “everybody in that room said they wanted trade, not aid” to reimburse farmers for impacts of China’s retaliation, he said.

Roger Johnson, President NFU

But, Johnson said, “the ugly part of this administration has been the insulting, bellicose behavior that frequently comes from the president to presidents of other countries,” Johnson said, “and I think that is the reason that Mexico is buying corn from South America” rather than the U.S., its usual source.At the Agri-Pulse summit, meanwhile, NFU President Roger Johnson, explained he agrees with Trump’s view that trade deficits suck wealth from the U.S. economy and must be reined in. “I agree with the president that you can’t continue down this road with a half-trillion dollar trade deficit and not pay consequences. It’s a 3 percent drag on our GDP,” he said.

Darci Vetter, recently named general manager for public affairs at Edelman DC and former agricultural trade negotiator for President Obama, voices similar concerns about the tone of Trump’s trade policy. “Words do matter. It is false to suggest that vocabulary and policy can be separated,” she said.

But, like Conner, she also points to the erosion of support for multilateral trade leadership. “I think it is consequential that we have stopped talking about a global economy and the United States’ leverage … and the importance of global supply chains.” Instead, she observes, American leaders are now focused on “bilateral winners and losers . . . (and the idea) that if we have a bilateral trade deficit with your country, then we are losing and that it is not fair.”

As a long-time trade negotiator, she says successful trade is built better by partners than by warfare between opponents: “If the underlying vocabulary in trade with other countries is that … we see each other as partners, it’s easier to solve problems. If the overall relationship is in question, it makes it harder to solve problems,” she said.

Vetter believes, however, that Trump’s biggest threat to U.S. agricultural trade, much more than his combative tone, is his withdrawal from completed trade pacts, inconsistency and lack of follow through.

Darci Vetter, Edelman DC

Some farm commodity export advocates are objecting to the lone ranger trade offensive. When Trump announced his first list of penal tariffs against China, the U.S. Wheat Associates (USW) and the National Association of Wheat Growers (NAWG) issued a statement encouraging U.S. trade actions against China’s unfair trade practices when pursued in line with world trade rules.For example, after shocking people in the U.S. and abroad recently by telling Lighthizer and Kudlow in a meeting with farm-state Republican lawmakers that he wants to examine options for rejoining TPP, Trump undercut his own order within hours. He tweeted that he “would only join TPP if the deal were substantially better” than what the U.S. had inked earlier and, anyway, he’s “working to make a deal with the biggest of those nations, Japan …” A few days later, he tweeted about TPP, “I don’t like the deal for the United States … and no way to get out if it doesn’t work.” The lawmakers have been less than pleased about the presidential head fake.

But, “It is unfortunate that the well-intentioned decision to challenge . . . Chinese trade policies has been implemented in a way that violates” the due process of World Trade Organization rules, the wheat groups declared. They complained that Trump’s string of unilateral actions “further erodes historical support for rules-based trade policies.”

Vetter said perhaps her biggest long-term fear for the U.S. “is the creation of doubt that we are a reliable trading partner . . . or a desirable partner for future trade agreements. That may prove to be quite expensive in the long run.”

U.S.-Japan bilateral instead of TPP

Trump isn’t alone, though, in eyeballing both TTP and an alternative U.S.-Japan deal. “Whether (the U.S.) gets back in (to TPP) or not is quite a dubious thing,” Grassley said recently. “A bilateral with Japan, if we get a good one, is probably worth five times the countries all added together (in benefits) to the United States,” he said. Japan’s economy is triple that of Australia, for example.

But costs from Trump’s TPP exit loom and have likely started to accrue even though the 11 remaining nations (Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam) in the revised TPP, now called the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), won’t implement it until six have approved it.

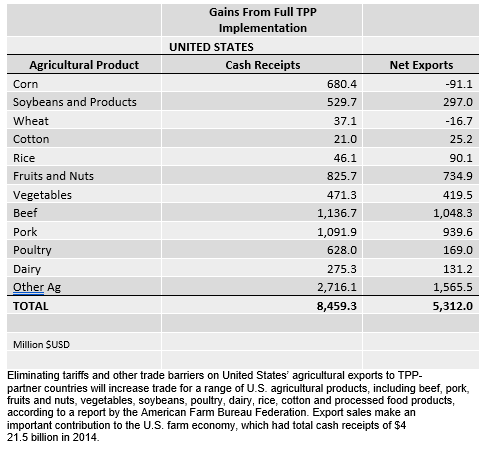

For the U.S., however, the value of the 12-nation TPP projected by an American Farm Bureau Federation (AFBF) analysis, included $4.4 billion of annual gains in U.S. net farm income, driven by a $5.3 billion yearly increase in farm exports. Thus the first cost of TPP withdrawal may be one of forfeited business.

A slice of that added farm income would have been headed to GOP Rep. Dave Reichert’s agriculturally diverse Washington State district, where, “40 percent of our jobs are tied to trade,” Reichert says. During the TPP negotiations, “I frequently heard from Washington’s agriculture community about the benefits of lower tariffs in Japan and Vietnam, in particular, because we would have access to markets without prohibitively high tariffs. For wheat, beef, dairy, potatoes, and wine, Japan is a top market,” he said.

A lot of Washington State frozen french fries go to Japan, Reichert reports, and, “for Washington’s apple, pear, and cherry growers, Vietnam is an important market where they would have benefited from the removal of Vietnam’s 10 percent tariff on produce.”

Now, unfortunately, he said, “because of the completed CPTPP and other trade agreements already in place that do not include the U.S., our producers are falling behind competitors like the EU, Canada, and Australia. Our producers continue to face tariffs in countries like Japan, but our competitors enjoy duty-free access to this critical market. Our potato growers estimate a loss of $100 million in export sales to Japan as a result of the CPTPP.”

“This is why I will continue to urge the administration to consider the cost of inaction and to work instead to open new markets,” Reichert said.

At this point, Vetter says, she is “not sure there is a lot of appetite” among CPTPP partners for another go at US membership. Still, she sees U.S. re-entry as quite possible, noting that the agreement won’t be implemented for a while. Fortunately, from the prospective of American farmers, she says, while the CPTPP countries dropped some provisions that the U.S. valued in the TPP, “they have accepted almost the entirety of the agricultural package – not only the level of market access, but strong and more comprehensive rules on SPS (sanitary and phytosanitary) measures.”

New tires on NAFTA

On Trump’s orders, meanwhile, U.S. negotiators are trying to update NAFTA and renegotiate better terms of what Trump has called “the worst trade deal in history.” Fixes may include some farm-friendly ones, such as improved access to Canada for U.S. milk, wheat, poultry and eggs. Trade officials say they hope to finish the task soon.

Total U.S. agricultural trade with Mexico and Canada has grown about 425 percent (U.S. farm exports up 340 percent; imports, up 530 percent) in dollar value since the pact was approved nearly a quarter century years ago. USDA officials say that Trump agrees U.S. agriculture has benefitted greatly from it, yet he still threatens to pull the U.S. out of NAFTA if he isn’t satisfied with the remake.

At the same time, even though President Trump has raged against NAFTA, calling it “horrible” and "the worst trade deal in history," USDA Deputy Secretary Steve Censky says the president’s anger about the North American pact is focused on non-food manufacturing sectors. “We want to be sure we do no harm (to agricultural trade),” he said.

Duvall, of AFBF, recited the U.S. farmers’ mantra these days on NAFTA when he told Agri-Pulse, “they’re reworking it (and) we’re hoping they’re not going to do any harm to the agricultural piece of it.” His tracking of progress led him to say, “We’re encouraged we’re going to be OK there.”

Dan Halstrom, a senior vice president with the U.S. Meat Export Federation, for example, notes that Mexico and Canada “claim 30 to 40 percent of our meat exports,” and “retaining the zero percent tariff (under NAFTA) is a must.”

With NAFTA in limbo, Mexican millers and feed lot operators have already shifted some corn purchases to Brazil, and Vince Peterson, USW president, says, “if NAFTA went away, the Mexicans have surely … already looked into alternatives to find all the wheat and corn and soybeans and other things – they’re prepared to look at other places” if pre-NAFTA tariffs returned.

There is danger in taking too long to wind up renegotiation, Vetter says. “The longer the status of that (NAFTA) trading relationship is uncertain, the more incentive we give our customers in Mexico and Canada … to diversify their purchases. A lot of our products can be found elsewhere,” she points out.

On the other hand, Vetter says, it’s also risky for Trump to push U.S. officials too fast to wrap up NAFTA’s agricultural provisions because Canada’s trade policies and supply management programs for dairy and poultry are complex, so agreements on reform take time. Another pitfall, she says, is that some of NAFTA’s benefits to U.S. farmers could be sacrificed to gains for another U.S. sector as the renegotiation wraps up.

Most of U.S. agriculture isn’t panicking yet about the NAFTA redo, however. Jim Sutter, chief executive for the U.S. Soybean Export Council, for example, explains that, during initial fears about U.S. withdrawal, “we saw some of our customers, particularly in Mexico, looking for alternative sources. But the fact is, they continue to be very, very good customers … and I think our exports to Mexico were actually up this past year. We haven’t seen a deterioration there.” In fact, he pointed out, Mexico has expanded its crushing facilities and now buys less soybean meal but more U.S. soybeans to crush in Mexico than in years past.

Competitors stepping in as Americans step out

Recently, there have been abundant examples, however, of ways U.S. exporters will be losing out by sitting on the TPP sidelines.

The Japanese government just finished its first projections of economic growth stemming from implementing the TPP and a new free trade agreement with the European Union, both to likely be implemented in 2019. The gain in real gross domestic product: $114 billion (13 trillion yen), or about 2.5 percent of real GDP.

On the EU side, gains from that trade agreement will be at U.S. pork producers’ expense, USDA’s Foreign Agricultural Service projects in a new report. The Japan-EU deal spells a “significant duty disadvantage” for American pork exporters, since Japan will entirely phase out duties on 60 percent of its pork and pork products in 12 years and lower duties on bacon, ham, and other ground pork and sausage items.

Japan, meanwhile, is the top U.S. pork export market by value – $1.6 billion in 2017 – and third largest by volume. So, the impact of greater advantage for the EU, a leading pork exporter, could be substantial.

As noted above, wheat is one of many Washington State farm products that would enjoy better market access thanks to TPP, and lose ground to competitors without that pact in place.

In fact, like some other products, U.S. wheat’s access abroad has been put at risk by all of Trump’s major trade initiatives: “Putting it simply, joining TPP is the best way to avoid a potentially devastating loss of wheat sales to Japan,” said USW Chairman Michael Miller, a Washington State wheat grower.

Ben Conner, US Wheat

Also, if the U.S. dumps NAFTA, there is potential loss of Mexican sales to competitors. The European Union and Mexico have already reached an agreement that is designed to increase trade by making many goods duty-free. USW’s director of public policy Ben Conner explains that Japan will phase down its import markup of $150 a metric ton in nine years to $85 a ton – a $65 reduction per ton – but only for TPP members such as Canada and Australia. U.S. exports won’t get that relief. “We already sell premium wheat,” accounting for about half of Japan’s wheat imports, he said, but “we’re going to be much more expensive” and thus lose market share in Japan.

Agricultural exports from the EU will benefit the most from the agreement, the EU said. Specifically, the new pact will provide preferential access for many cheeses such as Gorgonzola and Roquefort; allow the EU to substantially increase its pork exports to Mexico, with duty-free trade for virtually all pork products; and ensure that Mexico not allow imitations of 340 distinctive European foods and drink products in Mexico.

EU Trade Commissioner Cecilia Malmström said the agreement “sends a strong message to other partners that it is possible to modernize existing trade relations when both partners share a clear belief in the merits of openness, and of free and fair trade."

For more news, go to: www.Agri-Pulse.com