(Editor's note: This is the fourth in our seven-part in-depth editorial series where we look ahead at “Farm & Food 2040.” Part four looks at changes in the protein sector meeting a growing demand for a wide variety of products around the world and the constant debate about the environmental footprint of meat production.)

Farmers, ranchers, fisherman and the rest of agribusiness will try to satisfy dietary protein demands as the global population soars in number toward the nine billion the United Nations projects by 2040. With that steady increase comes rising incomes and, especially in developing countries, demand for more and more protein-laden foods.

How to meet the demand? Boundless possibilities emerge, butting up against the array of challenges of bringing protein foods to market — the shrinking bases of arable land base and fresh water, for example, plus climate change, concern about animal agriculture’s environment impacts, animal rights issues, and more.

A cornucopia of foods contribute protein for the human diet, of course, and emerging ones such as cell-based meats — growing meat by feeding animal muscle (without the animal) in a medium — will likely edge into the global protein market as well.

What’s more, meat and dairy substitutes are already landing on our dietary shores with a thump.

In its February Talking Points, worldwide Rabobank reported its food industry customers’ answers to this main annual survey question about food trends: “In the world of food, what surprised you the most over the last twelve months?”

Answer: “The breakneck advancement of plant-based food and beverages was easily the biggest surprise to our readership.” Separately, from various market data sources, Rabobank estimated retail sales of plant-based meat alternatives had risen by almost one-quarter to an estimated $770 million in the twelve months up to August 2018,” and “the wider range of plant-based alternatives to conventional animal foods (including milk, cheese, yogurt, etc.) ... up 17 percent in the past twelve months. Equally impressive are the number of new entrants and players in the “new protein landscape.”

But let’s back up a step and start with a huge source of protein that happens to be low-hanging fruit.

First Stop — Grains

“Half of the world’s (human food) calories come from grains,” says Caroline Sluyter, program director for the Whole Grains Council (WGC). She points out three of them — amaranth, quinoa, and buckwheat — “have the nine essential amino acids that the human body needs ... (and thus) are considered complete proteins.”

Grain commonly used for food (except rice) are 11 to 15 percent protein. But, “unfortunately, most of the world has moved toward refined grains in ... the last 200 years,” Sluyter says, even though “whole grains have on average about 25 percent more protein than refined grains. So when you’re stripping away that bran and germ you are stripping away key nutrients.”

Africa, she says, is the lone part of the world that has kept whole grains extensively throughout their diets. Nonetheless, she says, American, Canadian and Mexican consumers have been gradually shifting back to more whole grains for many years, “and Brazil and China have been big players in the last three to four years.”

Caroline Sluyter, Whole Grains Council

If the goal is getting enough protein, the world’s supply of grain is almost always ample, fortunately, so opting for whole grains is an easy way to boost protein intake, Sluyter says. She notes the WGC’s own labeling icon, the Whole Grain Stamp, has proliferated and is already on more than 12,000 cereal products in 61 countries.

Beans, of course, are known as a rich source of protein. And soybeans, always plentiful and a relatively cheap food source worldwide, are particularly protein-dense, and they’re a complete protein (all nine amino acids) as well. Like grains, they have the highest level of protein when mature (in roasted beans versus green edamame, for example).

Mitts off my animal protein, please

Looking broadly across the spectrum of protein-laden animal products, bet on robust growth in production and consumption in both the U.S. and worldwide, though diverse and often sporadic in select regions, owing to economic conditions.

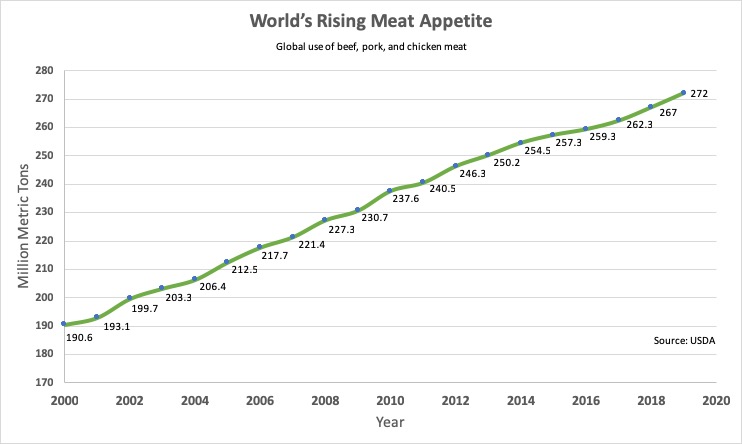

In the U.S., overall 2018 consumption and production of total red meat and poultry “was at an all-time high,” notes Matt Ball, a spokesman for the Good Foods Institute, which promotes investment, research and development of plant-based protein foods and cell-based meats. “The average American ate more meat last year than at any time before ... and will eat more in 2019, and the same is true for global consumption,” he said. (For fish and shellfish, meanwhile, U.S. per capita consumption has remained around 15 pounds for several years.)

GFI, though devoted to advancing plant-based meat alternatives, assumes “people still want to eat meat, people are still buying more and more meat,” Ball said. “We don’t think people are going to ... start cutting way, way back on meat. The evidence is all to the contrary.”

Humans evolved with a natural penchant for “eating meat, (desiring) concentrated sources of amino acids and fats” Ball says, and “aren’t going to live on bean and greens instead of the meat and dairy products that they like to eat.”

Experts writing a global food supply outlook report in 2013 for the Council for Agricultural Science and Technology focused on “challenges and opportunities in sustaining animal agriculture” to 2050, and they took a similar view of the vital role that protein-dense animal products must play in the decades ahead.

CAST notes the Earth’s 48 least-developed countries are expected to have a virtual stampede in population growth, 2.5 percent a year. Per capita incomes in China, India and many developing countries “are predicted to increase until they reach levels similar to those enjoyed by residents of developed regions by 2050,” the report says.

“A positive correlation exists,” CAST points out, “between per capita income and demand for animal source foods (milk, meat, and eggs) ... (and) livestock production will have to substantially increase over the next 40 years to supply global demand. The importance of animal-source foods ... in maintaining health and nutrient supply is well recognized.”

Slower market growth may loom

But not so fast. In its annual 10-year world agriculture outlook report through 2027, meanwhile, the Organization for Economic Cooperation and Development (OECD) and the UN Food and Agriculture Organization (FAO) project recent decades of strong demand growth in agriculture will falter in some regions.

Says OECD-FAO: “per capita consumption of many commodities is expected to be flat at a global level. This is not only expected for staple foods such as cereals and roots and tubers, where consumption levels are close to saturation levels ... but also for meat. Some low-income regions which currently have low per capita consumption levels of meat, such as sub-Saharan Africa, are not expected to increase these levels significantly due to a lack of sufficient income growth.” Some emerging economies, such as China, have already boosted their incomes and meat consumption. And in India, demand for dairy products, but not meat, will expand, says the report.

But all is not dismal. Although OECD/FAO expects per capita consumption of meat and fish to edge up just 3 percent (and just 0.3 percent in the developing countries) through the decade, total consumption is expected to increase 15 percent, owing to rising populations, although “with stark variations across regions.”

For example, though sub-Saharan Africa’s per capita use will slip by 3 percent, total use will jump by 28 percent, owing to the region’s annual population growth, reaching 32 million people in the year 2027.

The OECD/FAO report also points out that when animal agriculture expands, so does demand for feed, which “will continue to outpace food demand as livestock production intensifies. While demand for corn will keep rising, the report projects, “demand for protein meal is expected to expand by 23 percent, considerably faster than the other commodities used as feed.” Much of the higher demand will come from China, OECD/FAO expects.

Trade snags threatening protein markets

“Agricultural trade plays an important role in ensuring food security,” OECD/FAO says. But reduced economic growth in some regions will already throttle back agricultural trade worldwide to “about half the rate of the previous decade,” the report says, which underscores “the need for an enabling trade policy environment.”

However, says OECD/FAO, “there are increasing uncertainties with respect to agricultural trade policies and concerns about the possibility of rising protectionism globally.”

Such an outlook may spell trouble, for example, for the world’s top exporters of pork (the U.S., European Union, Brazil, and Canada). In the U.S., producers fill all domestic orders and then need to sell much of their production abroad to survive economically.

Brett Kaysen, National Pork Board

Brett Kaysen, an assistant vice president for the National Pork Board, notes, “for the last 20 years, per capita consumption in America of pork has been around that 50 (pounds) mark, holding steady.” Pork producers’ engine of economic growth is “our export market, and I can’t emphasize enough how important those foreign markets are to us ... (the meat from) one out of every four hogs produced in this country are exported,” he says.

The producers, Kaysen says, know “as countries evolve into wealthier states, there is no question that their palates turn to an appreciation for protein ... and with that wealth pork exports from here increase. There’s a direct correlation,” and he doesn’t want those U.S. shipments, which represent a third of global pork exports, to take a hit.

The wild cards in protein demand

Look for a spectrum of cultural diets fads, animal welfare, animal rights, and nutrition and health concerns about meat consumption to continue their mixed influences on demand for high-protein foods.

Though the European Union exceeds the U.S. in pork and dairy exports, for example, meat use is declining across Western Europe, where folks are flocking to vegan, vegetarian, and flexitarian (only occasional meat) diets, and where animal welfare sensitivity and activism are very popular.

In the U.S., those trends are visible, too, and several states have even passed laws banning gestation crates — the latest, California, did so last fall. Giant hog farm operators and processors, including Smithfield and Cargill, have been phasing the crates out in recent years and requiring farms that sell hogs to them to do likewise. Plus several major food companies have pressed their own suppliers to phase out crates, and such changes in animal housing can be expensive and can affect operating margins, sow health, and more.

Note that the housing changes have apparently not altered U.S. production or consumption of pork: they keep climbing.

So even though heavy red meat consumption has been criticized by some physicians, for example, Hannah Thompson-Weeman, communications vice president for the Animal Agriculture Alliance (AAA), notes paleo and other high-meat diets have been on the rise with Americans. “We do see more and more ... people focusing on their health and on niche diets ... with an emphasis on eating animal protein.”

Another animal welfare crusade, in this case to ban use of small cages for laying hens, also shows no sign of choking Americans’ fondness for eggs. The share of eggs from the U.S. flock of 326 million laying hens that are sold as cage-free or from organic farms (tiny hen cages would violate organic standards) is 18 percent and climbing steadily, USDA reports.

Meanwhile, consumers keep paying big premiums for them. USDA Market News has listed average retail prices at usually more than $4 a dozen for organic large eggs in recent months, versus about $1.50 for conventional. Still, eggs remain cheap per ounce compared with most other high protein choices, and U.S. production and per capita consumption keep rising.

Environmental footprint: the biggest wildcard?

While most of animal agriculture has been intent on shrinking its environmental footprint, especially on a unit-of-production basis, public policy on animal agriculture and the environment is, on the other hand, enlarging its footprint in the U.S. and abroad.

Especially with one long-term atmospheric and oceanic outlook study after the next foretelling ever worsening climate catastrophes, U.S. animal agriculture is taking it increasingly hard on the chin for its 3.9 percent of total greenhouse gases (GHG) ascribed to it. That 3.9 percent is the U.S. Environmental Protection Agency’s latest estimate, and EPA says GHG for all U.S. agriculture is 9 percent, which compares with 28 percent EPA assigned to electrical power companies and the 28 percent it allocated to transportation.

Agriculture is a larger part of the economy and human activity worldwide than in the U.S., so its share of GHG is larger globally. Some sources have linked huge GHG shares to livestock in past years. About a decade ago, the World Watch Institute blamed livestock for 51 percent of GHG; FAO, 18 percent.

Frank Mitloehner, UC Davis

Frank Mitloehner, an animal science professor and air quality expert at the University of California, Davis, says the high percentages are often still erroneously used and distort the actual share of GHGs from livestock. The higher share estimated worldwide for livestock is often mistakenly applied to the U.S. as well in arguments against animal agriculture, he says. The most credible estimate of worldwide livestock emissions, Mitloehner said, is a 2014 FAO report that lists animal agriculture GHG at 14.5 percent, most of them from beef and dairy cattle.

Environment advocates pressing against animal agriculture point to the 14.5 percent global impact, and they focus on the world growth in livestock product markets and accompanying increases in GHG globally, rather than the livestock sector’s GHG reductions based on per unit of food production.

Two climate-change fighters, Ceres and FAIRR (Farm Animal Investment Risk and Return), recently went behind corporate lines and recruited more than 80 jumbo global investors (with over $6.5 trillion in assets) to jointly send letters in January strong arming fast food giants to set tough requirements on their meat and dairy product suppliers to slash their greenhouse gas emissions and water pollution.

The letter — to Domino’s Pizza, McDonald’s, Restaurant Brands International (Burger King), Chipotle Mexican Grill, Wendy’s Co. and Yum! Brands (KFC, Pizza Hut) — says animal agriculture is one of the world’s highest-emitting sectors without a low-carbon plan, and the investors expect the fast food giants to demand specific plans and metrics from their meat and dairy suppliers and expect an initial response by March 1 on executing such plans.

The letter also suggests damage to the companies’ future profits if they don’t join the Ceres/FAIRR campaign, saying their suppliers’ environmental impacts “are associated with increasingly material reputational, operational and market risks for the companies buying and selling animal protein-based products.”

Count on a long tug of war

Whatever the level of blame thrown at the livestock sector for climate change, the issue surely feeds what will surely be a long, escalating debate.

A recent wave crashing on the shores of agricultural sustainability: the first report of the EAT-Lancet Commission on Food, Planet, Health, an international team of scientists’ worldwide recommendations for healthy and sustainable diets. Posted in January, it is a little like the U.S. Dietary Guidelines (now heading toward a 2020 update). But instead, it is heavily focused on global eating habits that must change to sustain both the Earth’s food production and environment.

The Lancet report does recognize that local and regional cultures, established food systems and environments make livestock a necessity, so future changes must be “carefully considered in each context and within local and regional realities.”

Nonetheless, the report echoes recommendations by other nutrition groups and environmentalists in past years and calls for “doubling in the consumption of ... fruits, vegetables, legumes and nuts, and a greater than 50 percent reduction in ... added sugars and red meat (i.e. primarily by reducing excessive consumption in wealthier countries).”

Another analysis addressing human diet needs and food production to 2050 — by University of Illinois agricultural economist Gerald C. Nelson and others — declares experts are too focused on agricultural production and instead should concentrate much more on consumption and access to healthful nutrients, including protein rich foods. With so many millions both starving, on one hand, and obese on the other, this report says, the greatest need is “increasing availability and affordability of nutrient-dense foods and improving dietary diversity.”

Ana Islas Ramos, FAO nutrition specialist in Rome, takes a similar view. Humans’ protein need are greatest as children. She says breast milk takes care of infants’ protein needs, and she described to Agri-Pulse an array of affordable, inexpensive options among whole grains, beans, peas, lentils, vegetables, milk, etc., that would “provide for a healthy child’s dietary needs of protein and most amino acids.”

So, like Nelson, Islas Ramos says, “the main issue is not production of protein dense foods, but access and utilization.” She notes, for example, that one egg contains 6 grams of protein, and says that, for growing children, an egg per day is an “excellent source of highly bioavailable protein, providing already about half of the (daily) dietary protein needs of the child.”

Ag technologists emphasize need for livestock

The CAST outlook report noted earlier comes down sturdily on the essential importance and need for livestock on several counts.

“Nutrient-dense animal-source foods represent the predominant, most affordable source for many essential dietary nutrients,” the report notes. Especially in developing countries, “livestock play an invaluable role in maintaining the health and nutritional status of inhabitants ... for whom the supply of high-quality protein is often limited,” the report says.

Much of those protein-dense foods come from grasslands that comprise 70 percent of all world agricultural areas” where food is produced typically “through the grazing of cattle, sheep, goats, water buffalo, and wildlife,” CAST observes, saying that “ruminant animals are best equipped to harvest the solar energy stored” in the forage on those lands.

The paper also explains how grass, hay and much of other farm animals’ feed, doesn’t compete with the human food supply, but are byproducts from grain fields, dairies, distilleries, flour mills, bakeries, seed crushing plants, and more.

So, says CAST: “The suggestion that animal agriculture should be abolished and that the global population could subsist on a vegetarian or vegan diet is a narrow view and ... (ignores) consequences.”

Not surprisingly, American livestock sector advocates aren’t impressed with the Lancet report’s recommendations on animal agriculture and see them as overly simplistic and off the mark.

As the CAST report also argues, ranchers and swine and poultry farms have been gradually reducing their environmental impact and carbon footprint in many ways for decades.

On that topic, AAA’s Thompson-Weeman said “calling for less meat consumption ... doesn’t really take into account the strides we’ve already made and what can possibly done in the future.”

Hannah Thompson-Weeman, Animal Ag Alliance

Indeed, several top national livestock organizations have completed studies assessing their strides in footprint-shrinking via a range of advances in efficiency, animal growth, nutrition, etc., which, together, spell declines in acres, gallons of water, electrical kilowatts used per unit of food produced. The reports also set yardsticks for future progress.

Check them out:

Cattlemen's Beef Board’s 2014 Beef Industry Sustainability Assessment, a detailed study “to provide a bench mark (to) help all beef operators ... find individual means of improving the efficiency and sustainability of their operations,” the Beef Board states.

National Pork Board’s Retrospective Assessment of U.S. Pork Production: 1960 to 2015 (posted in January 2019), which reports these trends across 55 years in impact per hog marketed: 76 percent less land used, 25 percent less water used, 8 percent reduction in carbon footprint, and 7 percent less energy used.

FARM Environmental Stewardship program of the National Milk Producers Federation. Co-ops launched FARM (Farmers Assuring Responsible Management) a decade ago, has enrolled more than 37,000 out of 40,000 total U.S. dairy farms and has built a team of 400 professional evaluators to help farmers meet bench mark standards.

Emily Yeiser Stepp, senior FARM director, said the Environmental Stewardship initiative began less than two years ago, and already “about 750 farms have had a FARM Environmental Stewardship evaluation conducted.”

The American Egg Board did likewise for egg farms. “We call it the 50-year study — 2010 compared with 1960,” says Mickey Rubin, executive director of the AEB's Egg Nutrition Center. He reports the industrywide found “egg production in 2010 resulted in about a 71 percent reduction in greenhouse gases ... water use was also down significantly ... (as was) land use. At the same time, hens are producing 27 percent more eggs and living longer.”

Thompson-Weeman points to the gamut of livestock sustainability studies and asks: “What could those numbers look like when they do new studies in 2050? We could have an even smaller footprint.”

Breeders on sustainability’s front lines

Although organic producers and many other proponents of sustainable agriculture exclude gene editing and transgenic tweaks to livestock and crop genomes from their notions of acceptable tools, biotech advances will likely end up essential to keeping farm animals healthy and livestock operations efficient.

Clint Nesbitt, senior director of science and regulatory affairs, at the Biotechnology Innovation Organization (BIO), says animal and plant breeders have a huge range of genetic advances in the works, but new disease resistance traits are probably most likely to advance in the decade ahead.

“With the change of climate, disease pressures are going to be a really big deal to try to stay on top of and are an increasing problem for animal production,” Nesbitt said. “Just keeping the animals alive is (going to be) a big factor.”

Growth traits, such as the first-ever one approved by the Food and Drug Administration for the fast-growing AquaBounty salmon, will also advance in the next several years, he thinks, because researchers already know the techniques to make those adjustments, “making a lot more meat with a lot less inputs.” He believes “that’s a big deal, and I think you’ll see similar examples in a variety of animals.”

Researchers are also making biotech tweaks, switching genes on and off and so forth, Nesbitt says, to makes forages, grains and other feeds more digestible for livestock, for example, and to alter fungi and bacteria in the microbiomes of the animal gut to improve digestion to promote animal growth, health, disease resistance and so forth.

Meat from the laboratory edging toward our plates

It’s been five and a half years since the televised tasting of the first laboratory-grown meat muscle — a beef patty — in the Netherlands. Since, countless labs and investors have been gathering to launch this new version of animal muscle product that’s called cell-derived or cell-based meat by most, and clean meat by many of the products’ proponents.

GFI’s Ball says cell-based meat investors’ intent is to “sort of take out the middleman,” the meat animal, in this case, from the pipeline so making meat becomes cheaper and impacts the environment much less than does conventional meat.

Matt Ball, Good Food Institute

“There is an inherent inefficiency in feeding crops to animals,” he said, “because they spend more of their calories on their own metabolism ... their brains, their blood, their bone ... (and) feathers. Even though the chickens of today grow much faster and with much less feed than when my grandfather was a farmer, they still take more input than they give as output.”

One startup, San Francisco-based New Age Meats, for example, has been holding tastings for its experimental cell-based sausage around the country. And Just, which market’s plant-based products such as Just Mayo, wants to grow its beef from the genetics of a top-line Japanese cattle breed.

Meanwhile, California-based Memphis Meats (MM) sampled its first cell-based meatballs more than three years ago and now says it has beef, duck, and chicken products in development. It announced last August that it had already raised $22 million from investors, including Cargill, Tyson, Bill Gates and others.

Livestock and processing industries have both pressed regulators to decide rules on labeling and processing for this new type of bloodless meat that eschews slaughter.

In the U.S., USDA and the Food and Drug Administration, which are working jointly toward regulating this meat category, held a hearing last October, and Food Safety and Inspection Service Administrator Carmen Rottenberg said at USDA’s Outlook Forum last week that “we expect to have something out very soon on a general framework” for cell-based meats.

At the same event, Uma Valeti, MM’s chief executive, declared that his company, when regulations are completed, will “be ready to go tomorrow.”

Meanwhile, Ball says that, like any new product for mass markets, corporations trying them out on restaurant and supermarket customers will likely absorb losses for a while. “I don’t think the first products are actually going to be cost-competitive; they’ll be in high-end restaurants — like, proof-of-concept (products),” he says.

To be successful in the food market, he says, cell-based meat must appeal to average consumers and “be products such as burgers and chicken and the like that are available at competitive prices ... where they already shop.”

At the same time, some makers of vegan meat alternatives, such as Nestle’s Garden Gourmet, and Impossible Foods, with its Impossible Burger, have found new success in meat-taste and texture in their products, and such plant-based meat substitutes, already on the market, may end up a better sell with consumers long term than cell-based meats.

But also note that consumers do develop tastes for foods concocted in laboratories. Modern cheese makers, for example, use genetically altered microbial rennet rather than the traditional rennet from calf stomachs to curdle milk for cheese, and vegetarians typically prefer the microbial version.

Meanwhile, for the Impossible Burger itself, researchers isolated heme, an essential molecule in all plants and animals but exceptionally concentrated in meats, thus supplying meaty flavor.

Already, says Ball, “everywhere from White Castle to fancy, high-end restaurants are selling Impossible Burgers.”

For more news, go to: www.Agri-Pulse.com