A surge of nationwide cheese demand driven at least in part by the Trump administration’s Farmers to Families Food Box program sparked wild swings in dairy markets and fueled a new debate over changes in federal milk pricing policy made in the 2018 farm bill.

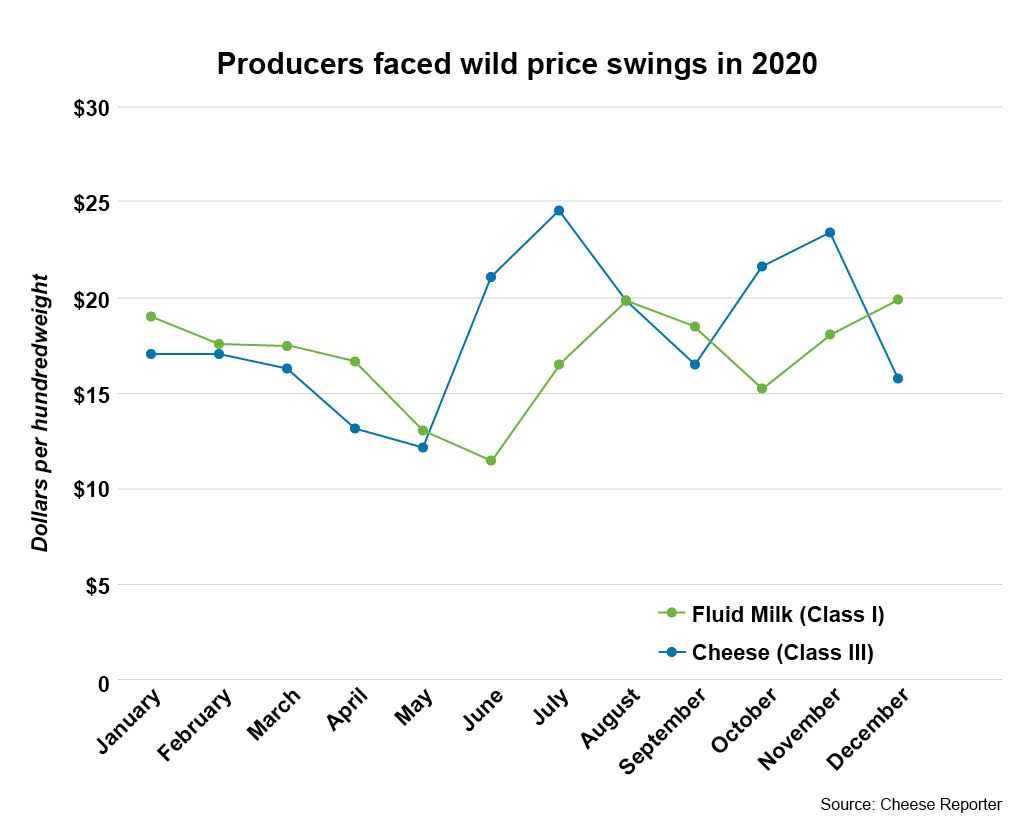

Prices for all uses of milk plunged in March and April as schools, restaurants and hotels closed because of the COVID-19 pandemic.

But cheese prices skyrocketed starting in May as the Agriculture Department launched the first round of the Food Box program, which was aimed at aiding farmers and the food service sector by funding the delivery of fresh food, including dairy products and produce, directly to the needy.

Meanwhile, prices for milk sold for fluid milk or for butter, which is heavily used in restaurants and food service outlets hammered by the pandemic-related restrictions, remained relatively lower.

Jim Mulhern, NMPF

But many producers failed to benefit from the booming cheese prices, in part because of the complex rules for pricing under the federal milk marketing order system, together with a key change made in the 2018 farm bill.

At issue are rules that link milk sold in fluid form to prices for cheese and butter and other rules that allow processors to remove milk from revenue-sharing pools, economists say.

An analysis by the American Farm Bureau Federation estimated in December that the rules resulted in $3 billion in forgone income to producers. Meanwhile, USDA announced the launch of a fifth round of the Food Box program, which is likely to help maintain demand for cheese.

The National Milk Producers Federation is starting internal discussions on reworking the pricing changes the farm bill made as the result of an agreement NMPF had reached with the International Dairy Foods Association.

The formula included in the farm bill was intended to be “a revenue-neutral solution to the concerns of fluid milk processors about hedging their price risk,” NMPF President and CEO Jim Mulhern said in a statement issued following a decision by the group’s executive committee. “With that balance severely upended due to the pandemic, a modified approach is necessary. We need a solution that provides more equity and balance between farmers and processors.”

Paul Bleiberg, NMPF’s senior vice president for government relations, said there is “a lot of urgency” to address the issue among members in some regions of the country, depending on how much of their milk goes into fluid milk. The feeling among many members is that the demand surge caused by the Food Box program highlighted a flaw in the pricing system that needs to be addressed before another disruption occurs, he said.

Under an agreement between NMPF and the IDFA that was written into the farm bill, the price for fluid milk is set at 74 cents per hundredweight over an average of the prices for Class III (milk sold for cheese) and Class IV (butter and milk powder).

Under the old system, the price for fluid milk was set as a premium over the price paid for either Class III or Class IV, whichever was higher. The change was intended to eliminate price spikes and provide companies buying fluid milk with more predictability. Processors had preferred getting the legal authority to forward contract for fluid milk, but NMPF has long declined to support that. (The 74-cent premium was based on the historic average of what producers have been receiving for fluid milk over the cheese and butter prices.)

But the change in the formula also meant producers of fluid milk didn’t really benefit last year when cheese prices surged, and then many processors also removed a significant amount of milk from revenue pooling. Other producers saw deductions in their payments from producers based on the “producer price differential,” or PPD. PPDs turned negative in some months due to the divergence in milk pricing.

“Producers are rightfully agitated about” the formula change, said Marin Bozic, an economist at the University of Minnesota. “They were promised a system that would be facilitating risk management programs by companies such as Starbucks or others that wanted to lock in their budgets for multiple months and are using fluid milk in their offerings.”

He said producers “were promised that they would not be hurt” by the formula change, but “they were hurt by like many hundreds of millions of dollars in 2020.”

Interested in more news on farm programs, trade and rural issues? Sign up for a four-week free trial to Agri-Pulse. You’ll receive our content - absolutely free - during the trial period.

In June, with the Food Box program up and running, the average Class III price hit $21.04 per hundredweight, while the Class I and IV prices remained at just over $14 and under $13 per hundredweight respectively.

An official with IDFA cautioned against making changes to the formula as the result of market disruptions related to the pandemic. But Dave Carlin, senior vice president for legislative affairs and economic policy, said he expected the issue to be discussed by the group’s economic policy committee at an upcoming meeting. The committee includes companies’ milk procurement experts.

“Let’s be careful about coming up with a solution that is based on current market conditions, and those current market conditions are just so crazy and skewed compared to what they normally look like,” Carlin said.

Revenue pooling is intended to allow producers to receive a uniform price for their milk regardless of how it is used. But the sharp divergence in milk component prices led many processors to de-pool Class III milk, which was benefiting from the cheese demand, so that producers didn’t benefit from its higher value, economists say. Only Class I milk is required to stay in the pool.

Marin Bozic, University of Minnesota

The AFBF analysis provided two examples of the impact on dairy farms: From June to November, a 200-cow dairy in western Pennsylvania would have experienced PPD milk check deductions of nearly $130,000, while a 3,000-cow dairy operation in California would have seen deductions of more than $2.5 million.

Another issue, according to Bozic, is that processors aren’t required to disclose to producers when they have de-pooled milk to avoid revenue sharing.

Under the 2018 farm bill, the pricing formula can be changed anytime after May by USDA. But it remains to be seen whether the industry can agree on what USDA should do.

Bozic said it’s important that there be a vigorous public debate about any changes. If not, “those that mean well may end up producing something that doesn't perform as well,” he said.

USDA didn't respond to a request for comment on the pricing issue.

For more news, go to www.Agri-Pulse.com.