WASHINGTON, Sept. 15, 2015 - Facing the possibility that crude oil prices could drop below the current range of $45 to $50 a barrel, far below June 2014’s $114 peak, oil producers and their allies in Congress are pushing hard to end the 40-year-old ban on crude exports.

Despite Markey’s arguments, ending the ban gained ground last week when 14 conservative House Democrats, members of the Blue Dog Coalition, signed on, including co-chair Rep. Jim Costa of California.

“Expanding our export opportunities to include crude oil, in addition to gasoline and natural gas products, will further stimulate our economy and create jobs,” Costa said. “Providing our domestic producers the ability to sell crude oil to the global market will reduce the geopolitical influence of bad actors like Iran and Russia.”

Proponents insist that lifting the 1975 ban would boost jobs and the U.S. economy, help America’s allies, and end a long outdated policy, all while lowering gasoline prices for American consumers. Opponents counter that unleashing crude exports will raise U.S. gasoline prices, ship jobs overseas, help China’s economy by driving down global oil prices, and trigger new oil-sector investments which otherwise would go into renewable energy.

Lifting the ban got a major endorsement when the federal Energy Information Administration (EIA) concluded in a September report, Effects of Removing Restrictions on U.S. Crude Oil Exports, that removing the export restrictions would leave prices for gasoline and other petroleum products “either unchanged or slightly reduced.”

Still, at the same time, the EIA’s Sept. 9 Short-Term Energy Outlook warned: “The oil market faces many uncertainties heading into 2016, including the pace and volume at which Iranian oil reenters the market, the strength of oil consumption growth, and the responsiveness of non-OPEC production to low oil prices.”

EIA’s forecasts assume Republican lawmakers will not be able to block the Iran nuclear deal, and that international sanctions, including barriers to Iranian oil exports, will be phased out in 2016. Expected results include Iran boosting its oil production as much as 700,000 barrels per day (b/d) and returning to its pre-sanctions level of over 3.5 million b/d and selling its 30 million barrels of stockpiled oil. That additional Iranian oil would depress world oil prices and compete with any U.S. crude oil exports.

Current U.S. regulations already allow U.S. crude exports to Canada, some exports from Alaska and California, exports of lightly processed “condensate,” and provide for Commerce Department waivers as needed. The EIA notes that “Current policies restrict, but do not prohibit, exports of crude oil.” There are no restrictions on exporting U.S. gasoline and other refined petroleum products.

Current U.S. regulations already allow U.S. crude exports to Canada, some exports from Alaska and California, exports of lightly processed “condensate,” and provide for Commerce Department waivers as needed. The EIA notes that “Current policies restrict, but do not prohibit, exports of crude oil.” There are no restrictions on exporting U.S. gasoline and other refined petroleum products.

House Energy and Power Subcommittee Chairman Ed Whitfield, R-Ky., insists that ending the export restrictions “would create additional demand and spur increases in oil production” and “would allow the U.S. to help counter the influence of Russia, OPEC, and potentially Iran . . . In sum, oil exports would help our allies and hurt our adversaries.”

In a House mark-up session last week, Whitfield’s subcommittee approved Rep. Joe Barton’s bipartisan H.R. 702 bill to end the ban. The full Energy and Commerce Committee will mark up both the Barton bill and a broad energy bill, the North American Energy Security and Infrastructure Act, in Wednesday and Thursday sessions this week.

Barton’s legislation states that based on the resurgence in U.S. oil production and America’s commitment to free trade, “the United States should remove all restrictions on the export of crude oil, which will provide domestic economic benefits, enhanced energy security, and flexibility in foreign diplomacy.” The bill also orders that “no official of the Federal Government shall impose or enforce any restriction on the export of crude oil.”

At the markup, House Energy and Commerce Committee Ranking Member Frank Pallone, D-N.J., opposed the Barton bill, arguing that any increased U.S. oil production should create new jobs in U.S. refineries rather than new jobs in refineries overseas. He also warned that “Increasing crude oil exports means increasing domestic production of crude oil which has impacts on climate change, on public health, on worker safety, on property owners, and on protection of our water supplies.”

In three briefs calling for Lifting the Crude Oil Export Ban, the non-profit Bipartisan Policy Center stated:

· “Credible research shows that lifting the ban would put downward pressure on gas prices, increase GDP and create thousands of new jobs.”

· “Unlike some of the world's largest oil producing nations, the U.S. is politically stable, meaning steady supplies of domestically-produced crude would likely help reduce current global oil market volatility.”

· “Additional U.S. crude oil in the market, or even the prospect of it, would provide American allies with a stable option to diversify their supplies and more leverage against potentially manipulative supplier nations.”

EIA notes that “In 2009, after declining steadily since 1985 (with the exception of a 60,000 barrels per day [b/d] increase in 1991), crude oil production in the United States increased by 350,000 b/d to 5.4 million b/d. Since 2009, annual production has continued to rise, averaging 8.7 million b/d in 2014 and 9.5 million b/d in the first five months of 2015.”

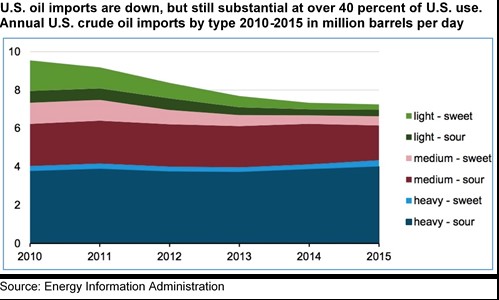

U.S. crude production at 9.5 million b/d is nearly double 2005’s 5 million b/d. For the same period, U.S. crude imports are down from 11 million b/d to 7.28 million b/d. For some, those changes argue for ending the export ban. Others see the improved picture as proof U.S. policies are working as intended to increase U.S. energy independence.

#30

For more news go to: www.Agri-Pulse.com