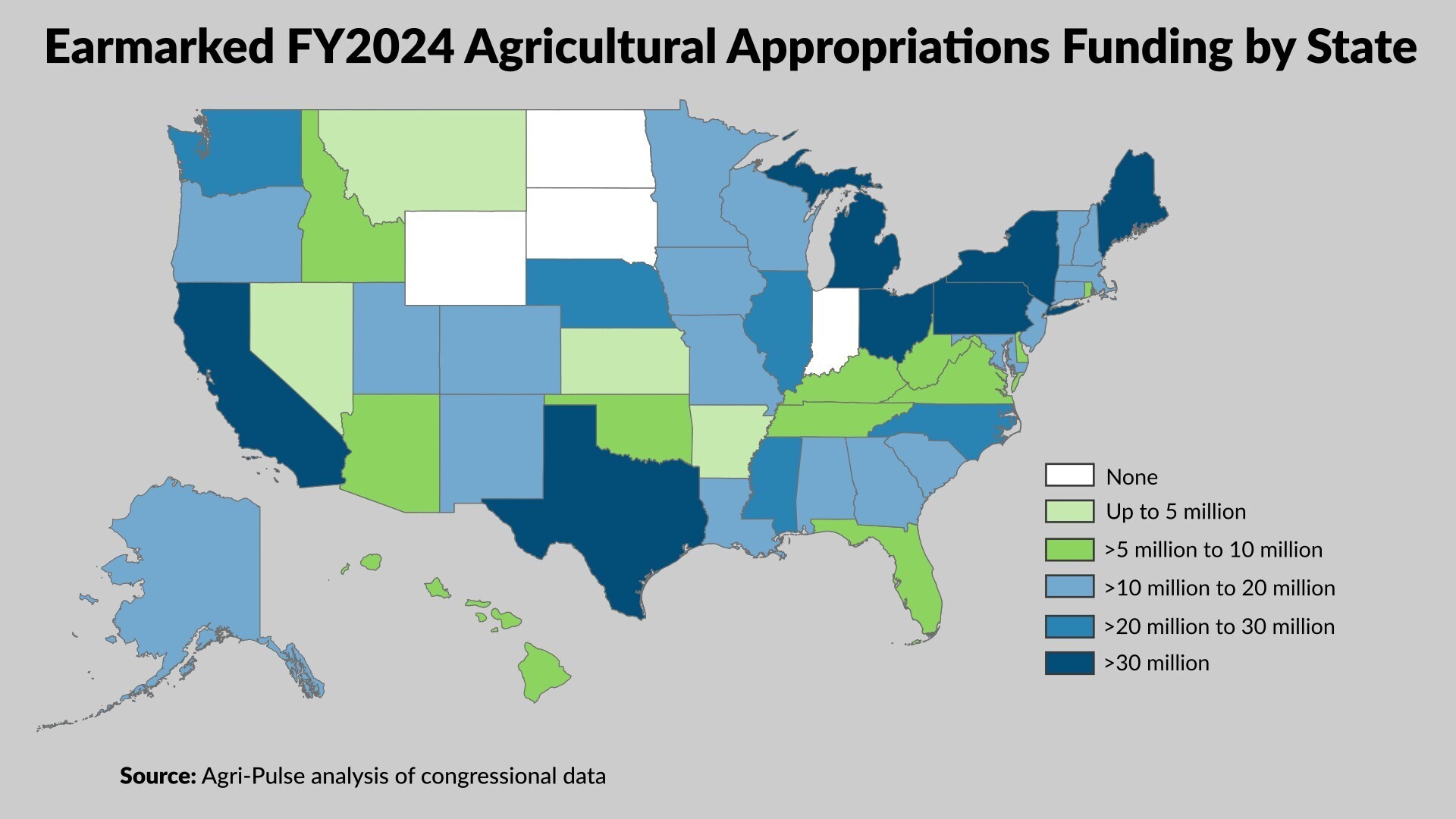

Earmarked FY 2024 Agricultural Appropriations Funding by State

Lawmakers are reserving more than $750 million in USDA funds for projects in their states.

That funding will come directly from fiscal year 2024’s $22 billion ag appropriations bill.

This map shows which states requested the most funding.

Topping the list was Maine, with nearly $53 million in reserved funding.

Second was Texas with $42 million. Pennsylvania was third with $41 million, and California was allocated nearly $33 million.

The funding will be spent on a variety of projects including research facilities and laboratories, hospitals and building renovations.

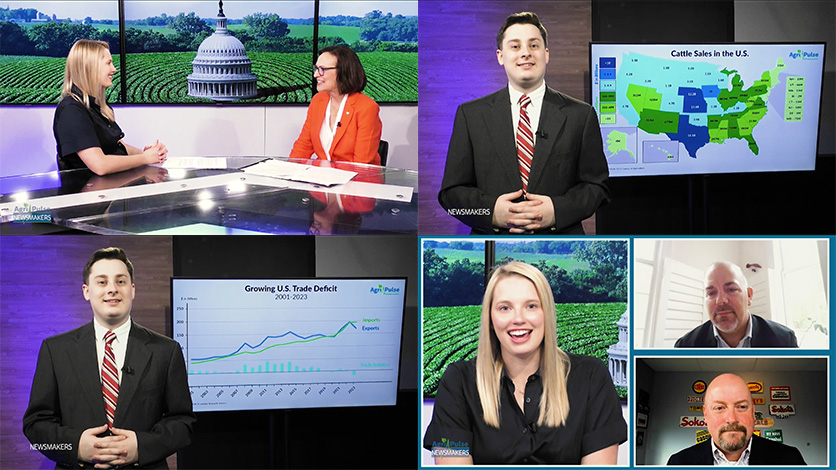

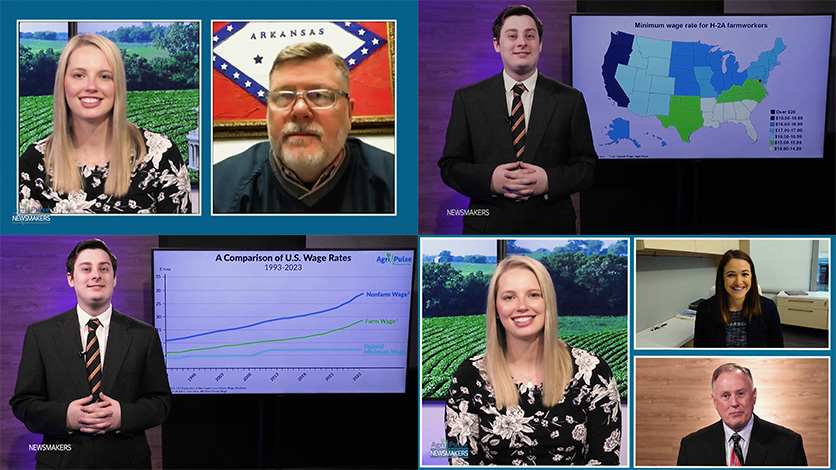

To learn more about our "Map it Out" segments, please check out our Newsmakers show.

.png?t=1714067100&width=100)

.png?t=1713886980&width=100)