WASHINGTON, Jan. 21, 2015 – The U.S. pet industry is in the midst of a bullish expansion phase for both pet nutrition and care, following the recession slowdown, making dogs and cats rising consumers of livestock industry and other farm and fishery products.

Americans spent more than $58 billion on pets – mostly dogs and cats – in 2014, the American Pet Products Association estimates, with $22.6 billion going to food, double the dollar figure of a dozen years ago. Trends suggest expenditures could be $2 billion to $3 billion higher this year, when vet fees, grooming and other care is taken into account.

What’s behind the growth? The U.S. economic recovery, in part, and demographics as well. American women, whether married or single, are waiting longer to have their first baby (the average age is now 27), and, increasingly, pets are their children. And urban singles get dogs for security as well as companionship. Plus there’s a surge of Baby Boomers entering retirement and they are getting more pets. Add to that the country’s rising proportion of city dwellers, filling the lack of animals in their lives with a dog or cat. Such factors have, overall, resulted in a 9 percent jump in U.S. households with dogs in the past five years, and a 5 percent increase for cats. By themselves, those trends would keep expanding the U.S. pet population – which now includes about 72 million dogs and 74 million cats.

Yet the biggest driver of increased pet spending is pampering – what the industry calls humanization of pets. Industry surveys report that more than 80 percent of Americans view their pets as family members, and nearly as many say their pets’ nutrition is as important to them as their own.

“Some of the trends are not based on nutrition; they’re based on perceptions,” as pet owners shop for what they believe is best for their pets,” says Kurt Gallagher of the Pet Food Institute. Owners tend to extend their own dietary preferences to their pets. While food allergies in cats and dogs are rare, and are confirmed even more rarely, sales of gluten-free pet food are on the rise. “Our industry is very dynamic,” he says, and pet owners’ growing discrimination in chow and other care only accelerates new trends in pet care and food.

Thus, Americans’ growing devotion to pets means not just more chow for more pets, but premium quality, specialty products and nutrition supplements. And that spells more sales by meat and fish processors for a swelling array of products from major manufacturers, such as Purina, Mars and Tuffy’s Pet Foods, but also from a surge of small start-up companies plying their all-natural, organic or other market pitches on their labels.

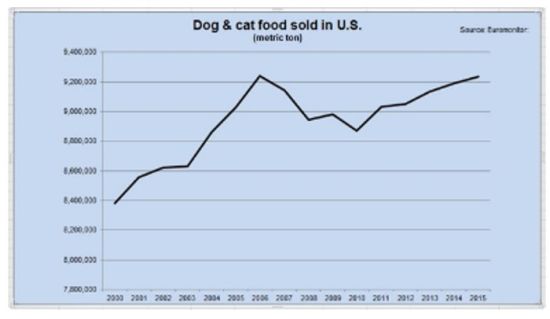

Euromonitor, which reports trends in pet care worldwide, says direct online sales are the channel of the fastest sales growth, largely because the Internet gives small operators a cheap, effective way to serve the swelling crowd who want locally-produced pet chow, including raw meat products.

Euromonitor, which reports trends in pet care worldwide, says direct online sales are the channel of the fastest sales growth, largely because the Internet gives small operators a cheap, effective way to serve the swelling crowd who want locally-produced pet chow, including raw meat products.

Leading the market growth: The “treats” category, including teeth-cleaning chews, vitamin-laced and other snacks with names such as Whisker Lickin’s, Waggin’ Train, Beggin’ and Temptations. Americans will spend well about $3.4 billion on dog and cat treats this years, industry statistics suggest, up nearly 30 percent in the past five years.

The trend in the chow itself is similar: More spending on high-priced premium products as pet owners tend more toward smaller dogs in urban settings. So while the volume of dry pet food is nearly flat year to year, the value keeps showing moderate increases.

#30

For more news, go to www.agri-pulse.com.