House Republicans are proposing to revive the expired $1-a-gallon tax credit for biodiesel but gradually phase it out after 2021.

A year-end tax package released by the House Ways and Means Committee Monday night would lower the tax subsidy to 75 cents a gallon starting in 2022, 50 cents in 2023 and 33 cents in 2024. The credit would be eliminated after 2024.

The $1.01-per-gallon tax credit for second-generation biofuels, including ethanol derived from corn stover or wood chips, and a separate tax benefit for biofuel pumps would be extended for 2018 only.

Kurt Kovarik, vice president of federal affairs for the National Biodiesel Board, said the biodiesel sector has long sought a long-term extension of the tax credit rather than a continued pattern of retroactive extensions, "which does not provide the certainty businesses need."

"We appreciate the recognition that the biodiesel industry is integral to our domestic energy needs through this long-term extension," he added.

The package, which would also extend some tax benefits for other biofuels, contains enhancements to retirement and other savings plans, legislation to redesign the Internal Revenue Service, and language to provide temporary tax relief for victims of the wildfires in California, Hurricanes Florence and Michael and by storms and volcanoes in the Pacific.

The Retirement, Savings, and Other Tax Relief Act of 2018 and the Taxpayer First Act of 2018 also makes some technical corrections to the Tax Cuts and Jobs Act, which Congress passed in December 2017.

Interested in more news about the farm bill, trade issues, pesticide regulations and more hot topics?

Sign up here for a four-week Agri-Pulse free trial. No risk and no obligation to pay.

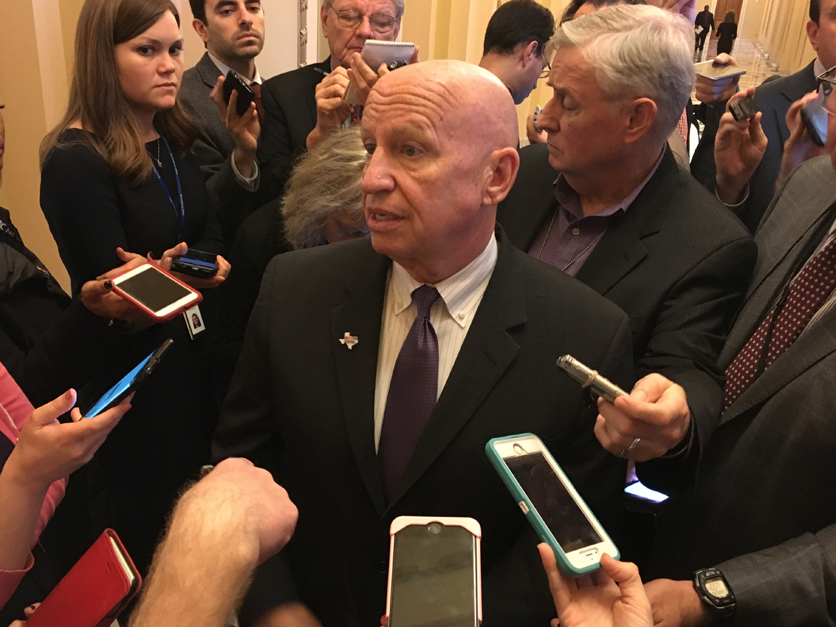

“This broad, bipartisan package builds on the economic successes we continue to see throughout our country," Ways and Means Committee Chair Kevin Brady said in a statement. "The policy proposals in this package have support of Republicans and Democrats in both chambers. I look forward to swift action in the House to send these measures to the Senate.”

CLICK HERE to read the full 297-page bill.

For more news, go to: www.Agri-Pulse.com