Keep building, expanding, innovating and educating. Those were some of the key messages to the crop insurance industry from Secretary of Agriculture Tom Vilsack, members of Congress and crop insurance industry leaders during the annual Crop Insurance Industry Convention in Indian Wells, California this week.

“America's farm safety net is the envy of the world and the public-private partnership, the federal crop insurance system is one of its key components,” noted Vilsack in a video address. “There are a lot of reasons our farmers and ranchers have turned to crop insurance as part of their risk management planning. Speed and payments when losses take place is obviously key,” he said, while describing the industry as “flexible and continuously innovating.”

Vilsack emphasized that “we still have work to do to provide coverage to all producers across every country” and touted the new micro farm policy, aimed at small farms who sell locally, as an example.

Representative Salud Carbajal, D-Calif., said farmers in his district often tell him they rely on crop insurance.

“I can’t tell you how often I hear from the growers in my district how important crop insurance can be to them,” he said. “And we can continue to work to improve and expand the program.”

Kendall Jones, chair of National Crop Insurance Services and president and CEO of ProAg, also highlighted some of the industry’s successes last year, including:

- $13.7 billion in multi-peril crop insurance premium with $136.6 billion in liability

- 461 million acres in total land area insured

- 90% of major field crop acres covered

- 91% of acres insured at 70% coverage level or higher

- $1.2 billion in Crop Hail premium with $40.3 billion in liability

- $573 million in livestock premium with $14 billion in liability

Farmers invested $5 billion dollars of their own money through premiums in 2021 to protect their crops, Jones added.

In listening to remarks from RMA Administrator Marcia Bunger, Jones said she understands the ongoing challenge to make crop insurance more understandable to all farmers, especially as some of the current workforce retires and new employees are hired.

“She didn’t say fix it or say it was broken…she just asked us to improve agent education,” Jones said. “The credibility of the program is impacted by the quality of agent education, and our agents in turn, take that information and share it with farmers.”

Looking for the best, most comprehensive and balanced news source in agriculture? Our Agri-Pulse editors don't miss a beat! Sign up for a free month-long subscription.

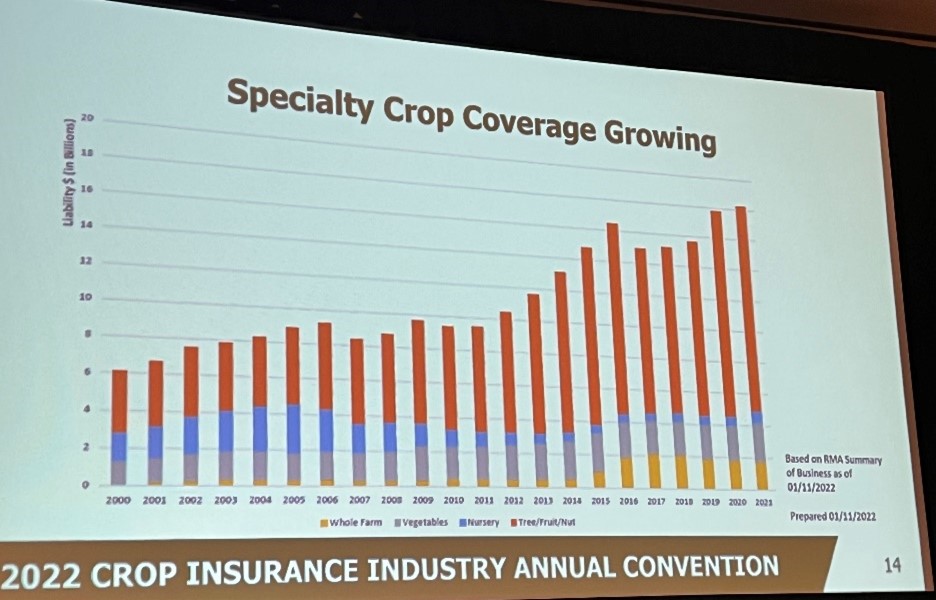

Jones pointed to several new crop and livestock policies that have been added to the crop insurance industry’s portfolio each year, the growth in coverage of specialty crops, and the complexity of trying to manage dozens of updates to insurance standards and handbooks each year.

“If anyone things crop insurance is easy to manage day to day…it’s not,” she emphasized. Still, she said the industry met all of the challenges thrown at it this past year while continuing to expand the breadth and depth of crop insurance with “new plans, programs and increasingly diverse participants.

“The world is changing, there's new risks, and we're going to have to adapt by doing things differently,” she added.

Kendall Jones displayed this chart showing how coverage of specialty crops is growing.

Kendall Jones displayed this chart showing how coverage of specialty crops is growing.

“The scale and size of crop insurance further demonstrate that farmers have come to rely upon our industry when the going gets tough,” she said. “We need to build on that credibility as the environment farmers operate in continues to evolve. We are in position to continue to modernize and improve – adapting risk management tools to the risk.”

For more news, go to: www.Agri-Pulse.com