Commodity groups face some critical farm bill decisions in coming weeks that hinge on factors out of their control, including an updated forecast of farm program costs and uncertainty about the ongoing debt ceiling standoff between the White House and House Republicans.

The Congressional Budget Office is expected to release new 10-year estimates as soon as May. The forecast is vital to the farm bill debate.

The cost estimates will set the limits on how much can be spent in the farm bill, assuming Congress doesn’t provide additional funding, and CBO’s estimates for future crop prices will be used to estimate the cost of modifying commodity program provisions. Experts say those price estimates, depending on how they come out, could make some policy options more attractive than others.

The battle over the debt ceiling and House GOP efforts to slash federal spending could determine whether there’s any extra funding available for the farm bill. If there isn't, budget rules make it difficult to spend anything more than CBO has forecast for the cost of existing programs.

With Congress now in a two-week recess for Easter, no negotiations are going on over the debt ceiling or the budget, and House Republicans appear nowhere close to coming up with their own budget allocation plan.

The uncertainty about both the debt ceiling battle and what the CBO forecast will show means “things are kind of frozen” for farm groups in planning the specific details of how they think the commodity program safety net should be improved, one farm bill lobbyist told Agri-Pulse.

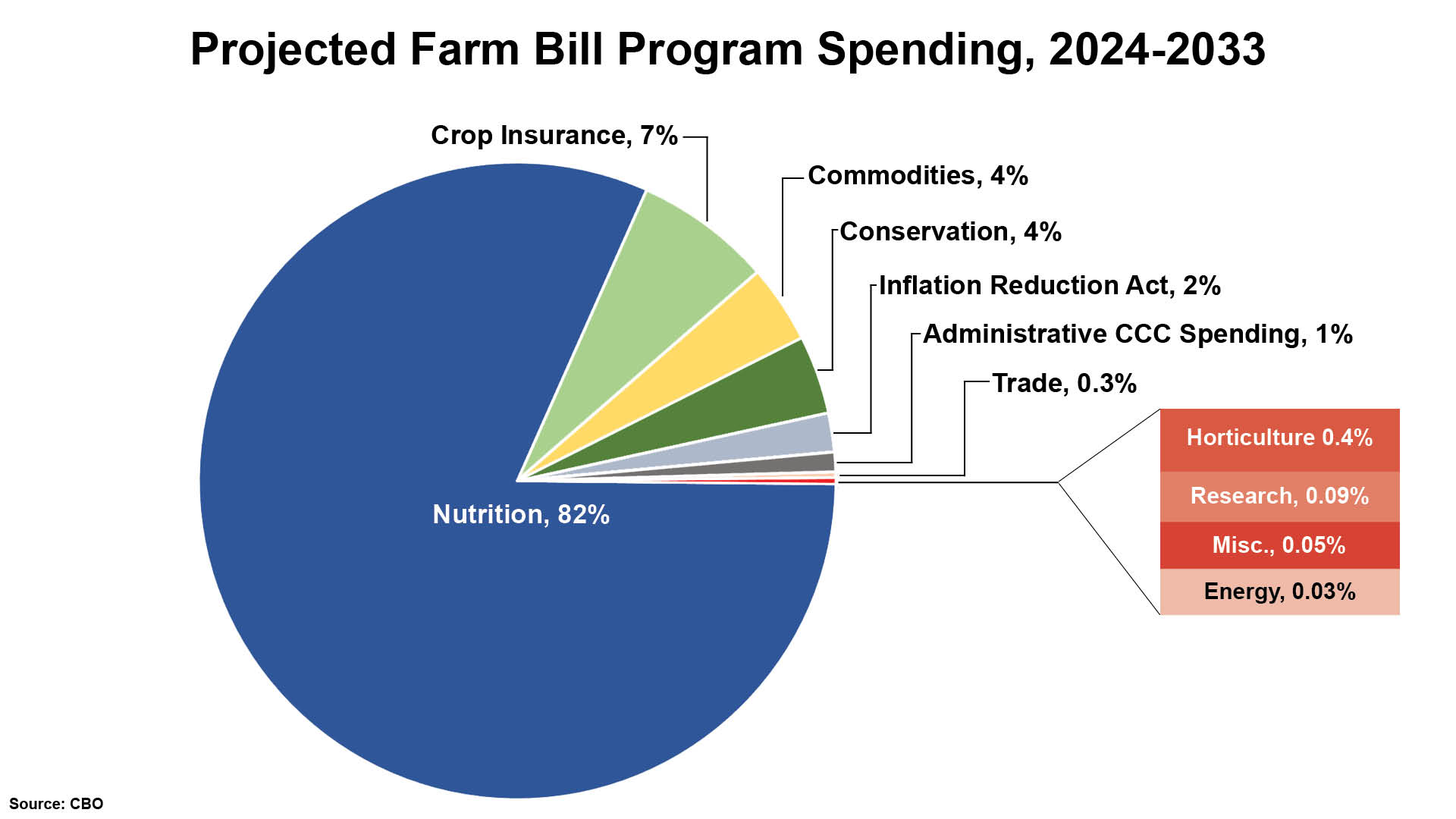

Congressional Budget Office breakdown of farm bill spending from its most recent forecast in February.

Congressional Budget Office breakdown of farm bill spending from its most recent forecast in February.“I think we’ll see a few more hearings start to kick up on this preliminary question of how would you do it,” said the lobbyist.

The commodity price estimates CBO uses in its updated forecasts will have a significant effect on options for addressing Price Loss Coverage reference prices, a major priority for several farm groups and Senate Ag ranking member John Boozman, R-Ark. In a recent interview with Agri-Pulse, Boozman said he would not vote for a farm bill that did not “that doesn’t take care of our reference prices and our crop insurance.”

The higher CBO’s price estimates, the less it will cost for Congress to increase the statutory PLC reference prices that were first fixed by the 2014 farm bill. Higher price forecasts make it less likely in CBO’s calculations that market prices will fall below the reference payments and trigger future PLC payments to farmers. Economists at Texas A&M University have estimated a relatively modest 10% increase in those reference prices would cost $20 billion over 10 years.

But lower price estimates could make another policy option look much more attractive: The 2018 farm bill included an escalator provision to raise PLC reference prices during periods when market prices have increased significantly. Any increases in what is known as the “effective reference price” are capped at 15% above the statutory price for a particular commodity.

For example, the statutory reference price for soybeans is $8.40 a bushel; the effective reference price can't go higher than $9.66, and it can rise and fall in any given year depending on the previous five-year average of market prices.

The future price estimates in CBO’s most recent farm bill forecast, released in February, are so low that Congress could eliminate the 15% limit on effective reference prices at relatively little cost, says Patrick Westhoff, director of the University of Missouri’s Food and Agricultural Policy Research Institute, which recently released its own farm bill forecast.

Ending the cap “wouldn't be free, but it wouldn't be horribly expensive to do that,” Westhoff told Agri-Pulse. “If you have a higher price forecast, it’s more expensive.”

CBO’s February forecast estimates soybean prices will fall from $10.40 a bushel next year to $9.50 a bushel by 2028, while FAPRI projects the 2028 price at $10.89. CBO estimates the 2028 prices for corn and wheat at $3.90 and $5.45 per bushel respectively, compared to FAPRI’s estimates of $4.33 and $5.77.

But there’s a significant trade-off for addressing the escalator provision rather than raising statutory reference prices: Raising the statutory reference prices would be permanent; any increases in effective reference prices are not, and farm groups argue the statutory price levels haven’t kept up with the markets and don’t adequately protect growers against increases in input costs.

Patrick Westhoff, FAPRI

Another option Congress could consider is a combination of an increase to the statutory reference prices and an increase to the 15% cap on the escalator. Some have also suggested a possible linkage of future reference prices to increases in production costs.

Patrick Westhoff, FAPRI

Another option Congress could consider is a combination of an increase to the statutory reference prices and an increase to the 15% cap on the escalator. Some have also suggested a possible linkage of future reference prices to increases in production costs.A key question for farm groups is whether they think commodity prices are likely to stay at a higher level than they have traditionally been at or whether they are likely to stabilize at lower, more historical levels.

The value of the escalator “depends on your forecast of future prices,” said Carl Zulauf, a longtime economist at The Ohio State University.

Don’t miss a beat! It’s easy to sign up for a FREE month of Agri-Pulse news! For the latest on what’s happening in Washington, D.C. and around the country in agriculture, just click here.

“If you believe that equilibrium price has not changed, then this has less value to you as a risk management tool. If you believe that equilibrium price has increased, then the escalator has more value because you think it provides a higher effective floor in the new price environment.”

Scott Gerlt, chief economist for the American Soybean Association, said farm groups are currently evaluating various options and their trade-offs amid the uncertainty about the next CBO forecast.

“No one will probably know final costs until we get the new CBO baseline. But I think we're all trying to work to kind of get ideas of what things would cost and the sort of benefits that would provide,” said Gerlt.

ASA is one of several groups that would like to see Congress provide some increase in Price Loss Coverage reference prices. Another is the National Association of Wheat Growers; wheat has a statutory reference price of $5.50 a bushel; last year, wheat prices averaged $9.08 a bushel.

“We would like to see an increase in the statutory reference price. However, depending on the availability of resources, there could be tinkering with the effective reference price and a revisiting of the statutory reference price,” NAWG CEO Chandler Goule said in a statement to Agri-Pulse.

“We are looking at several of the toggles that make up the effective reference price, including eliminating the 15 percent cap,” he added. “Ultimately, it will depend on what resources are available to us, and we should examine both to provide a meaningful change to growers.”

For more news, go to Agri-Pulse.com.