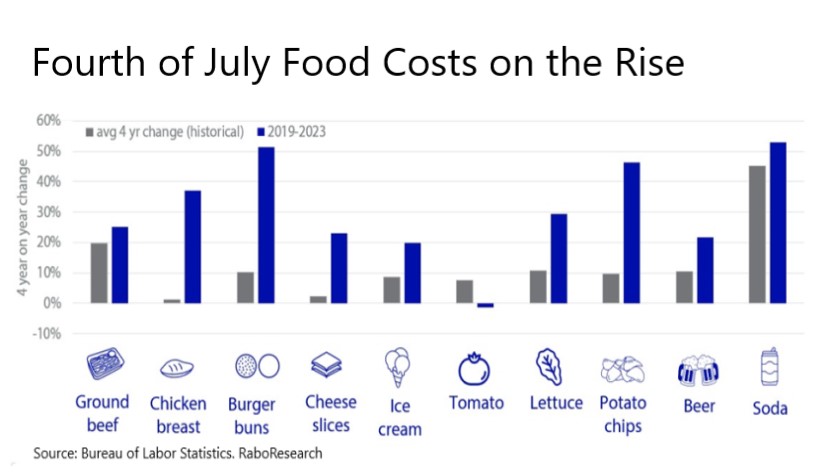

Consumers are unlikely to scale back on July Fourth celebrations even with prices for barbecue staple ingredients up 31% on average over the past four years.

The 2023 Rabobank BBQ Index, which measures the cost of familiar necessities for a 10-person barbecue, estimates it will cost $97 to host a cookout on Independence Day this year, up from $73 in 2018. Speaking during a webinar on the findings, Tom Bailey, senior consumer foods analyst at Rabobank, explained although this is only up 3% from last year, it is a $25 jump from pre-COVID levels. Some deflation occurred for some ingredients including chicken, lettuce and tomatoes.

Bailey said even at these elevated prices, consumers are proving resilient in managing higher food costs as they choose food as an experience worth splurging on.

“We may see spending heat up as consumers trade up to more premium products to make this year’s barbecue a more memorable one,” he said.

Commodity price increases in 2021 resulted in higher costs which passed on to consumers in 2022, Bailey said.

“Commodity prices have eased, but we are not seeing it yet in consumer prices,” Bailey said. “Retail prices historically are quite sticky on the way down. Rather than retailers just dropping their prices, we’re more likely to see some discounts and some promotional activity picking up for this year’s barbecue.”

Millennials, now the nation's largest consumer group, are generally willing to make those increased purchases if it creates an improved experience. This is especially true in the beef market, where demand is holding up better than expected despite competing pressures on a macroeconomic level, said Lance Zimmerman, Rabobank senior animal protein analyst.

Beef prices, which consist of 14% of the Rabobank barbecue cost breakdown, are at record levels in 2023. Zimmerman said he anticipates beef prices to remain elevated not only through the rest of the year but for the next several years because of the ongoing drought, which first began in 2019, and a stage in the cattle cycle where cattlemen are starting to aggressively cull herds.

“In 2023, while the culling is slowing starting to subside as the drought is getting more manageable, what we’re seeing is that the U.S. cow herd and the declines that had taken place the last several years are showing up in the beef supply,” Zimmerman said with cattle slaughter down 5% year-to-date. “Our expectation is new record highs in retail beef prices as we navigate through this year” and continued higher prices into 2024 and 2025.

He believes a higher percentage of these higher retail beef prices are going to find their way back to farmers and “encourage the next expansion and essentially make the U.S. cattle producer more profitable again after years of suffering some losses.”

Consumers also did not trade down to pork or poultry when beef prices increased as they did in the 80s, 90s and even into the 2000s.

“A pound of choice beef today costs a little over $7, approaching $8 a pound. With average per capita incomes where they are that works out to basically the average U.S. consumer needing to work less than 15 minutes to pay for a pound of choice beef,” Zimmerman said. “That pound of choice beef can feed that family of four a meal. And so even as one of the most expensive items in the grocery basket, it still is an incredible value.”

Other products that stood out with increases in the barbecue cart include bun costs, up 51%, and potato chips, which increased 46%. JP Frossard, a Rabobank consumer analyst, said fresh bread prices have increased double digits since last summer due to the war in Ukraine and a corresponding surge in wheat prices, and some of that was catching up from elevated wheat prices over the last six years that hadn’t been passed onto consumers.

Wheat prices remain 73% higher than three years ago, but margins for bakeries will remain under pressure with high costs of labor, energy, packaging and other commodities included in the cost of bread such as sugar and edible oils, Frossard said.

Consumers may see some relief in dairy products, although it may not be realized by consumers this summer, said Lucas Fuess, dairy analyst. “Milk prices paid to dairy farmers are relatively low, well below some of the records that we saw one year ago. Eventually those lower prices will trickle through to the consumer,” he said.

In the alcohol category, beverage analyst Jim Watson noted that consumers are also looking for an improved experience, which may have them looking at more costly beers with higher alcohol levels to provide “more bang for your buck.” Beer is facing stiffer competition from ready-to-drink cocktails and hard seltzers; brewers can’t increase prices so much that they lose market share to the wine and spirits markets.

Soda prices have shot up 36% in the past 18 months and the major players are looking to take prices even higher, Rabobank reported.

For more news, visit www.Agri-Pulse.com.