Prices for fertilizer products have been dropping for months from highs reached last year after many producers cut down on applications, but major manufacturers such as Mosaic and Nutrien see farmer demand rising amid bullish fundamentals.

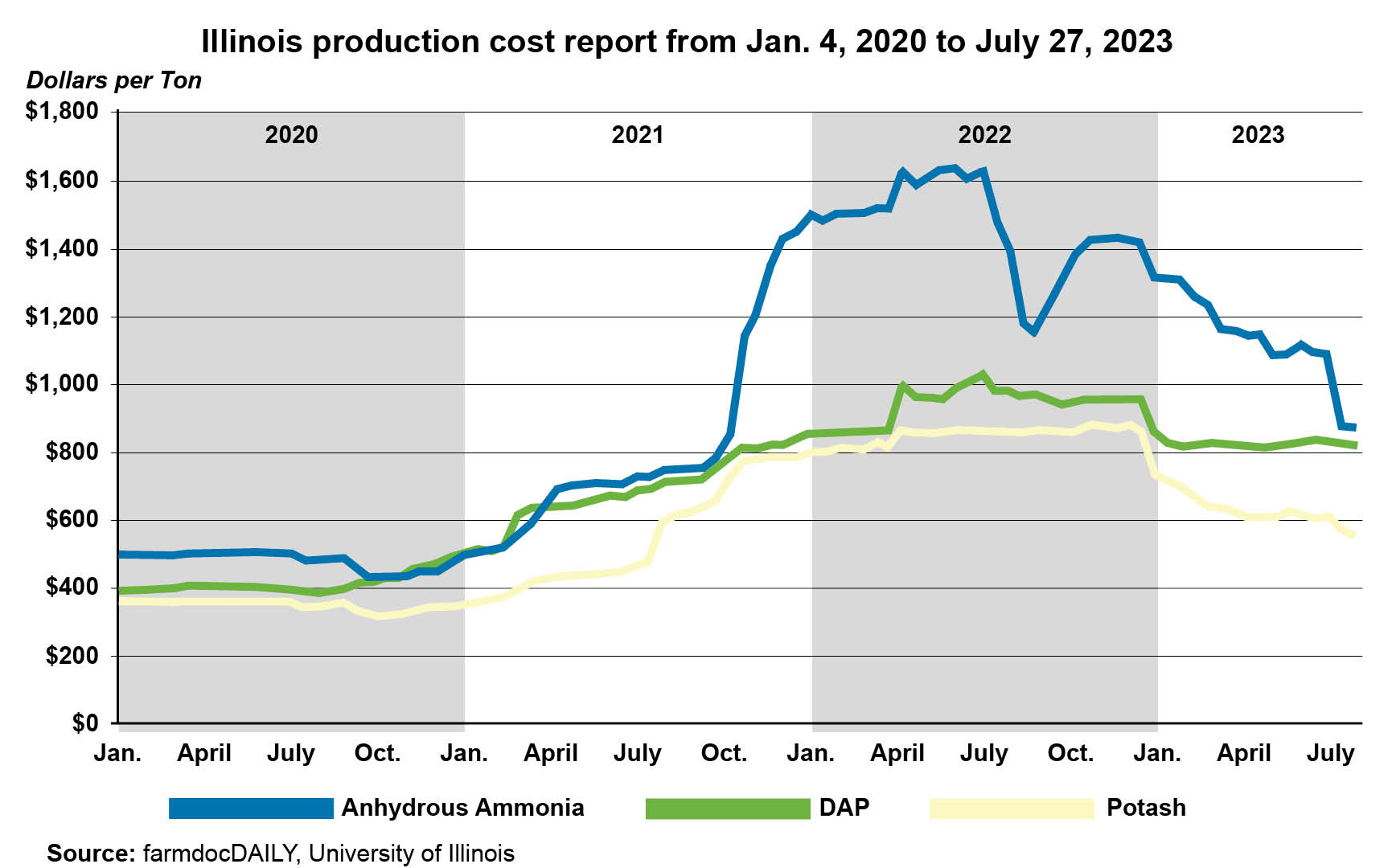

Anhydrous ammonia, which reached a price high of $1,635 per ton in June 2022, fell to $870 last month in Illinois, according to an analysis by ag economists at the University of Illinois and The Ohio State University.

Urea prices over the same period dropped by 50% to $497 per ton, and the cost of Diammonium Phosphate (DAP) has fallen by about 20% over the past year.

The price of potassium chloride, the most common form of potash fertilizer, continued dropping in the third quarter of 2022, but companies like Nutrien were confident that rising demand and world shortages would push prices higher.

Potash prices in Illinois had dropped to $558 per ton by July 27, down 35% from their peak in April 2022, according to the analysis by Ohio State’s Carl Zulauf and the University of Illinois’ Nick Paulson, Gary Schnitkey and Jim Baltz.

But farmers in the U.S., Brazil and India are coming back into the market, which is increasing demand, according to fertilizer industry officials.

Nutrien CEO Ken Seitz told analysts on the company's quarterly earnings call last week that American farmers are doing well this year and likely will be able to afford the fertilizer they need.

“Futures prices for corn, wheat and soybeans are 15% to 25% above the 10-year average, and fertilizer affordability has improved significantly over the last year,” Seitz said. “The combination of low … (crop) inventories and prospect for a strong fall season has contributed to increased demand for all fertilizer products in the third quarter.”

Canada-based Nutrien Ltd. reported that its net nitrogen fertilizer sales dropped to $1.5 billion in the first half of this year, down from $2 billion in the first half of 2022, even as sales volumes rose by 16%. Nutrien's net selling price fell from $751 per ton in the first half of 2022 to $484 this year.

The Mosaic Co. noted that commodity prices are in many cases higher than they were in 2021, another strong year for fertilizer sales.

“Markets are improving, a trend we expect to continue through the second half of 2023,” Mosaic President and CEO Joc O’Rourke told analysts on the Tampa-based company's recent earnings call.

Don't miss a beat sign up for a FREE month of Agri-Pulse news! The latest on what’s happening in Washington, D.C. and around the country in agriculture, just click here.

“Looking ahead to the third quarter, we have a solid order book with 70% committed and priced today. … Overall, the fertilizer recovery is playing out as we expected. In a tight market, volumes are moving and prices are following. Phosphate prices have risen over the last month, while potash prices have stabilized and are now beginning to move higher. This sets the stage for a constructive second half of the year and into 2024.”

Sanctions on Belarus, Russian restrictions on exports, and the war in Ukraine were all factors in global price hikes in the first half of 2022, but international markets did a better job adjusting than was initially expected, according to the Ohio State and Illinois economists.

The economists also say the past year of fertilizer price declines may make farmers “take a wait-and-see approach to booking any fertilizers for the 2024 crop year,” but that may be a mistake because there are signs that the market sees prices for natural gas – a key component of ammonia – rising over the coming months.

The economists advise that while fertilizer prices are approaching 2021 lows, “market expectations and ongoing risks suggest considering the pricing of at least a portion of fertilizer needs for the upcoming year."

Mosaic's O’Rourke sees fertilizer prices staying strong for several years to come.

“Constrained supply and strong demand will continue to put pressure on global stocks-to-use ratios, which are already at multi-year lows,” he said. “All these dynamics together continue to support constructive ag markets. The strong ag fundamentals should lead to strong fertilizer demand for the next several years.”

For more news, go to Agri-Pulse.com.