Food price inflation is on track to return to historical levels this year, as consumers can expect to see softened grocery store prices after experiencing a prolonged run-up during the COVID pandemic, economists say.

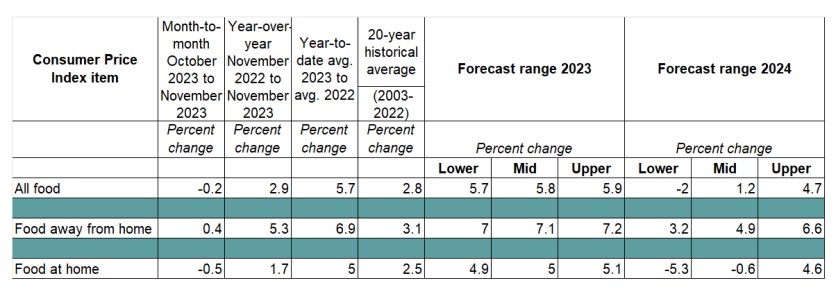

The latest Food Price Outlook by USDA’s Economic Research Service projects that supermarket prices will decline by about 0.6% in 2024. ERS projects that the cost of eating out will rise by 4.9% in 2024.

Ricky Volpe, associate professor at California Polytechnic State University, said there are still cost pressures in the food sector.

“The good news is that energy prices and agricultural commodity prices are trending down," Volpe told Agri-Pulse. "So those inflationary pressures have been easing.”

However, Volpe said the food sector is still dealing with historic shortages and bottlenecks in transportation, particularly refrigerated trucking and labor. “Labor is a major pain point in every sector of the food supply chain,” he said.

Acute inflation – impacted by weather, energy, feed, input costs and fertilizer prices – softened in 2023 and will continue that trend in 2024, said Thomas Bailey, Rabobank’s senior analyst for consumer foods.

Bailey said there are some structural challenges that will keep food prices from moderating significantly. This includes what he termed “green inflation” as companies work towards achieving targets and making investments in sustainable farming.

The geopolitical environment is another structural challenge food companies must weather in 2024, as geopolitical alliances are impacting trade flows and affecting the “freedom of movement that we enjoyed for the last 20 years that really helped keep prices low,” Bailey said.

Companies also continue to deal with relatively high interest rates, said Bailey.

Roger Cryan, chief economist at the American Farm Bureau Federation, expects overall food inflation, which includes the cost of eating out, will be about the same as general inflation, at 2-3%.

“Food away from home is probably going to be more than inflation,” he said, since it is dependent on labor, whose costs are “baked into the price of food away from home.”

Volpe said while “nominal food price deflation is unlikely,” lower food price inflation will prevail in 2024. Even after all the pain of higher prices that started in 2020 through 2022, “a representative basket of groceries is cheaper today than it was a generation or two generations ago,” because the real price of food has fallen, he said.

Eggs: After a period of skyrocketing prices for eggs, the lessening impact of highly pathogenic avian influenza finally allowed egg prices to drop back to earth at the end of 2023. Although HPAI is again impacting egg layers across the country, Volpe doesn’t anticipate prices to shoot up again. ERS’s latest Producer Price Index showed a 27.7% drop in farm-level egg prices for the year-to-date average.

In 2024, USDA projects farm-level egg prices will drop 5.4%.

It’s easy to be “in the know” about what’s happening in Washington, D.C. Sign up for a FREE month of Agri-Pulse news! Simply click here.

Dairy: Cryan said milk prices are probably going to go up modestly or possibly even trend slightly lower heading into 2024. Lucas Fuess, Rabobank senior dairy analyst, said, “Looking to 2024, the global market is transitioning to the next phase of the cycle. There is growing evidence that the bottom in the dairy commodity markets has passed, and the general trend is for prices to move higher through 2024.”

Fuess said the dairy demand story will be important to watch. “It’s a complex story of high dairy inflation in regions outside the U.S., especially in the EU, broader cost of living issues and weak consumer confidence remaining on the horizon. Sluggish underlying dairy demand and changes in consumer purchases impact volumes in some economies and channels,” Fuess said.

Meat: Beef price increases continue to lead the pack for the meat sector, although beef, pork and broiler prices are all valued around 25% to 35% higher than they were in 2019 ahead of the pandemic, said Lance Zimmerman, Rabobank senior beef analyst. He said wholesale beef costs and cattle market values today are inline, but retailers may have tried to increase consumer prices too quickly with a 10% increase in beef retail prices over the last 12 months.

“Beef prices are not exceptionally high today compared to the competition, but there is going to be considerably more availability of pork and broiler meat going forward,” Zimmerman said. “Beef demand in 2024 will be softer as consumer economic pressures mount and cheaper pork and chicken weigh on the market’s upside potential.”

Fruits and vegetables: Volpe said fruit and vegetable prices at the commodity level have been trending down, reflective of the favorable growing conditions and expanding acreage. Volpe expects those lower commodity prices to translate into consumer price relief for fruits and vegetables.

Baked goods: JP Frossard, Rabobank consumer foods analyst, said inflation on bakery goods hit double digits in the second half of 2022 and has stayed materially above food CPI since then and correlated with PPI. “Raising prices was a necessary measure to catch up with increasing costs, especially after February 2022 when the war in Ukraine led to a surge in wheat and energy prices,” Frossard said.

“Looking at 2024, bakers will likely list restoring volumes while keeping current pricing and margins as their New Year resolution,” he added. “Even as inflation eases, compressed discretionary income remains, high consumer debt, and the grim economy are likely to keep consumers cautious with spending in the year ahead.”

For more news, visit www.Agri-Pulse.com.