The Biden administration’s chief agricultural trade negotiator, Doug McKalip, will be joining a USDA trade mission to India later this month in search of new export deals for American-grown commodities in the face of a growing U.S. agricultural trade deficit.

In a short interview with Agri-Pulse, McKalip insisted the administration is succeeding at removing barriers to U.S. ag exports despite the lack of new multilateral trade agreements. The administration has come under fire from congressional Republicans for both the ag trade deficit and the administration’s pivot away from negotiating new free-trade agreements, or FTAs, that have been the priority of most administrations for the last half century.

“I think there is a bit of either misunderstanding or misinformation out there that tariff reduction and FTAs are synonymous and that the only way to get tariff reduction is through one method,” said McKalip, who serves under U.S. Trade Representative Katherine Tai.

“Our focus has been, let's work with countries bilaterally. Let's see what opportunities there might be for tariff reduction. And certainly we've gotten a lot of results that farmers are able to see immediately,” he said.

He noted that India last fall agreed to lift retaliatory tariffs, imposed in 2019 under the Trump administration, on U.S.-origin almonds, apples, chickpeas, lentils, and walnuts. The tariffs had hit apple exports particularly hard, according to USDA, which forecast that apple sales to India would rise from less than $5 million in 2022 to as much as $80 million in FY24. Almond exports to India were projected to reach $1 billion in FY24.

During the April 22-25 trade mission, various U.S. grains will be included in the discussions with potential Indian buyers, McKalip said, “but I'm also excited that a lot of specialty crops are part of it as well, such as tree nuts.”

“We were able to get the retaliatory tariffs on almonds and walnuts dropped in as well as a lot of fruit and vegetable producers as well. So it'll be a very diverse trade mission. And we're excited to connect again … with potential buyers there as we continue to develop the Indian marketplace.”

USDA’s under secretary for trade and foreign agricultural affairs, Alexis Taylor, also will be on the mission.

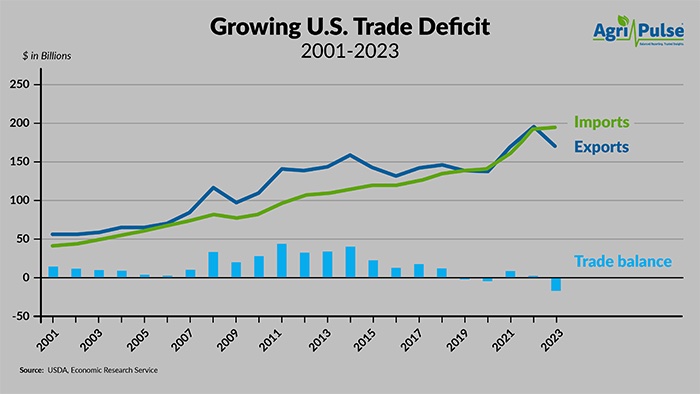

The United States long ran a surplus in agricultural trade but a deficit emerged in 2019 and the balance has been negative for three of the past five years, according to UDSA data. With imports continuing to increase and market prices for U.S. commodities decreasing over the past couple of years, the deficit is projected to reach a record $30.5 billion for fiscal 2024, up from $16.6 billion in FY23.

It’s easy to be “in the know” about what’s happening in Washington, D.C. Sign up for a FREE month of Agri-Pulse news! Simply click here.

A major factor in the deficit is that commodity prices have dropped sharply from their peak in 2022, reducing the value of U.S. exports. At the same time, a relatively strong dollar has made imported products relatively cheaper than they were, and Americans are consuming more fruits, vegetables, wine and other products produced overseas. Imports are projected at $201 billion in farm commodities for FY24, up from $195.4 billion in FY23.

McKalip said the “main focus” should be on agricultural exports, noting they topped $179 billion in FY23, the third highest on record.

“As folks have talked about the ag trade deficit, I think it's really important to recognize that the U.S. dollar is extraordinarily strong at the moment. That gives U.S. consumers a lot more buying power on the international market to buy goods from countries who have maybe slower economic recoveries and slower economies,” McKalip said.

“Certainly Americans are using that strong dollar to buy things like high-value products, tropical fruits, distilled spirits, coffee and other products that are not widely produced here in the United States,” he added.

McKalip also cited the administration’s efforts to build new domestic markets for major commodities such as corn and soybeans by expanding markets for biofuels and other products.

“I think what this administration has shown is that by moving into the bioeconomy to be aggressive about sustainable aviation fuel, to make sure that the Renewable Fuel Standard is implemented in a way that doesn't give exemptions to all kinds of refineries, etc., that you can actually drive demand and consumption in terms of U.S. consumption,” he said.

For more news, go to Agri-Pulse.com.