WASHINGTON, March 26, 2014 - The political crisis in Ukraine had had little affect so far on the country’s corn and grain exports, experts say.

USDA is forecasting the country will export 10 million metric tons of wheat and 18.5 million tons of corn in the 2013-2014 crop year. That would make Ukraine the world’s fifth-biggest shipper of wheat, with about 6 percent of global trade, and the third-biggest corn exporter, supplying about 16 percent of world markets.

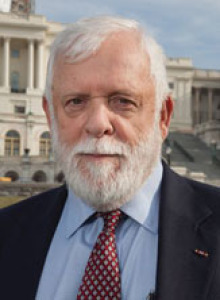

“Based on what we know today we have little reason to change those estimates,” Joe Glauber, the USDA’s chief economist, told Agri-Pulse. About 70 percent to 75 percent of the projected exports for the year have already been shipped, Glauber said, with no major difficulties reported. He noted that Ukraine normally ships very little grain from ports in Crimea, the Ukrainian peninsula annexed by Russia in defiance of international pressure.

Less clear for now, Glauber said, is how Ukraine will be affected by the weakening of its currency, the hryvnia, which has lost almost 15 percent of its value against the dollar last month.

“While a weaker currency would make Ukraine grain more attractive on world markets, it also will make imported inputs such as machinery and seed more expensive,” Glauber said.

Prices for natural gas will also bear watching, Glauber said. Russia supplies about 30 percent of the country’s natural gas needs, and a jump in prices could affect fertilizer supplies as well as planting, harvesting and transportation of crops.

While there has been lots of speculation about how these factors may be affecting spring planting, Glauber said it is “too premature to conclude very much at this time.” USDA is monitoring the situation from a post in Kiev, Ukraine’s capital, he added.

Casey Chumrau, a market analyst for U.S. Wheat Associates, meanwhile, said the Ukraine crisis has been getting too much credit for the recent jump in wheat futures. In Kansas City, for example, the May hard red winter wheat contract gained 15 percent in 13 trading days.

The “primary fuel” for the jump, Chumrau wrote in the group’s March 20 Wheat Letter, includes fears about global drought, potential freeze damage in the U.S. southern Plains, and position changes in the big index funds.

Chumrau agrees with the USDA assessment that there’s been little effect on Ukraine’s export operations. A monthly report by the country’s Agricultural Ministry released March 19 showed “no indication that grain shipments suffered” in the previous four weeks, she wrote.

And while financial fallout from the crisis could make spring planting difficult, that crop represents only about 5 percent of Ukraine’s total production, she said. In addition, Crimea is not a major wheat-producing region, so a cutback in planted area there would have little effect on global supplies.

The real concern, in both Ukraine and southern Russia, is not the turmoil caused by Russia’s incursion, but drought, Chumrau said. Dry conditions devastated Ukraine’s grain crops two years ago, forcing the country to suspend all exports.

“Once more, we are reminded that in the world wheat market, precipitation is always more important than politics.”

#30

For more information, go to www.agri-pulse.com.