WASHINGTON, Feb. 25, 2015 – Get ready for another wild price ride in 2015. That was one of the key messages from USDA’s annual Agricultural Outlook Forum last week in Arlington, Virginia, as the agency released projections for lower planted acres for corn, soybeans and wheat, and bigger livestock herds as producers recover from drought and expand.

According to a USDA report, the planted areas for corn and wheat are both expected to drop more than 1.3 million acres. Corn and soybean acres are falling because of high carryover in the commodities and lower returns from two years’ worth of bin-busting harvests. Despite an acreage drop, wheat production is projected to increase because of “increased yields and lower abandonment,” the report said.

According to a USDA report, the planted areas for corn and wheat are both expected to drop more than 1.3 million acres. Corn and soybean acres are falling because of high carryover in the commodities and lower returns from two years’ worth of bin-busting harvests. Despite an acreage drop, wheat production is projected to increase because of “increased yields and lower abandonment,” the report said.

Cash prices are also forecast to drop, placing pressure on cash rents and producers buying decisions. After the drought inflated average corn prices to $6.89 a bushel and soybeans to $14.40 in the 2012 marketing year, prices have been steadily falling. In the coming year, USDA estimates an average corn price of $3.50 a bushel, and $9 for soybeans. Wheat has also taken a sharp decline, from $7.77 in 2012, to a projected $5.10 in the coming season.

Soybeans may also be facing increased pressure from Brazil as the South American country becomes more aggressive in the global marketplace in the coming year. Bill George, senior agricultural economist with USDA’s Foreign Agricultural Service, said Brazil didn’t have the supply on hand to compete with the U.S. in its peak export season – from this past October through January. This year, Brazil’s Oct. 1 stocks are forecast to be 24.8 million tons, about 8.3 million tons higher than last year, “a figure that suggests increased competition with increased (U.S.) exports in late 2015,” George said.

Michael Cordonnier, with Corn and Soybean Advisor, a consulting firm focusing on South American corn and soybean production, said he sees Brazil as “the future,” but the country’s growers are currently hampered by infrastructure challenges preventing swift delivery of their product to export markets.

Michael Cordonnier, with Corn and Soybean Advisor, a consulting firm focusing on South American corn and soybean production, said he sees Brazil as “the future,” but the country’s growers are currently hampered by infrastructure challenges preventing swift delivery of their product to export markets.

“Brazilian farmers can produce soybeans as good as anybody in Illinois or Iowa. Their problem starts when they harvest,” Cordonnier said at the forum. Looking ahead, he said the country will have bigger stocks and will be “aggressive sellers.”

The livestock sector, meanwhile, will continue to benefit from low feed costs and solid demand, USDA said in a report released at the forum. Nationwide economic growth will also trigger higher demand for proteins, a welcome development to beef and pork industries hoping to hold back animals to rebuild drought and disease-reduced herds but still maintain solid price for animals brought to market.

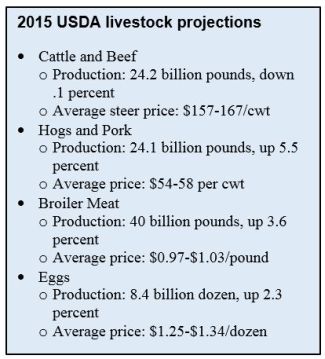

Last year, the beef herd increased for the first time since 2007, up 1.4 percent to 89.8 million head. As more heifers are retained to build the herd, beef production is anticipated to dip slightly – 0.1 percent – to 24.2 billion pounds. Beef exports are predicted to drop 4.8 percent due to tight supplies and higher prices. USDA also projects average steer prices will break 2014’s record of $1.55 a pound, reaching $1.57 to 1.67 a pound.

As the pork industry works to rebuild its herd from the devastating impacts of the porcine epidemic diarrhea virus (PEDv), producers are indicating they will retain 4 percent more sows for breeding this year. Even with the increased retention, the industry is still expected to take a 5.5 percent jump in production to 24.1 billion pounds. Domestically, both imports and exports are expected to drop. Growth in global demand has been slow, and increased domestic production will pressure prices downward.

Russia’s sanctions on agricultural imports don’t appear to have impacted the broiler industry too severely as much of the product has moved to new markets. Increased domestic demand for alternatives to more expensive beef and pork also helped the poultry industry, and that demand is likely to continue as prices drop a projected 4.4 percent. Exports of the product are expected to dip as concerns about avian influenza have created export barriers in the Chinese, South Korean and other markets.

#30

For more news, go to www.agri-pulse.com.