WASHINGTON, July 21, 2015 -- While raising many questions, President Obama’s controversial nuclear agreement with Iran has already resulted in at least one tangible impact: Even before sanctions are eased in perhaps six to eight months, world oil prices are being driven down by the prospect of Iran selling as much as an extra 1 million barrels per day of its stockpiled crude oil into world markets. And experts are debating what this means for renewable energy.

Do the math. The world oil market is struggling with surplus production estimated at 2.6 million barrels per day (mbpd) going into the 94 mbpd world market. The surplus already is credited with holding oil prices down. U.S. benchmark West Texas Intermediate crude oil is hovering around $50 a barrel this week, with the prospect of dropping as low as $30 to $35 a barrel, according to some analysts.

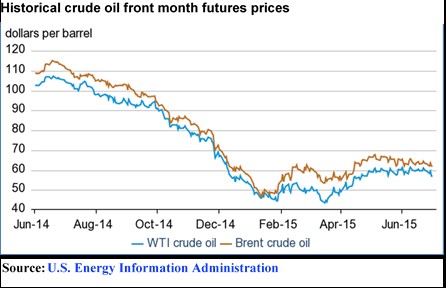

Those prices compare with a $107 per barrel peak in June 2014 and a $42 low this past March.

A major reason to expect oil prices to drop further is the international nuclear agreement signed with Iran on July 14. If implemented, the agreement will ease sanctions that were imposed on Iran to force it to abandon its nuclear weapons program. Lifting the sanctions, which could begin late this year or early in 2016, would allow Iran to sell far more crude oil into already oversupplied world markets.

The deal’s immediate impact is limited because a skeptical U.S. Congress has 60 days to review the agreement and vote on it. The United Nations Security Council approved the agreement unanimously on Monday. If Congress either approves the deal or if President Obama vetoes a congressional attempt to block the deal, there still will be months of international inspections and verification of Iranian compliance before international sanctions would begin to ease.

The deal’s immediate impact is limited because a skeptical U.S. Congress has 60 days to review the agreement and vote on it. The United Nations Security Council approved the agreement unanimously on Monday. If Congress either approves the deal or if President Obama vetoes a congressional attempt to block the deal, there still will be months of international inspections and verification of Iranian compliance before international sanctions would begin to ease.

If all goes smoothly, the International Atomic Energy Agency (IAEA) plans “to issue a report setting out the agency’s final assessment of possible military dimensions to Iran’s nuclear program, for the action of the IAEA Board of Governors, by 15 December 2015.”

Additional limits on Iran’s ability to increase its oil exports include these:

- Once mothballed, producing wells take time, new equipment, and new financing to resume production.

- Low crude oil prices make new financing harder to find and higher cost.

Yet despite delays and constraints, Iran remains a low-cost oil producer, with its proven reserves ranking fourth in the world after Saudi Arabia, Venezuela and Canada.

Under the limits imposed by international sanctions since 2012, Iran’s current production has dropped to 2.85 million barrels per day (mbpd) compared to its 2011 pre-sanctions level of 3.6 mbpd.

After meeting in Tehran July 20 with a German business development team led by Vice Chancellor and Economy Minister Sigmar Gabriel, Iranian Oil Minister Bijan Namdar Zanganeh said Iran plans to boost its production and exports quickly regardless of whether the added supply drives world prices even lower.

Zanganeh predicted that by early 2016 Iran will set a new production record of 4 mbpd with the goal of 4.7 million as soon as possible. “Our only responsibility here is attaining our lost share of the market, not protecting prices,” he said. Iran’s is aiming to double its oil exports from the current 1.2 mbpd to 2.3 million as soon as possible after the sanctions are lifted. For comparison, the world’s leading oil exporter, Saudi Arabia, set a new record in June when it exported 10.56 mbpd.

Iran may struggle to reach its lofty goals. The nuclear agreement is expected to release as much as $150 billion in Iranian assets which were frozen by the international sanctions. But U.S. Treasury Secretary Jacob Lew expects Iran to experience a slow economic recovery, explaining that the sanctions reduced Iran’s oil export revenues by more than $160 billion since 2012.

Even with a slow recovery, analysts expect Iran’s increasing oil exports will hold prices down. This prospect raises concern that lower oil prices will reduce both demand for and interest in energy efficiency and renewable energy including biofuels, wind and solar power.

However, Amory Lovins, the cofounder and chief scientist of the Rocky Mountain Institute (RMI) think tank, is confident that lower oil prices will benefit rather than hurt renewables. He argues that since lower prices have already slowed high-cost hydraulic fracking in the U.S. and put some companies out of business, the drop in crude prices “defers development of costlier, often higher-carbon resources.” As a result, he explains, “This buys more time for efficiency and renewables to get bigger, hence cheaper,” improving the ability of renewable energy to compete with fossil fuels.

Writing in RMI’s Solutions Journal, Lovins concludes that “cheaper oil means less fracked oil, less byproduct natural gas, higher (natural) gas prices, hence even more-competitive wind and solar power.”

Nathan Rudgers, director of business development at Farm Credit East and member of the 25x’25 Steering Committee, sees a potential benefit for ethanol and other biofuels in particular. He explains that “If lower oil prices lead to stronger demand, then that will lead to higher consumption of 10 percent blended ethanol, for example, and renewable fuel producers are used to dealing in a competitive marketplace.”

#30

For more news go to www.Agri-Pulse.com