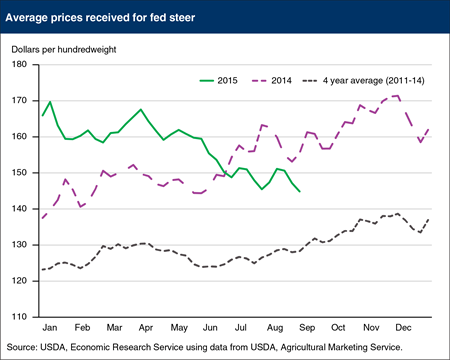

WASHINGTON, Oct. 7, 2015 - After a record-setting 2014, live and feeder cattle prices have taken a tumble in recent weeks with experts pointing to a rebounding supply and heavier cattle going to market.

In the last six months, the live cattle contract has lost over $25 per hundredweight, and the feeder cattle contract has lost even more, $33.75 per hundredweight. Longer-term figures look even grimmer, as the live cattle contract has lost over $35 since its 12-month high in November and the feeder cattle contract is down $52.75 since reaching its peak in the last year in early December.

Duane Lenz, general manager of the beef industry research firm CattleFax, told Agri-Pulse that the current downward swing represents “one of the biggest breaks in history, definitely in the top three.” He said it’s hard to predict when the current market swing will find a floor, but it’s clear that the booming 2014 figures that carried into 2015 are a thing of the past.

“Next

year will probably average lower than this year, so other than short-term price

bounces . . . the next rally is probably not going to occur here for a while,”

Lenz said, adding that there was “no way to forecast” the current drop, which

he said really caught the industry off guard.

“Next

year will probably average lower than this year, so other than short-term price

bounces . . . the next rally is probably not going to occur here for a while,”

Lenz said, adding that there was “no way to forecast” the current drop, which

he said really caught the industry off guard.

There may be a silver lining to the historic declines in prices, should a less expensive product at the grocery stores result in winning back consumers who have turned to cheaper poultry and pork. However, Lenz said those kinds of changes – either going up or down – don’t tend to happen very quickly.

“It’ll take longer than you think just because retailers don’t know if this is a temporary or a long-term situation,” he said. “We are starting to see retail prices drop, but it’s very small. I would say that before we see a big change in the supermarket, you’re probably looking at five, maybe six months.”

Lenz said producers could expect some seasonal price increases going forward, but said a return to “the good ol’ days” of the high cattle prices of 2014 isn’t likely to happen. He said last year was an outlier, and now the market will work down from those prices.

“There’s going to be moves up and down, but the price trend has turned lower and it’s going to be at least a couple-year event, probably,” Lenz said.

#30

For more news, go to: www.Agri-Pulse.com