WASHINGTON, March 2, 2016 - What do strawberries, fresh market tomatoes and onions all have in common? In terms of the average federal premium subsidy per crop insurance policy in 2015, these crops top the list, according to a new analysis by Mississippi State Agricultural Economist Keith Coble.

The average subsidy was $39,169 for crop insurance policies covering strawberries, $39,064 for fresh market tomatoes and $36,845 for onions. For the full list of subsidies per crop insurance policy, click here.

At the lowest end of the scale? The average premium subsidy for tobacco growers in Maryland was only $44. The data come from USDA’s Risk Management Agency’s Summary of Business report for 2015 and reflects the direct reduction of premiums provided to farmers. It does not include administrative and operating expenses paid to the insurance companies.

Coble’s

analysis sheds an interesting light on the debate over the appropriate level of

premium subsidies at a time when critics continue to attack the crop insurance

program. And USDA’s Risk Management Agency – driven largely by the 2014 farm

bill – has been extending the crop insurance program to more growers of

high-value fruits and vegetables, both conventionally grown and organic.

Management Agency – driven largely by the 2014 farm

bill – has been extending the crop insurance program to more growers of

high-value fruits and vegetables, both conventionally grown and organic.

Crop insurance policies covered only about 17 percent of the fruit and nut acreage in 1990, but that market share grew to 74 percent of the acres by 2014, pointed out RMA Administrator Brandon Willis during a recent presentation. During that same period, the number of vegetable acres that were covered more than doubled, but still represented only about 990,000 acres, or 36 percent of the total acres planted in 2014.

For many vegetable crops, RMA has not yet developed policies because of inadequate data or because producers have expressed concerns that a risk management policy could encourage farmers to plant more acreage and conceivably drive down prices. However, that attitude has been changing and more grower groups are asking RMA to take another look, says the agency’s Deputy Administrator for Product Management Tim Witt.

For example, he cited Western Growers recent interest in working with RMA to improve crop insurance policies for strawberry growers.

Witt says there’s also been a lot of interest among vegetable growers in Whole Farm Revenue Protection, which covers multiple crops. On coverage options between 50 and 75 percent, the subsidy rate is 80 percent, compared to an average premium subsidy of about 62 percent for all crop insurance policies.

“In many cases, the subsidy is high for large specialty-crop farms where the crop is also high value,” Coble explains. “If all other factors are equal, the subsidy will be greater if there are more acres, higher value, higher coverage level, enterprise units and higher rates.”

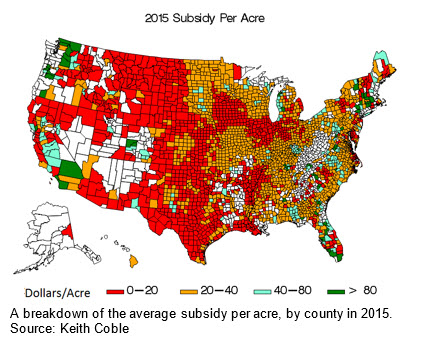

Looking at premium subsidies by crop, the bulk of producer subsidies are still for corn, wheat, soybeans and cotton – accounting for about 80 percent of total federal investment in 2013, according to a Congressional Research Service (CRS) report. Still, expansion into new crops and new regions – an effort that RMA started about 25 years ago – seems likely to continue.

But the analysis by Mississippi State’s Coble could prompt even more discussion about capping subsidies per policy – a debate that’s surfaced several times in recent years. For example, Sens. Jeanne Shaheen, D-N.H., and Pat Toomey, R-Pa., introduced a bill in 2015 that would place a $50,000 a year cap on the premium subsidies a person or entity can receive.

Ferd Hoefner, National Sustainable Agriculture Coalition’s policy director, agrees with RMA’s expansion of subsidized crop insurance, but supports premium subsidy caps.

“It is true, of course, that higher value crops, even at the same subsidy percentage level, will have higher premiums and hence higher premium subsidy amounts, as well. In our view, that does not mean there shouldn't be subsidy caps,” Hoefner said. “Like nearly every other federal entitlement program, there should be limits and eligibility rules. The days of open-ended entitlements are rapidly drawing to a close. That said, the tools used to target the subsidies in the next farm bill should be sensitive to considerations such as crop value per acre.”

But Tara Smith, vice president of federal affairs for the Crop Insurance and Reinsurance Bureau, disagrees, pointing out that caps on premium subsidies could indirectly impact every single producer and drive more out of the program – raising costs for those who remain. “Some of the highest value crops are specialty crops or even organic crops, which means they will often be hardest hit by ill-advised premium assistance caps. This is in complete contradiction to 2014 farm bill efforts to provide meaningful risk management protection to specialty crops, organic producers, and other underserved segments of the agriculture community,” says Smith.

Tom Zacharias, president of National Crop Insurance Services, emphasized that, in total, U.S. farmers pay approximately $4 billion out of their own pockets for crop insurance protection.

“Premiums are discounted to ensure that crop insurance is available and affordable for specialty crop growers, and farmers in general. Legislation that would increase farmer-paid premiums would hurt farmers at a time when farm income has been falling and high-value specialty crop growers would be disproportionally affected.”

#30

For more news, go to: www.Agri-Pulse.com