WASHINGTON, July 5, 2017 - House Republicans looking for a way to offset the cost of reducing corporate and individual tax rates have their eyes on ending a tax benefit critical to farmers – the deduction for interest expenses. Farmers borrow for everything from production inputs to equipment, land and buildings.

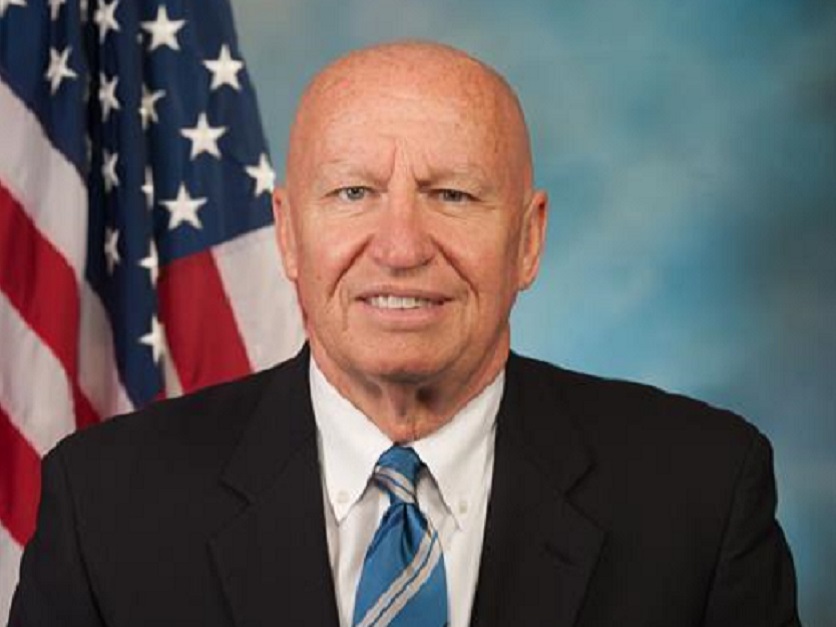

Rep. Kevin Brady

But House Ways and Means Chairman Kevin Brady, R-Texas, says farmers will be protected because small businesses would still be able to write off interest expenses and that borrowing costs on land could be deducted as well. The size of the small business exemption has not been disclosed. Interest deductions also would continue to be allowed for existing loans.

Meanwhile, Brady said farmers will benefit from the reductions in tax rates. “The ag community is very excited about low tax rates, not just (for) corporations but all size businesses,” he said.

President Trump has proposed to slash tax rates by up to 15 percent for pass-through, owner-operated businesses, such as farms, as well as corporations. Farms typically file as sole proprietorships or partnerships. Pass-through businesses, including subchapter S corporations, are currently taxed at individual rates, which range from 10 percent to 39.6 percent.

Veronica Nigh, an economist for the American Farm Bureau Federation, said the impact on farmers depends on the definition used for small business. “We’re sort of waiting to make a determination about” the impact of the tax proposal “until we’ve actually seen the language,” she said. “On its face, it sounds like they’re making attempts to address some of our concerns.”

Interest accounts for as much as 28 percent of production expenses for grain and oilseed producers, she said.

Eliminating the interest deduction completely would increase federal revenue by $1.5 trillion, according to the Tax Foundation, providing a huge offset for lowering tax rates. The small business exemption would lower the potential savings.

Another revenue raiser that Brady’s committee has proposed – a border adjustability for businesses taxes – has run into strong opposition from House conservatives and from the Senate.

The border adjustment would mean businesses would be taxed on domestic sales of products but not on exports. Depending on what happens to the value of the dollar, that could have the effect of raising prices for imported goods.

Brady said Republicans in Congress continue to work with the White House on a unified tax reform plan that could be released this fall. The timing depends in part on when Congress finishes work on health care and whether Republicans can agree on a fiscal 2018 budget resolution. The resolution is necessary to trigger the budget reconciliation process that Republicans would use to enact the tax bill. Reconciliation measures need only a simple majority to pass the Senate, not the 60 votes required for moving other legislation.

Reconciliation bills must be revenue-neutral, so offsets such as the restriction on interest expensing will be vital to the plan.

“We’re staying at the table with President Trump’s team and Senate Republicans until we can bring through a very bold, permanent, unifying tax-reform plan,” Brady said.

Treasury Secretary Steven Mnuchin told reporters last week that both Congress and the White House are “100 percent committed to getting tax reform done this year.”

#30