To boost the stalled farm economy and rural development, Congress and USDA need to focus on farm-sector healthcare needs. That’s the message from researchers who say one vehicle to deliver that boost is the 2018 farm bill.

Drawing from ongoing surveys about farm-sector healthcare impacts, the researchers concluded in a Choices magazine article that “The 2018 farm bill presents a new opportunity to integrate access to healthcare, healthcare costs, and health insurance into (USDA’s) Risk Management Agency (RMA) and Rural Development (RD) initiatives that work to promote a vibrant and resilient farm sector.”

R.J. Karney, director of congressional relations for the American Farm Bureau Federation, tells Agri-Pulse that it’s too soon for specifics about new farm bill provisions for healthcare. But he says AFBF supports the Labor Department’s proposed rulemaking announced in January “to offer employment-based health insurance to small businesses through Small Business Health Plans, also known as Association Health Plans.”

R.J. Karney, AFBF

Raising hopes for farmers and ranchers, the DoL announcement states that “Up to 11 million (uninsured) Americans working for small businesses/sole proprietors and their families . . . could find coverage under this proposal.” Karney says the proposal could provide just what farmers need: greater access to more health insurance options at lower cost.

Critics charge that the Association plan would only bring down health insurance premiums by waiving some coverage requirements. Advocates argue that the plan would allow farmers and other small groups to pool their resources and risks to benefit from economies of scale and a stronger bargaining position.

Whether through the farm bill, new Association provisions, or other means, Karney notes that Farm Bureau members need improved federal support for healthcare. He says this should include repealing the current health insurance tax on providers and increased support for telemedicine and rural broadband.

Healthcare researchers note that while USDA and past farms bills actively help farmers manage business risks, they have neglected healthcare risks. They see these risks mounting because, compared to the U.S. overall, the aging rural population is at greater risk from serious injuries and health problems, and has less healthcare access as more rural healthcare facilities disappear.

The 2017 National Farmer and Rancher Survey noted that “two out of three farmers and ranchers (64 percent) report having a pre-existing health condition,” 74 percent “believe USDA should represent their needs in national health insurance policy discussions,” and that 73 percent “report that health insurance is an important or very important risk management strategy for their farm or ranch.”

The researchers warn that “Rural development programs embedded in the farm bill need to account for these emerging trends when creating programs and developing incentives for rural economic development.”

These survey findings result from a Health Insurance, Rural Economic Development and Agriculture (HIREDnAg) project funded by a $500,000 2015 USDA grant that runs through 2019. The project’s lead researcher, University of Vermont rural sociologist Shoshanah Inwood, says the goal is “to understand what parts of health insurance are working well for farmers and ranchers and what types of policy and program modifications need to be made.”

National Farmers Union Government Relations Representative Matt Perdue tells us that health insurance access and affordability are “significant priorities for farmers and ranchers.” He says NFU looks forward to having the 2018 farm bill “take advantage of new opportunities to improve rural healthcare” by expanding USDA Rural Development’s community facilities, distance learning and telemedicine programs.

Perdue welcomes the possibility that USDA will appoint someone to work with the Department of Health and Human Services “to make sure that farmers and ranchers are well represented” in healthcare policy-making. He also welcomes the administration’s proposal for Association health insurance but cautions that these plans must provide “equal access to that health plan, regardless of preexisting conditions or age.”

One positive development is that last year Minnesota – not waiting for federal action – authorized farmer co-ops to provide health insurance, Perdue says. As a result, the Minnesota Farmers Union (MFU) is working with 40 Square Cooperative Solutions which now provides health insurance to over 400 co-op members, covering more than 1,000 individuals.

MFU Government Relations Director Thom Petersen tells us that “It’s always unfortunate that among our members, either the husband or the wife has to get a job off the farm in order to afford to get healthcare.” While he supports federal efforts to improve healthcare, he says “We’re more interested in what we’re doing, providing healthcare through the co-op type option.”

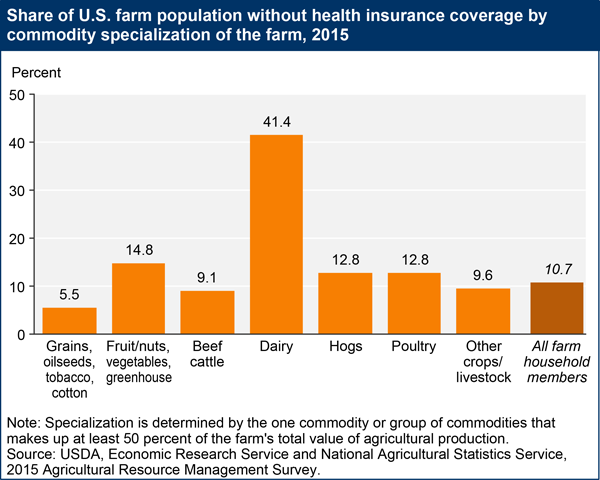

One measure of rural healthcare needs is that while 9.1 percent of the U.S. population have no health insurance coverage, 10.7 percent of all farm household members lack coverage. The rather narrow margin is mainly because so many farm spouses hold off-farm jobs or farmers purchase expensive health care plans with high deductibles.

More alarmingly, 44.1 percent of dairy farm households have no form of health insurance. This creates a level of risk, researchers explain, that puts many farmers “one injury away from financial collapse.” Researchers note that dairy farms tend to have far less health insurance because the time demands on dairy farmers limit their ability to have the full-time off-farm jobs that provide health coverage for most farms and ranches.

For more news, go to: www.Agri-Pulse.com