Last year, U.S. cellulosic ethanol production rose to 10 million gallons, a milestone but still a tiny fraction of the 2007 Energy Bill’s original 5.5 billion-gallon mandate for 2017 – and a small part of total U.S. ethanol production of 15.8 billion gallons.

One sign of progress comes from Quad County Corn Processors, the Iowa-based cellulosic pioneer that launched its Cellerate D3 ethanol production in 2014 and produced 1.3 million gallons of D3 cellulosic ethanol in 2017. Even more important for other ethanol producers thinking about adding cellulosic ethanol to their product mix, Quad County last year captured a $2 per gallon market price premium for its D3 ethanol.

Renewable Fuels Association (RFA) Executive VP Geoff Cooper expects more milestones ahead. Speaking recently at RFA’s 23rd annual National Ethanol Conference in San Antonio, Cooper told the ethanol-producer crowd that as more corn ethanol plants become integrated biorefineries, their product mix is expanding.

“You’re not just making ethanol and distillers grains anymore,” he said. “You’re making fuel ethanol, distillers grains, corn distillers oil; some of you are making high-protein distillers grains, some of you are making biodiesel and renewable diesel on site from your corn distillers oil; many of you are capturing CO2, some of you are making industrial or beverage-grade alcohol.”

RFA Executive Director Geoff Cooper

Cooper praised ethanol producers for continuing to create greater value and more products from “that wonderful little corn kernel.” He said more and more ethanol plants “are producing cellulosic ethanol from the fiber, from the cellulosic portion of that corn kernel, and I believe we’re really on the verge of seeing a wave of adoption of these technologies across the industry – and in fact it’s already happening.”

Cooper added, however, that “we know how to do this from a technology standpoint, but we’ve got EPA involved, and whenever you have EPA involved, nothing is simple.” To back up his assertion, he called on Jim Ramm, founding partner and director of engineering at Des Moines-based EcoEngineers, who explained some of EPA’s unique registration, recordkeeping and reporting requirements for producing corn kernel fiber ethanol.

Ramm said that with complex technologies already working well, ethanol producers can simply focus on producing corn fiber ethanol to boost profits from both the fuel and its RINs, or renewable identification numbers. He stressed that EPA has already approved pathways both for co-processing cellulosic ethanol with conventional corn-starch processing and for the separate processing that requires greater investment, but offers greater returns and less analysis.

EcoEngineers' Jim Ramm

Ramm explained that an ethanol plant can launch in-situ co-processing by investing $300,000 or less while separate processing involves $10 million to $20 million in new investment. He says the trade-off is that the small investment for co-processing delivers only a 1 percent to 3 percent boost in the plant’s ethanol output while the far greater investment in separate processing offers a 7 to 10 percent boost. Another benefit is that separate processing avoids the fact that with co-processing, “sampling, analysis, and calculation of cellulosic converted fraction must be performed every 500,000 gallons.”

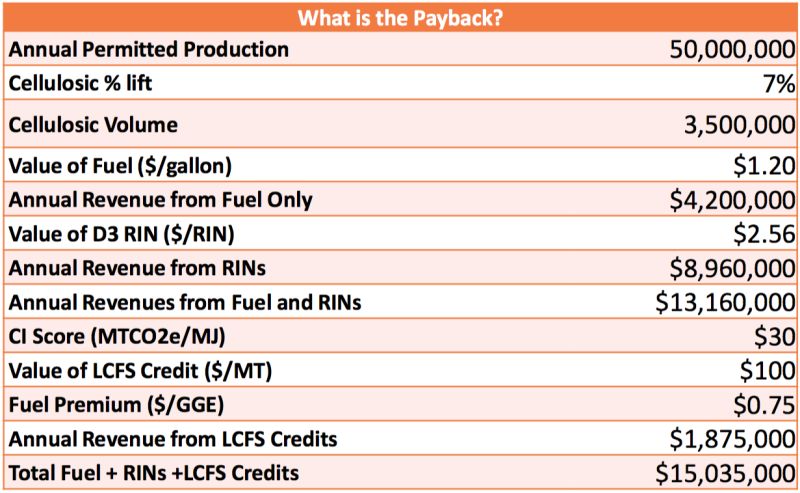

Ramm, whose company works with ethanol plants across the country to help meet EPA requirements and improve efficiency, concluded that either co-processing or separate processing with acid hydrolysis to separate the corn fiber from the starch is a moneymaker. He said, as illustrated here, that with separate processing, “If a 50-million gallon facility were to produce 7 percent D3 gallons, between the D3 credits, the value of the fuel, the value of the California (Low-Carbon Fuel Standard) credits, it could be a total value of $15 million annually … in additional revenue.”

This extra $15 million per year per 50 million gallons of cellulosic production means more income to farmers through better prices for their corn, particularly if they raise corn that's specialized to boost cellulosic production; more income to the ethanol industry to expand their cellulosic production; and more income flowing to the rural economy. The chart below also shows how important generating premium-priced D3 RINs is in boosting returns to farmers, ethanol plants and the rural economy.

Ramm’s message is that to catch up with the industry’s pioneers like Quad County Corn Processors, Syngenta, POET and Archer Daniels Midland, ethanol producers should consider co-processing a worthwhile first step.

Source: EcoEngineers statistics from the National Ethanol Conference

Ramm says that low- or no-investment co-processing allows for “getting your feet wet in D3 gallons and starting the work to market D3 gallons and see premiums for D3 gallons.” The next step would be to decide whether to invest in creating more D3 gallons, more D3 RIN premiums, and even higher-protein grains.

Just the initial move into co-processing, he says, “allows you to convert the lowest-value feedstock already coming into your plant into a high-value cellulosic ethanol gallon.”

Next, he says, plants should “consider acting as a blender in order to separate and sell RINs to maximize economic value, achieve higher-protein levels in your grains, and start to create even more efficient local feed markets and use Q-RIN (a voluntary quality assurance program) as an opportunity to differentiate your ethanol products leaving the facility.”

Ramm adds that with markets like Colombia placing new carbon-intensity restrictions on ethanol imports at a time when the U.S. needs to increase its ethanol exports, it’s also important that adding corn-fiber ethanol to U.S. ethanol supplies is already “lowering the carbon intensity, spreading the farming practices and the indirect land-use change over a larger volume of ethanol.”

But in a Feb. 15 letter to EPA Administrator Scott Pruitt, 20 biofuels industry groups charge that EPA’s current combination of restrictive regulations and unreasonably low forecasts for cellulosic production capacity “continues to undercut demand for liquid cellulosic biofuel gallons.” The groups insist that if EPA corrects its corn fiber ethanol regulations and forecasts, “Existing ethanol plants could produce hundreds of millions of gallons of cellulosic ethanol from this single stream of agricultural residue in the near term.”

For more news, go to www.Agri-Pulse.com