Buoyed by the Trump administration's trade mitigation payments, U.S. farm income is expected to increase for the third straight year, but still will not come close to its 2013 peak.

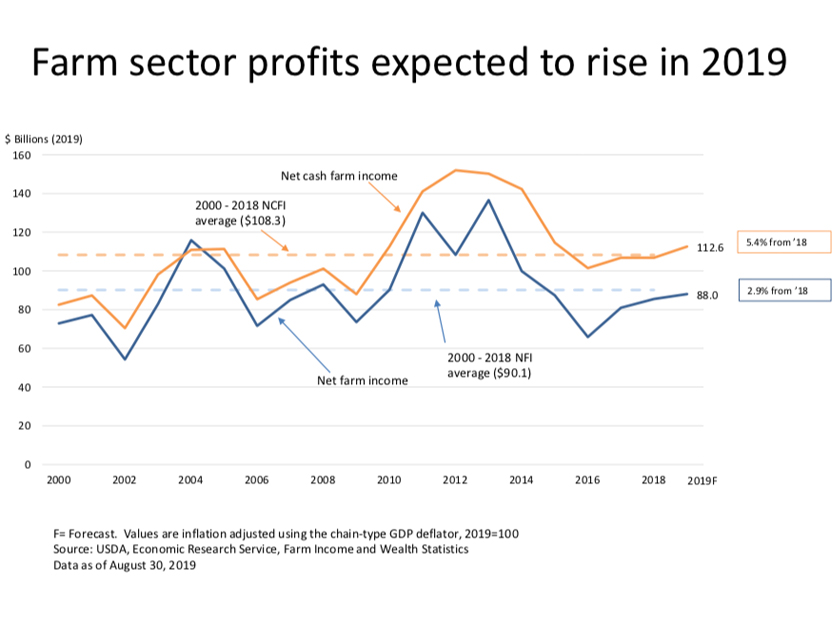

USDA's Economic Research Service forecast net farm income at $88 billion for 2019, an increase of $4 billion, or 4.8%, from 2018. In inflation-adjusted dollars, however, that number is down 35.5% from the peak of $136.5 billion in 2013, and also below the 2000-2018 average of $90.1 billion.

Using another measure, net cash farm income is expected to increase $7.6 billion, or 7.3%, this year. Adjusting for inflation, net cash farm income is forecast to increase $5.8 billion (5.4%) from 2018, which would be 4% above its 2000-18 average ($108.3 billion).

Net cash farm income includes cash receipts from farming along with farm-related income, including government payments, less cash expenses, ERS said, noting that direct government farm payments are forecast to increase $5.8 billion (42.5%) to $19.5 billion in 2019, following higher payments from the Market Facilitation Program.

Without those mitigation payments, net farm income would be about $68.5 billion, ERS economist Carrie Litkowski said on a Friday webinar. That total would be about a 19% decrease from last year. Without commodity insurance indemnities of $6.6 billion — a 160% increase from 2018 — overall net farm income would be $62 billion.

Go here for the charts used in the webinar

USDA allocated $14.5 billion in MFP trade mitigation payments for this year, a substantial increase from 2018 payments that so far stand at about $8.59 billion, according to USDA.

The total of $19.5 billion in direct government payments estimated for this year includes $13.1 billion in MFP payments, $3.7 billion for conservation, ND $2.8 billion in commodity income-support payments.

Crop cash receipts are forecast at $193.7 billion in 2019, a decrease of $3.3 billion (1.7%) from 2018 in nominal, or unadjusted, terms. “Lower receipts for soybeans and cotton are expected to more than offset higher receipts for wheat and vegetables and melons,” ERS said.

ERS forecast farm business average net cash farm income will increase $8,400 (11.4%) to $81,900 per farm in 2019. “This would be the first annual increase after four consecutive years of declines,” ERS said. “Every resource region is forecast to see farm business average net cash farm income increase by 5.6 percent or more. All categories of farm businesses except poultry are expected to see average net farm income rise in 2019.”

Median farm income is expected to increase slightly but is still projected to be a loss; the metric was reported at -$1,840 in 2018 and is projected at -$1,644 in 2019.

“In recent years, slightly more than half of farm households have had negative farm income,” ERS noted. “Many of these households rely on off-farm income — and median off-farm income is forecast to increase 2.2 percent from $65,841 in 2018 to $67,314 in 2019.”

ERS estimates that total production expenses (including operator dwelling expenses) will stabilize in 2019.

“Spending on feed and hired labor is expected to increase while spending on seed, pesticides, fuels/oil, and interest are expected to decline,” ERS said. “After adjusting for inflation, total production expenses are forecast to decrease $4.6 billion (1.3%).”

Observing that this is the fifth straight year of declining expenses, Litkowski said, "We haven’t seen a decline of this duration or magnitude since the farm crisis of the 1980s."

Overall, Litkowski said the “balance sheet remains strong,” but also pointed to increasing debt. While farm sector equity is expected to increase 1.8%, unadjusted for inflation, ERS said “most liquidity measures are expected to weaken, with working capital levels forecast down 18.7% to $56.9 billion.

ERS continued, “Farm sector debt is forecast to rise 3.4% to $415.7 billion, with real estate debt forecast to rise 4.6 percent to $257.1 billion. Debt-to-asset levels for the sector are forecast to rise again in 2019, continuing an upward trend since 2012.”

An ERS chart showing rising debt-to-asset and debt-to-equity ratios notes the ag sector’s “risk of insolvency [is] at its highest level since 2009.” But the likelihood of default is also “historically low.”

The dairy sector is expected to rebound in 2019, with a 41% increase in cash receipts, largely due to higher prices, Litkowski said. Total animal/animal product cash receipts are expected to remain flat in 2019, however. Individually, however, ERS forecast cash receipts for hogs to rise 16.2% due to higher prices and higher quantities sold.

Cow/calf receipts are forecast to rise 0.3%, with broilers down 12.4% and eggs down 35.9%.

ERS expects soybean receipts to fall in 2019 by $5.7 billion, or 14.3%, “reflecting anticipated declines in both price and quantities sold.”

Corn receipts are forecast to fall $200 million (0.4%) in 2019 because of a decrease in the amounts sold, while cotton receipts are expected to fall by $600 million, or 7.4%, reflecting “expected decreases in cash receipts for upland cotton lint and extra-long staple (ELS) cotton lint.”

Receipts for wheat are forecast to increase almost $700 million, or 7.5%, from 2018, “reflecting an increase in quantity sold alongside a slight price decline,” ERS said.

More rice sold will translate into a $100 million, or 4.5%, increase in cash receipts, ERS said.

For more news, go to www.Agri-Pulse.com.