Soaring prices for commodities ranging from corn to cotton have fueled a sense of optimism for some farmers this growing season, but economists and land investors warn that the highs could be short-lived and that higher cash rents and production expenses could squeeze growers sooner than they expect.

Near-term futures prices for corn, soybeans, wheat, hogs, cotton, and milk have all seen healthy gains, and in some cases prices have nearly doubled from pandemic levels.

Around May 28 a year ago, nearby corn futures were around $3.18 per bushel, soybeans were at $8.35, and wheat was at $5.16, according to Brock Associates, an Indiana-based commodity futures consulting firm. This year, prices were at $6.59, $15.26, and $6.74, respectively, on May 28.

Hog prices hit seven-year highs last week, but the cattle industry has not enjoyed the same post-pandemic price recovery other commodities have seen, said Iowa State University Economist Chad Hart.

Chad Hart

“Beef export sales were up 22% compared to last year at this time, so that’s a sizable increase in international purchases,” he said. However, producers are still feeling the pinch of more limited processing, which has put a pinch on cattle prices, Hart noted.

“We’ve seen record to near-record export sales and shipments for a lot of our agricultural products, and then you throw on top of that the idea of this drought from last year that didn’t stop,” Hart told Agri-Pulse. “We are still worried about drought conditions as we plant this year’s crop.”

And livestock producers are feeling the margin squeeze from high grain prices.

In west Texas, producers are happy about higher prices for cotton — prices hit 90 cents a pound in early May, up from 56 cents the year before — but farmers in the region have been dealing with an exceptional drought this spring, said Plains Cotton Growers President Brent Nelson.

Some recent rains helped some farmers, but the accompanying hail also ruined part of Nelson’s crop. “It’s kind a double-edged sword now. Our planting is at a standstill in my region right now, plus we have a lot to replant,” he told Agri-Pulse.

“Of course, high prices are great, but you have to make the crop and right now that seems to be our problem is getting a crop started,” he noted. In Texas, 40% of the cotton crop has been planted as of May 24, compared to 49% the year before, according to USDA.

With strong commodity markets and historically low interest rates, some farmers are flocking to land auctions and equipment dealers.

“Farmland sales prices are up 5 to 15% in the past six months, with most of the increase coming since the first of the year,” said Randy Dickhut, senior vice president of real estate operations at Farmers National Company, based in Omaha. “Competitive bidding among interested buyers is really pushing land prices right now.”

Steve Bruere, president of People’s Company, a real estate firm based in Clive, Iowa, said an increase in land values is especially evident in the Midwest.

“Some of those crazy sales that you’re hearing about, I mean you’re hearing about those pretty routinely,” he told Agri-Pulse. “There was one in Northeast Iowa that was $18,900 an acre, and these are farmer buyers that are paying aggressive prices.”

“What’s scary about it is, it wasn’t 12 months ago where there was a lot of talk about distress and farm bankruptcies and you just went from that to the hottest farmland markets I’ve ever seen,” he said.

Tractor sales continue to see double digit growth in the U.S., according to the Association of Equipment Manufacturers. Total farm tractor sales jumped 22.7% in April compared to 2020, the first month of the current trend.

Bankers also are seeing the impact of robust commodity markets in many parts of the country, with many borrowers refinancing at lower interest rates or paying down debt. Repayment rates for farm loans rose during the first quarter, according to the Federal Reserve Bank of Kansas City, which covers the Fed’s Tenth District of Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri.

"Following multiple years of steady deterioration, around 70% of all participating bankers reported that farm income was higher than a year ago," the report said. Average interest rates remain low — the fixed rate on all ag loans was roughly 40 basis points less than last year and 170 basis points under the 20-year average.

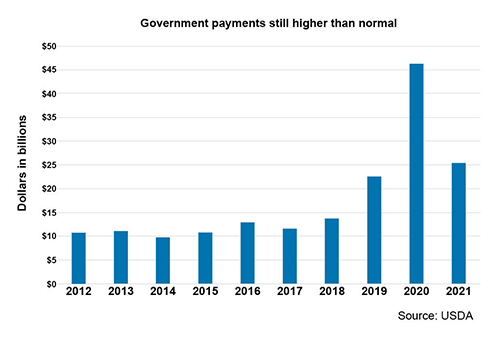

“Government payments and PPP made all of the difference in averting a deterioration of credit due to a combination of drought and disruptions from the pandemic,” noted a banker from Southeast Colorado in the Tenth District’s most recent Ag Credit Survey, referring to the Paycheck Protection Program.

However, another lender from Northwest Oklahoma noted that producers might still see tight margins and more volatility this year, saying the increase in input costs "is going to be significant for 2021."

With short global supplies and China’s fast purchasing pace, some analysts have raised the possibility that the Asian giant could meet its commitment to buy $40.4 billion in U.S. commodities this year.

“Given what we’ve seen thus far in 2021 in terms of sizable purchase commitments of new crop commodities expected to ship in the latter months of 2021 and current commodity prices, there is a real chance that the 2021 Phase One commitment level might be reached,” according to a recent analysis by the American Farm Bureau Federation.

But Hart expects exports to taper off at some point because of how high prices have risen, specifically citing some foreshadowing in May’s World Agricultural Supply and Demand Estimates report.

“They ended up backing off on some of their export expectations over the next 12 to 18 months,” he said, noting USDA in February forecast near-record exports for several commodities would be maintained. USDA updated that forecast last week with even more bullish figures.

Dan Basse, Ag Resource Co.

Ag Resource Co. President Dan Basse believes that grain markets this year are fundamentally different from the last time commodity prices spiked, when a widespread drought devastated Corn Belt crops in 2012, resulting in a supply-driven price surge.

Some 80% of U.S. agricultural crops were affected by drought in 2012, and corn export prices skyrocketed 128% above the historical 20-year average, measured by the Bureau of Labor Statistics.

Basse said the current market for corn is being driven largely by China’s import needs and U.S. ethanol production, and he thinks the market will continue strong for a couple of years.

Cash receipts for all commodities in 2021 are forecast at $390 billion versus $401 billion in 2012, according to USDA's Economic Research Service.

However, Basse said a weather disruption this year — something less severe and widespread than the 2012 drought — could push prices even higher, given that stocks are so low, especially for soybeans.

Government payments topped $46 B in 2020, according to USDA’s ERS and are forecast to remain relatively high at $25.2 B in 2021.

“USDA is already forecasting U.S. soybean stock use ratios in a new crop position at a record low. Never before have we had old and new crop where we just can’t find a solution even with expanded acreage.”

USDA is projecting soybean ending stocks for the 2021/2022 crop year at 140 million bushels, far below the 525 million bushels for 2019/2020.

Meanwhile, the size of Brazil and Argentina's corn crop keeps getting adjusted downward, pushing world ending stocks lower, Basse said. USDA currently estimates the South American crop at 109 million metric tons, but Basse thinks it will end up being closer to 91 million or 95 million metric tons.

Interested in more news on farm programs, trade and rural issues? Sign up for a four-week free trial to Agri-Pulse. You’ll receive our content - absolutely free - during the trial period.

"We need the world to somehow find an additional 12 million acres of corn longer term to satisfy this Chinese demand,” Basse said. Some of that will have to come from Brazil, Argentina and Ukraine, but China currently does not have a phytosanitary agreement to take Brazilian or Argentine corn, he said.

But some farmers and economists warn that a downturn in the market is inevitable, referencing the adage that “the cure for high prices is high prices.” And even if commodity prices stay relatively high, the rising costs of cash rent, plus inputs like fuel, fertilizer, seed and crop protection chemicals may slice into margins.

Ben Reinsche, who grows corn and soybeans near Jesup, Iowa, told Agri-Pulse farmers need a downside strategy to prepare for the next five years.

"You scrape by and then have devastating losses in any one given year, and every so often you get a windfall ... farmers need to bank this one," he said.

In North Dakota, farmer Paul Anderson of Coleharbor is also concerned when a market correction could happen after extra cash has chased commodity prices higher.

“When the correction comes after that, is what’s a little scary,” Anderson told Agri-Pulse.

Bruere cautioned that producers need to be cautious because generally, farmers get in trouble when they start making decisions based on high commodity prices, such as buying farmland at $12,000 to $14,000 an acre, only to find out later they can't afford it when prices sink.

Mark Jensen, CEO of Farm Credit Services of America, says he’s been in agricultural lending for 29 years and “we feel like we may have seen this movie play out before.”

“Our caution to our producers is to be careful," he said. "Make sure you're building liquidity and you're watching cash flow because we’ve seen these margins go the other direction before and we’ll likely see that again in the future.”

For more ag news go to. www.Agri-Pulse.com.