Fruit and vegetable growers are debating potential options for expanding crop insurance coverage in the next farm bill, including reforms to the lightly used Whole Farm Revenue Protection policies.

The Specialty Crop Alliance, a coalition representing more than 100 producer organizations around the country, including the Florida Fruit and Vegetable Growers, National Potato Council, U.S. Apple Association, Western Growers Association and the Wine Institute, is looking to agree on a set of proposals early in 2023.

Industry officials say ideas being discussed include making it easier for growers to insure revenue on specific varieties of crops like apples and finding ways to calculate revenue guarantees on crops for which there is limited public data on pricing.

The discussions around WFRP include the possibility of merging it with USDA’s Non-insured Crop Disaster Assistance Program (NAP) or providing an alternative to both. NAP, which is run by USDA’s Farm Service Agency, covers weather-related losses to crops that are ineligible for insurance.

It’s not clear how much the changes to the bill’s crop insurance title would cost or how they could potentially be paid for.

The next Congress is due to write a replacement for the 2018 farm bill, portions of which expire Sept. 30. The incoming chairman of the House Agriculture Committee, Glenn “GT” Thompson, R-Pa., has said he wants to move a new farm bill ahead of the August congressional recess.

Incoming House Ag Chair Glenn “GT” Thompson, R-Pa.

Incoming House Ag Chair Glenn “GT” Thompson, R-Pa.

“While we encourage our growers to purchase crop insurance, unfortunately, crop insurance is not available to many of our growers,” said Christina Morton, a spokesperson for the Florida Fruit and Vegetable Growers. “To those where it is available, because of the high pre-harvest cost of fruits and vegetables, it is prohibitive because premiums are high, and the payouts are low.”

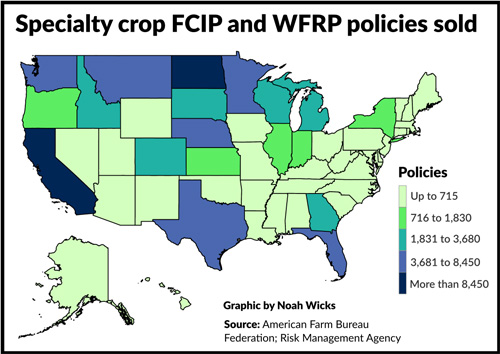

Insurance coverage of specialty crops has grown sharply over the past two decades, but policies remain concentrated in a handful of sectors, including almonds and other tree nuts, dry peas and beans, potatoes and tomatoes, according to a recent analysis by the American Farm Bureau Federation.

The specialty crop policies sold this year covered $23.7 billion in liabilities, compared to $13.3 billion a decade ago and $22 billion last year, AFBF said.

California has the largest number of policies this year, with 22,921, followed closely by North Dakota, a major producer of dry peas and beans as well as potatoes, with 22,761. Minnesota, which also produces pulse crops and potatoes, ranks third with 8,445 policies, followed by Nebraska (7,772) and Washington (7,456). Florida is a distant sixth with 6,703.

Some 91% of dry bean acreage was covered by crop insurance this year, compared to 32% of the peach production, 12% of U.S. pepper acreage and less than 1% of the U.S. lettuce and strawberry crops.

The 2018 farm bill provided USDA with funding to increase collection of specialty crop pricing data, the lack of which remains a major barrier to designing new policies, said AFBF economist Danny Munch.

There are many distinct varieties of fruit and vegetable crops, and there can be differences in pricing within a single farmer’s crop due to issues such as grading, according to Munch.

“The dynamics and diversity in (field crops) make it difficult to establish a price series and have futures prices, or anything sort of reflective of that,” he said.

The lack of data is one of the issues the Specialty Crop Alliance is wrestling with, said Dennis Nuxoll, vice president of federal government affairs for Western Growers. Apple growers, for example are interested in policies designed to reflect the markets for the specific varieties they produce.

“You’ve got to collect data in order to do that. And unlike our friends in corn and soybean world, there aren't publicly traded commodity markets, where you can point to data that's collected from individual growers,” he said.

Another focus of the alliance’s discussions, Whole Farm Revenue Protection, is popular in the Pacific Northwest but it is minimally used elsewhere.

Interested in more coverage and insights? Receive a free month of Agri-Pulse!

Sales of WFRP have fallen every year since peaking in 2017 with 2,833 policies; this year 1,810 were sold, with more than 700 purchased in a single state, Washington, according to USDA’s Risk Management Agency.

Unlike traditional, crop-specific policies, WFRP is designed to trigger indemnities when a farm’s entire revenue falls below an insured amount, which is based on a five-year average. To make the policy more attractive to large operations, RMA recently doubled the maximum insured revenue to $17 million.

Dennis Nuxoll, Western Growers

Dennis Nuxoll, Western Growers

But WFRP still has flaws to turn away producers, said Nuxoll. The policy can work well for producers whose crops are similarly affected by market fluctuations or weather-related losses. For example, a weather problem that affects a farm’s apple crop is also likely to harm its pear crop, so the revenue for both will drop. In that case, WFRP could trigger indemnities to the farm.

But a farm that grows significantly different commodities, such as almonds and tomatoes, may have a revenue hit on one crop that offsets the loss on the other. In that case, the farm is unlikely to get a benefit from WFRP.

Nuxoll said Western Growers and other organizations are discussing possible alternatives to WFRP and NAP or even a merger of them. “That's certainly an area that I think we and some of our other colleague organizations are thinking through,” he said. He didn’t provide any detail on those discussions.

NAP is designed somewhat like an insurance program in that producers pay fees that vary by level of coverage level. NAP payments are capped at $125,000 at the minimum coverage level and $300,000 for higher coverage.

Regina Thomas, a senior vice president of Farm Credit of Central Florida, said there are other modifications to WFRP and crop-specific policies that could make insurance more attractive.

For example, allowing farms to exclude harvesting costs from crop revenue calculations would lower WFRP premiums, she said. “Harvest costs for specialty crops are so much more than they are for grain crops,” she said.

Another issue, she said, is that WFRP premiums are higher for farms that produce a single crop, a common practice in Florida.

There are separate, commodity-specific issues that hinder sales of conventional crop insurance products. For example, blueberries are grown on bushes that are periodically replaced with new varieties. The replacements initially don't yield as much as existing varieties, reducing the farm’s Actual Production History, which determines coverage levels. One way to address that issue would be to allow farms to insure their crop in separate units rather than together.

Meanwhile, some fruit and vegetable growers are likely to continue pushing Congress to provide insurance that would cover losses related to outbreaks of foodborne illness.

This year, U.S. strawberry prices dropped because of an E. coli outbreak linked to organic strawberries grown in Mexico. Such losses currently aren’t insurable because they are considered preventable and not naturally caused, said Nuxoll.

For more news, go to Agri-Pulse.com.