USDA’s latest farm income forecast could provide some ammunition to farm groups and their allies in Congress who argue that soaring production costs are eating into farm earnings while producers have little chance of seeing payments from commodity programs.

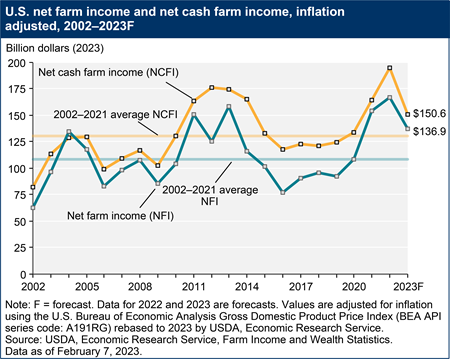

USDA’s Economic Research Service estimated Tuesday that net cash farm income is estimated to fall 20.7% from last year’s record to $150.6 billion in 2023. Net cash farm income jumped 27% in 2022, ERS said.

Prices for a range of commodities, including corn, soybeans, wheat, dairy and eggs, are expected to be somewhat lower in 2023, while farmers’ cash expenses are expected to rise another 3.3% this year after skyrocketing more than 19% in 2022.

Net cash farm income, a measure of farmers’ cash flow, is based on cash receipts from farming, plus government payments and other farm-related income, minus cash expenses.

A broader measure of farm profits — net farm income — is expected to decline by 15.9% in 2023. Net farm income also factors in depreciation and changes in inventory values.

Farmers are expected to see only slight relief on fertilizer costs. Farmers are expected to spend $42.2 billion on fertilizer this year, slightly less than the $43.7 billion they spent in 2022 but well above the $32.4 billion they spent just two years ago.

Meanwhile, farmers are expected to spend 22.4% more on interest this year, reflecting rising loan rates, plus 7.3% more on labor and 2.3% more on seed. Fuel prices are one of the few places where they’ll see relief; fuel costs are expected to be down nearly 15%.

“The ag economy is getting a lot of high altitude to it in terms of the costs of inputs,” Senate Agriculture Committee member Mike Braun, R-Ind., said in a recent interview.

While commodity prices remain historically high, the rise in production costs means it’s “a lot more risky financially” for producers, Braun said.

What matters to farmers is their profit margin, said House Agriculture Committee Chairman Glenn “GT” Thompson, R-Pa. “At the end of the day, given the inflated costs of everything, you know, you can have a record commodity price, but you could still be losing money,” he said.

He said he’s going to be making the case to conservative colleagues that farm programs account for only a small fraction of federal spending. “From what little we spend compared to everything else. I would say it has a better return on investment than almost anything else we do in this country,” he said.

The American Farm Bureau Federation and some commodity groups are asking Congress to increase the commodity program reference prices to reflect increases in production costs. Payments are triggered when market prices fall below the reference prices.

With commodity prices still relatively high in relation to reference prices, direct government payments to farmers are expected to fall to $10.2 billion this year, which would be the lowest level since 1982 when adjusted for inflation.

“That’s pretty shocking. It shows you what has been happening with farm bill spending,” said Scott Gerlt, an economist with the American Soybean Association. He said he's concerned about the impact on farm income if producers' margins continue to tighten down the road and government payments remain low.

Government payments peaked at $52 billion in 2020 as a result of a flood of pandemic assistance to producers and a final round of Market Facilitation Program payments stemming from the 2019 iteration of the program. But government supports then fell to $28.5 billion in 2021 and $16 billion last year. The totals don't include crop insurance indemnities.

Even with the projected decline in farm profits this year, they will still be well above the historical average and higher than 2018, when the last farm bill was enacted.

This year's predicted net cash farm income of $150.6 billion would be 15.4% above the 20-year average when adjusted for inflation. Net cash farm income was $121.3 billion in 2018 and $165.3 billion in 2014, another farm bill year.

The average farm with more than $1 million in sales is expected to see net cash income this year of $848,100, down from $1.07 million in 2022 and $985,400 in 2021 when adjusted for inflation. The lowest net cash income for those farms in the last 10 years was $738,200 in 2018. The average for those farms in 2014 was $972,700.

Family-operated farms with more than $1 million in sales account for about 4% of U.S. farms but about half of U.S. ag production by value.

Executives of some leading agribusiness companies are assuring investors that they expect commodity markets to remain relatively strong in 2023.

Don’t miss a beat! It’s easy to sign up for a FREE month of Agri-Pulse news! For the latest on what’s happening in Washington, D.C. and around the country in agriculture, just click here.

Chuck Magro, CEO of Corteva Agriscience, told analysts recently that farmers are financially healthy and will be trying to increase yields in 2023 in response to prices that are still relatively strong. He said he expected “positive market conditions to continue throughout the year.”

Chuck Magro, Corteva

Chuck Magro, CortevaJoe Glauber, a former chief economist for USDA now with the International Food Policy Research Institute, said the projected drop in farm earnings for 2023 should be no surprise given that 2022 was a “remarkable year by any yardstick.”

He cautioned that early estimates of farm income “are full of uncertainty and with ongoing war and tight stocks, they may end up a lot different by the end of the year.”

Nearly all sectors are expected to see a drop in cash receipts this year, largely due to declines in prices, according to USDA.

Soybean sales are expected to fall 10.6%, while revenue from corn is expected to drop 7.1% and cotton revenue is estimated to fall 4.8%. Sales of vegetables and melons are expected to drop 11.2% while revenue from fruits and nuts is projected to decline by 3.1%

Receipts for wheat are expected to increase slightly 1.2%, but only because farmers are expected to sell more of the grain this year, offsetting a decline in the market price.

Dairy farmers, meanwhile, are expected to see a 16.9% decline in revenue, while broiler chicken revenue is expected to drop 10% and revenue from eggs is expected to fall 26.1%. Cow-calf receipts are expected to drop slightly, 0.4%, while revenue from hogs is expected to decline by 5.4%.

For more news, go to Agri-Pulse.com.