Even as a growing number of patients turn to pharmaceutical intervention to aid in their weight loss efforts, food industry observers say they do not see diets or food patterns shifting dramatically.

But food companies are still watching closely to position themselves moving forward.

A small percentage of Americans are already taking semaglutide – marketed by Novo Nordisk as Ozempic and Wegovy. The medication – which was originally a diabetes treatment – suppresses hunger by lowering blood sugar and slowing the stomach's emptying process. Users then eat less because they feel more “full,” and studies find they can shed 15 to 20% of their weight. In November, Novo Nordisk studies reported that in addition to helping patients lose weight, the drug also lowers the risk of heart attack, stroke and death from cardiovascular disease by 20%.

Usage of GLP-1 class of hormone regulators such as Ozempic and Wegovy has increased 300% between Q1 2020 and Q4 2022, Trilliant Health reports. Morgan Stanley projects 24 million people – or 7% of the U.S. population – could be taking obesity drugs by 2035.

While users of the drugs might be curbing their appetites, Thomas Bailey, consumer analyst for Rabobank, said he believes the hype around Ozempic and similar drugs’ impact on overall food consumption is “overblown.”

“It’s not going to devastate the wallet of retailers,” Bailey told Agri-Pulse, but noted the effects could be something to monitor.

Retailers and food companies are taking notice.

Walmart CEO John Fumer said in an October interview with Bloomberg that the major retailer saw a “slight pullback" in the quantity of what Ozempic users purchased and the calories in those items. Walmart plans to evaluate shopper trends more closely moving forward.

It’s easy to be “in the know” about agriculture news from coast to coast! Sign up for a FREE month of Agri-Pulse news. Simply click here.

Nestlé reported in its latest sales conference call that the company is watching the increase in consumer acceptance of the drug therapy and is “already developing a number of companion products” for the time patients spend on the drugs and after.

“The goal will be to address the risk of malnutrition and the loss of lean muscle mass while on the GLP-1 therapy and to avoid or limit weight rebound after the therapy,” said Mark Schneider, the company's CEO. “These innovations are right in our wheelhouse, where we can bring our deep understanding of nutritional science and appropriate supplementation to the table.”

Schneider believes any market disruption that could come from fewer purchases of its center-of-the-plate or snacking products will be offset by new products to complement the therapy.

Morgan Stanley’s tobacco and packaged food analyst Pamela Kaufman projects restaurants and food and beverage companies could all see “softer demand, particularly for unhealthier foods and high-fat, sweet and salty options.”

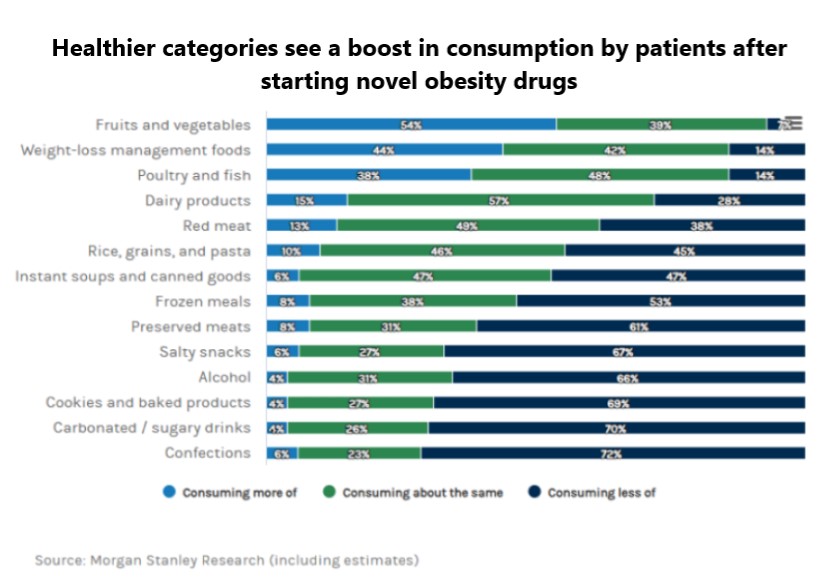

As more people use obesity drugs, overall consumption of carbonated soft drinks, baked goods and salty snacks may fall by up to 3% by 2035, Morgan Stanley anticipates. Dara Mohsenian, Morgan Stanley beverages and household products analyst, said shifting sales to low or no-calorie offerings can help balance the anticipated drop.

Morgan Stanley says consumers using the drugs are increasing their consumption of healthier foods such as fruits and vegetables, weight-loss management foods and poultry and fish.

More nutritional research is needed to better understand the links between food and these obesity medications, Grant Leslie, head of the FGS Global food team, told Agri-Pulse.

On Capitol Hill, she’s already seeing a new intersection between the pharma and agricultural sides, “universes that don’t really know each other.” Now, Leslie said it bears monitoring the type of research, conversations and eventual policy that comes out of this new intersection of ideas.

Short-term food demand impact will be subdued, Rabobank’s Bailey explained, as widespread adoption is limited by the medicine’s high cost; the drugs are generally not covered by most insurance plans.

In December, Yale School of Medicine diabetes expert Kasia Lipska told the Senate Health, Education, Labor and Pensions Committee the price tag for Ozempic is more than $900 per month; Wegovy can cost patients $1,300 per month.

“If Medicare were to fully cover Wegovy for all of its beneficiaries with obesity, we as American taxpayers would end up with a $268 billion invoice,” she said, noting that equals 70% of all the money that was spent on all prescription drugs in the U.S. in 2021.

Meanwhile, the same drugs cost roughly $100 per month in Sweden and $80 in Australia and France. These governments are negotiating directly with pharmaceutical companies to keep costs lower.

“That’s not socialized medicine. That’s smart negotiating,” she argued.

The Inflation Reduction Act already authorizes the secretary of the Department of Health and Human Services to negotiate prices with pharmaceutical companies under specific provisions and for a limited set of drugs. Lipska stated four out of the 10 initial medications selected for negotiation are medications for type 2 diabetes, but that did not include semaglutide drugs.

For more news, visit Agri-Pulse.com.