Farmers and ranchers would like to see increased crop insurance subsidies and commodity price supports in the new farm bill, and a strong majority support cutting the Supplemental Nutrition Assistance Program, according to an exclusive Agri-Pulse producer poll.

Some 59% of the 605 farmers surveyed by the Stratovation Group say the cost of the SNAP program should be reduced.

Republicans on the House and Senate Ag committees have floated the idea of cutting $30 billion from projected SNAP costs by restricting the way USDA conducts future updates of the Thrifty Food Plan, an economic model of food costs the department uses to set SNAP benefits. Republicans want to put the $30 billion into other areas of the bill, but the producers were not asked about that idea in the poll.

The poll shows strong support for the 2018 farm bill, which has been extended through this year while Congress struggles to agree on new legislation. Some 48% of those surveyed say they support the 2018 bill, while only 16% disapprove of it; the remaining 36% have no opinion.

The survey, conducted online from Dec. 14-22, includes representative samples of farmers and ranchers with at least $100,000 in gross farm income in the Midwest, South and California.

The producers were asked their opinions on a broad range of issues, including farm bill priorities and their views on cover crops, carbon markets and ag labor issues.

When asked for their top concerns on a new farm bill, the leading answer was increasing trade promotion funding for U.S. commodities, a concern supported by 51% of the survey respondents.

Some 44% of the farmers surveyed believe the next farm bill should increase crop insurance subsidies, while 41% want the legislation to increase reference prices. The Price Loss Coverage program triggers payments to farmers when the average market price for a commodity falls below its reference price.

The support for higher reference prices reflects a concern about softening commodity markets, said Bill Northey, a former Iowa agriculture secretary who served as USDA's undersecretary for farm production and conservation during the Trump administration.

“There’s a nervousness and a fix-it-before-we see-if-it’s-broken” attitude in farm country, he said.

Northey said farmers who say SNAP should be cut see that the cost “has just exploded on the feeding programs on SNAP from five years ago” and know that it accounts for more than 80% of projected farm bill spending. But he also noted that a new farm bill that cuts nutrition assistance likely would not pass.

Data: Stratovation Group for Agri-Pulse

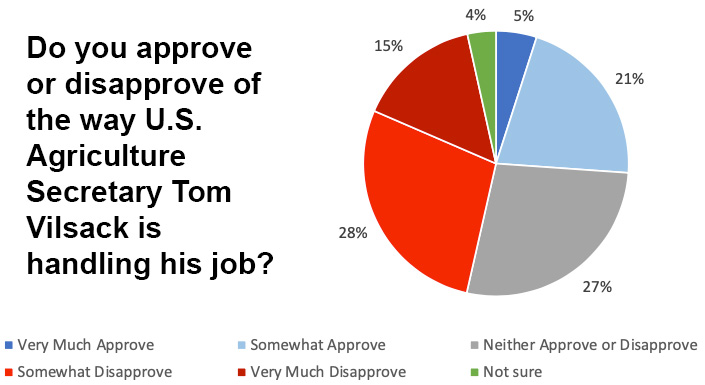

Data: Stratovation Group for Agri-PulseSome 61% of the farmers surveyed identified as Republicans, versus only 10% who consider themselves Democrats, and the heavy GOP lean is reflected in the farmers’ view of two Biden administration officials critical to farm policy, Agriculture Secretary Tom Vilsack and Michael Regan, administrator of the Environmental Protection Agency.

Vilsack, Regan approval ratings: Some 28% of the farmers “somewhat disapprove” of the way Vilsack is doing his job. Another 15% of farmers “very much” disapprove of his performance. Only 26% approve of the job Vilsack is doing, while 27% neither approve nor disapprove.

Vilsack has been running USDA since 2009 except for the four years of the Trump administration.

Regan, a former North Carolina official who joined the Biden administration in 2021, has an approval rating of just 12%, according to the survey, while 59% of producers disapprove of his performance.

Regan has been at the forefront of the Biden administration’s regulatory agenda on a variety of issues affecting farmers, not the least of which is the “waters of the U.S.” rule redefining the jurisdiction of the Clean Water Act. The latest version of the rule is being challenged in federal courts.

Climate and carbon markets: More than four in 10 farmers believe they may have to change their farming practices in some way due to climate change, and there is significant interest in carbon payments, according to the survey.

It’s easy to be “in the know” about what’s happening in Washington, D.C. Sign up for a FREE month of Agri-Pulse news! Simply click here.

Some 13% of the farmers strongly agree that they’ll have to change farming practices, and 29% somewhat agree it will be the case. Another 26% are unsure; the remaining 32% of farmers don’t believe they’ll have to do anything differently.

A near majority of farmers say they’re at least somewhat likely to participate in carbon markets, with many undecided.

Carbon markets take different shapes but generally allow farmers to get paid for practices that reduce greenhouse gas emissions or sequester carbon in soil or trees and plant life.

One such program, operated by Bayer, is paying farmers up to $12 an acre this year based on the practices they have adopted. Another program, operated by Truterra, a unit of Land O’Lakes Inc., is offering farmers up to $30 per metric ton for stored carbon this year with a minimum payment of $2 an acre for making specific practice changes. In 2022, 273 farmers received an average payment of $18,000 from the Truterra program.

Of the surveyed producers, 17% say they are extremely likely to take part in carbon markets, while 31% are somewhat likely. Only 20% say they are unlikely to take part. The remaining one-third of producers are unsure what they will do at this point, according to the survey.

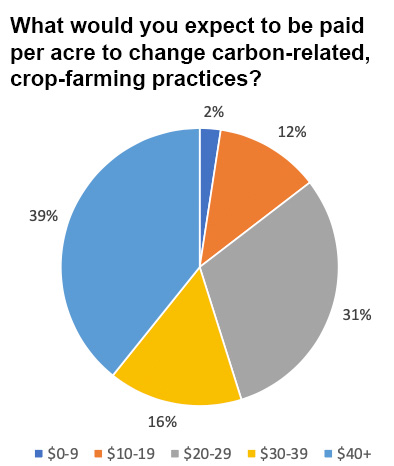

A key factor in the decision of many, if not most, farmers will be the size of the payment. Nearly four in 10 producers (39%) surveyed say they would expect to be paid at least $40 an acre, an amount well over what markets have typically been offering. Another 16% want at least $30. Some 31% are OK with getting at least $20.

Nearly two of every three farmers surveyed, about 65%, say they use cover crops on their farm, with 87% of those producers saying the benefits include preventing soil erosion.

Data: Stratovation Group for Agri-PulseMost of those farmers — 81% — cite soil health as a benefit and 65% cite weed management. Some 45% note grazing as a benefit, and 43% say cover crops can improve water quality. One-third of those surveyed see drought mitigation as a benefit.

Data: Stratovation Group for Agri-PulseMost of those farmers — 81% — cite soil health as a benefit and 65% cite weed management. Some 45% note grazing as a benefit, and 43% say cover crops can improve water quality. One-third of those surveyed see drought mitigation as a benefit.

Cost is the biggest deterrent to planting cover crops for those farmers who don’t use the practice. Many producers — 39% — say they aren’t sure of the effectiveness, while 36% say the lack of moisture in their soil is a deterrent.

Rob Myers, who directs the Center for Regenerative Agriculture at the University of Missouri, said in an email to Agri-Pulse that “it’s certainly possible that 65% of farmers have at least some cover crops. That 65% figure seems a little high for the U.S. as a whole but probably realistic for parts of the Southeast and portions of the Corn Belt, especially the eastern half of the Corn Belt.”

Ag labor concerns: There’s widespread support among the farmers surveyed for congressional action to address farm workforce issues. Some 44% want Congress to pass immigration reforms that would make it easier to hire farmworkers, and 41% of those surveyed specifically want Congress to “improve the H-2A program.”

A bill that stalled in the past two Congresses under Democratic control, the Farm Workforce Modernization Act, would have expanded the H-2A program to include some year-round workers. The program is now limited to seasonal employment.

Farmers with sales of at least $1 million were more likely than other producers to say the H-2A program needed to be improved. Producers in the Midwest were less likely than farmers in the South or West to answer that way.

Some 27% of the farmers who were surveyed say they would like to see training programs for farmworkers.

For more news, go to Agri-Pulse.com.