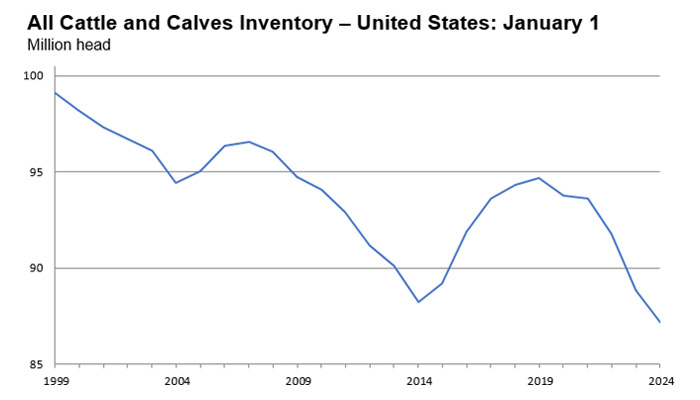

The American beef cattle herd is as small as it has been since the 1950s, giving producers booming sales checks, but leaving packers to foot the bill for a diminishing supply of livestock, and consumers to pay higher prices for beef.

USDA’s latest cattle inventory report puts the size of the nation’s herd at 87.2 million head as of Jan. 1, a 2% year-over-year decline and a 15% decline since the cattle cycle’s recent peak in 2019. All told, the current inventory is already the smallest figure recorded since 1951, and indicators of future herd growth like heifer retention and the size of the calf crop were both reported lower as well.

Don Close, the chief research and analytics officer for Terrain, said the economic climate will put pressure not just on the nation’s packers, but many feedlot operators as well.

“I think the margin operators of all categories are going to have some really challenging times. Price is obviously not going to be the concern, but you know, the last thing that producer wants to hear when we're out talking with them is how you guys really need to manage your costs,” he told Agri-Pulse on the sidelines of last week’s Cattle Industry Convention in Orlando. “Price (and) cost management is going to be the biggest challenge they have for the foreseeable future.”

The contraction, primarily driven by drought and solid prices on the auction block that have led more producers to opt against retaining cattle to grow their herds, could last several more years. Some economists aren’t expecting the herd to rebuild in earnest until 2026 or 2027, which could stretch not only the budgets of the packing houses but the consumers at the grocery store as well.

Kevin Good, vice president of industry relations at CattleFax, noted the average consumer has made progress recovering from the economic headwinds of the COVID-19 pandemic, but is now faced with new realities that are impacting purchasing decisions and limiting their trips to pricier restaurants.

“You're starting to see a consumer that … he's fully employed, but he’s spent the COVID bucks, he's not saving anything, and he's got credit card debt,” he said. “And so now you're actually starting to see a little of that dollar swinging back to grocery stores, just as their budgets are not quite as big.”

As American Farm Bureau economist Bernt Nelson notes in a recent report, USDA is projecting a drop in per capita beef consumption in 2024, and consumers are pointing to price as a growing concern in their meat purchasing decisions.

The market swing is also coming as USDA is pumping millions of dollars into expanding domestic processing capacity in a bid to diversify the nation’s packing sector away from the four major players: Cargill, JBS, Tyson and National Beef. But Close worries the current market dynamics might not support an entrance into a market known for its boom and bust cycles.

“I have a lot of concerns that USDA has pumped all that money into that sector, right when supplies are tightening up,” he said. “They're going to spend a lot of money just in time for cattle supplies to tighten. I'm not I'm not sure we're positioned to get the best use of those dollars.”

It’s easy to be “in the know” about what’s happening in Washington, D.C. and across the coast. Sign up for a FREE month of Agri-Pulse news! Simply click here.

It’s not just American consumers that could be forced to reevaluate their beef purchasing; consumers abroad have also been impacted by the price swings. U.S. Meat Export Federation President and CEO Dan Halstrom says the U.S. beef production declines have a direct correlation to a drop in exports to foreign customers.

“On the surface, we're down 5% in production, so that's 5% less short plates for Japan, and the list goes on and on,” he said. “But really, it's an opportunity as well to really do a better job of maximizing the value of the carcass globally.”

Some 15% of the country’s beef exports, Halstrom noted, are variety meats unpopular with American consumers.

Aside from the economic challenges, the situation also lays something of an “I told you so” moment at the feet of beef packers.

The sector was adamantly opposed to legislation that would have mandated a certain amount of transactions take place on the open cash market rather than through private contracts known as alternative marketing agreements. At the time, the inverse of the current profit picture held steady — packer margins were strong while producers had a harder time making money.

The legislation — championed by Senate Ag Republicans Deb Fischer of Nebraska and Chuck Grassley of Iowa, among others — actually advanced through the Senate Ag Committee in 2022 but never ended up on President Joe Biden’s desk.

Colin Woodall, NCBA“None of this should surprise anybody,” Mark Dopp, chief operating officer and general counsel for the Meat Institute, said in an interview with Agri-Pulse. “This is exactly what we were telling people back in 2020 and 2021 when prices were low. There were a lot of cattle, and now there aren’t.”

Colin Woodall, NCBA“None of this should surprise anybody,” Mark Dopp, chief operating officer and general counsel for the Meat Institute, said in an interview with Agri-Pulse. “This is exactly what we were telling people back in 2020 and 2021 when prices were low. There were a lot of cattle, and now there aren’t.”

With no speedy change in sight and the current market dynamics, National Cattlemen’s Beef Association CEO Colin Woodall said the organization hopes to keep the sector from splitting into warring factions.

“You can be unhappy with the other players in the beef supply chain, but you have to talk to them,” he said. “If we can't all be profitable, our future is pretty bleak. We need to continue the discussions to find ways that we can all work together on how we react to the market to make sure that no one group or segment of the industry overreacts. So that way, hopefully we can all kind of try to find a way toward that joint profitability.”

For more news, go to Agri-Pulse.com.