No

matter who wins this November’s presidential election, one of the first items

facing a new Secretary of Agriculture will be developing a 2018 Farm Bill, a

process sure to begin early in 2017. As we start that effort, its worth noting

that for all its rich diversity, American agriculture seems to be united behind

a few large overarching issues: coordinated and scientific regulatory policy by

EPA, FDA and USDA; healthy trade promotion; biotechnology; and, farm labor

issues, including immigration.

No

matter who wins this November’s presidential election, one of the first items

facing a new Secretary of Agriculture will be developing a 2018 Farm Bill, a

process sure to begin early in 2017. As we start that effort, its worth noting

that for all its rich diversity, American agriculture seems to be united behind

a few large overarching issues: coordinated and scientific regulatory policy by

EPA, FDA and USDA; healthy trade promotion; biotechnology; and, farm labor

issues, including immigration.

But at the individual farmer level, no issue is more important than defending and improving Federal crop insurance. All farm groups agree that crop insurance is critical to the future of agriculture, leveling out the booms and busts.

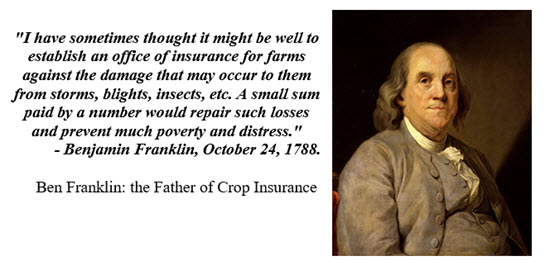

Crop insurance has deep roots in America. As noted above, Benjamin Franklin first raised the idea back in the 1780’s as a way of applying good Yankee sense to agriculture. The Federal program itself dates back almost 80 years to 1938.

Crop insurance remained a small program limited mostly to Midwest row crops, though, until the 1990’s when the disastrous 1993 flood prompted Washington leaders to fundamentally re-think how best to respond to emergencies.

The 1993 flood had caused massive crop losses through wide swaths of the country and forced Congress to respond by enacting an off-budget, after-the-fact, $8 billion ad hoc disaster relief bail-out package, which was typical for that era. Farmers waited months for relief, the process was plagued with uncertainly, and taxpayers suffered as well. Beginning that year, a succession of Congresses and Administrations spanning three decades and three Administrations, both Democratic and Republican, began investing in Federal crop insurance as an alternative, increasing fiscal supports and developing better products in partnership with private providers.

The changes worked. Higher-quality crop insurance became affordable, and farmers began voting with their checkbooks to make it a stable, permanent replacement for the old ad hoc disaster bailouts. Today, farmers can insure everything from yields to revenue and input costs, from corn to clams, cabbage and cultivated wild rice.

Today’s modern crop insurance system is a vast improvement over what existed just a few decades ago. Sheer numbers tell much of the story. Federal crop insurance today covers almost 300 million areas of American farmland, over 90 percent for major commodities and over 70 percent for specialty crops, representing over $100 billion in insurance guarantees. USDA backs the program by developing and regulating the policies, subsidizing a portion of the farmers’ premiums, and providing financial backup to the seventeen private companies approved to deliver the program through its Standard Reinsurance Agreement.

Federal crop insurance today covers more than a hundred individual crops representing over 540 types and varieties. Coverage takes a multitude of forms: yield protection, revenue protection, margin protection, whole farm policies, livestock risk protection, rangeland coverage, special policies for organics, and a growing list of tailored policies for smaller crops. While some regions and crops remain underserved, this list grows shorter each year.

As other federal farm support programs have been affected over the years by budget cuts, adverse international trade rulings, and political crossfires, crop insurance has grown into the indispensable element of the Federal safety net for American farm producers.

One key example of how American farmers have grown to rely on crop insurance came last October when Congressional leaders quietly inserted a $3 billion crop insurance spending cut into the two year budget agreement. The move sparked an almost-unprecedented and immediate uprising from across the agricultural community -- all regions, all crops, bipartisan – forcing the Congressional leadership to agree to repeal the cut in the omnibus appropriations bill.

There are good reasons for this growing acceptance:

- The crop insurance model is flexible and highly adaptive. It can cover specialty fruits and vegetables like apples and cherries as well as big row crops like wheat, corn, and cotton, while insuring yield risk as well as price risk, all under the same umbrella. Every year, new features are added and built into an actuarial structure that protects the program’s fiscal integrity.

- It puts individual farmers in the driver’s seat. Farmers pay a premium charge for their insurance, giving them ownership and responsibility. They can then tailor it to their operations and business plans, choosing their own features and coverage levels and using their individual yield histories. Farmers have seen how the system rewards good management and record-keeping, and many have upgraded their own internal management systems accordingly. Also, since crop insurance guarantees are based on annual legal contracts, no politicians can step in and take them away once signed for the year.

- It uses a unique private-public partnership combining the dynamism of private enterprise with the stability of government oversight. Under it, USDA-backed policies are delivered to farmers by seventeen private insurance companies and some 15,000 private insurance agents who can assure payment of claims within 30 days once a claim is finalized. And in addition to USDA support, these companies also place significant portions of their insurance risk with private reinsurance firms that spread the risk around the globe -- another savings for taxpayers.

Marshall Matz and Ken Ackerman are partners at OFW Law, specializing in agriculture. Mr. Ackerman was the Manager of USDA’s Federal Crop Insurance Corporation from 1993 to 2001.

#30