WASHINGTON, Nov. 10, 2015 -- One certainty about U.S. and world oil prices, and consequently energy prices overall, is to expect continuing volatility. That’s why major oil companies are laying off workers and postponing some projects and yet continue to invest even with today’s sub-$50 crude oil prices, down more than 50 percent from prices in June 2014.

Major energy companies continue to invest even though the consensus forecast is that oil prices might not climb back to the $70 a barrel level needed to justify many high-cost fracking and offshore operations until 2017 or later.

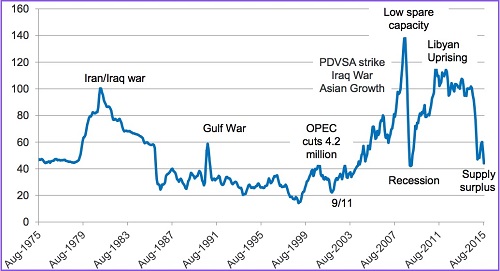

The American Petroleum Institute (API), the U.S. oil and gas industry’s leading trade association, uses the chart below to make the point that no matter how low crude prices drop, crude will recover – and in our politically unstable world, the recovery will be steep enough to make even the high cost of extracting Canada’s thick tar sands oil profitable once again.

API: “The price of oil has fluctuated sharply before”

Source: API and U.S. Energy Information Administration(EIA)

In an Agri-Pulse interview, API Senior Economic Adviser Rayola Dougher explained that today’s low crude oil prices are driven by “the massive supply from the United States that we’ve brought to the world market in such a rapid way that it has surpassed demand.” Without the increased U.S. production, which has climbed from 5 million barrels per day in 2008 to over 9 million today, she says oil prices could have reached $150 or more, “given all the instability that we’ve seen in the Middle East over the last few years.”

Dougher says that rather than focus on today’s low energy prices or the risk of stranded assets, the oil and natural gas industry is “looking decades ahead, looking at the world demand for fuel and looking at societies moving to better incomes and more energy demand.” In this view, the U.S. should be building more infrastructure like the Keystone XL pipeline and ending the ban on U.S. crude oil exports to put the U.S. petroleum industry in the best position to supply growing world demand and to create “the opportunities to produce more.”

“To understand the oil and natural gas industry “ API says, “one must recognize it as an industry characterized by long lead times, huge capital requirements and returns realized only decades later in the face of very real investment risks.”

Renewable energy advocates, however, insist that the historic boom/bust volatility of fossil fuel prices is a major reason to invest in emissions-reducing, zero-fuel-cost wind and solar energy and in low-cost waste-to-biofuels rather than continue to subsidize fossil fuel investments.

API’s response to the renewables argument is that the petroleum industry in fact is a major investor in wind, solar, biofuels and other alternatives including energy efficiency: “Between 2000 and 2014, the industry invested $90 billion in new low- and zero-emissions technologies. This represents 30 percent of the $304 billion spent by all U.S. industries and the federal government combined,” API says. Acknowledging the need to control carbon emissions, API concludes that “These large investments are critical to provide the low-carbon energy we will need in the years ahead.”

Specifically endorsing the role of renewables, API states that “U.S. oil and natural gas companies are pioneers in developing alternatives and expanding America’s use of virtually every form of energy – from geothermal to wind, from solar to biofuels, from hydrogen power to the lithium ion battery for next-generation cars. . . Oil and natural gas companies are taking action now to reduce greenhouse gas emissions and investing in the technologies and fuels that will reduce them even more in the future.”

Despite the oil and gas industry’s commitment to invest in lower-emissions alternatives, Dougher calls the federal Renewable Fuel Standard (RFS) requiring increased ethanol blending with gasoline “unworkable.” Insisting the U.S. vehicle fleet isn’t designed to use higher ethanol blends, she calls for either limiting the RFS mandate to 9.7 percent or “just get rid of it entirely.” Most U.S. service stations offer only a blend of gasoline containing 10 percent ethanol.

Forecasting that fossil fuels will continue to dominate energy markets, API states that:

- “Although the share of non-fossil fuels is growing rapidly, fossil fuels – oil, natural gas and coal – will continue to play leading roles through 2040.”

- “Just 9 percent of the nation’s energy needs are supplied by renewables…”

- “Despite the rapid growth and because they are starting from such a small base, renewables are expected to supply just under 12 percent of the nation’s energy needs by 2040.”

- “Renewables are expected to grow rapidly between now and 2040, with EIA (the federal Energy Information Administration) forecasts showing biomass and other renewables increasing by 58 percent.”

- “Although ethanol and other biofuels are expected to grow rapidly in the future and steadily displace some oil use, EIA forecasts oil will continue to account for the largest share of our energy needs filling 33 percent of total energy demand and 88 percent of our transportation needs in 2040.”

#30

For more news, go to: www.Agri-Pulse.com