WASHINGTON, Nov. 1, 2017 - Coming soon to your home and business electricity bills could be significant price hikes designed to delay the “premature retirement” of coal and nuclear power plants. But will investments now provide greater and more secure electrical reliability in the future?

Those issues are at the heart of a debate triggered after Energy Secretary Rick Perry directed the Federal Energy Regulatory Commission (FERC) to issue a new pricing rule that would favor electricity-generating plants that can store a 90-day fuel supply on-site. As part of Perry’s Notice of Proposed Rulemaking (NOPR), DOE expects FERC to finalize the proposed new “grid resiliency” rule within 60 days.

Concerns about the DOE pricing directive mounted last week when FERC’s Trump-appointed chairman, Neil Chatterjee, told reporters that while he supports FERC’s traditional “fuel neutral” approach, FERC should take steps to ensure that “current market pressures don’t inadvertently prematurely retire plants that we need down the road.”

Responding to Perry’s call for urgency, Chatterjee added his assurance that FERC will act on Perry’s directive by Dec. 11.

Also feeling the urgency, four former FERC commissioners along with a DOE official and stakeholders representing the utility industry and environmental interests agreed in a Bipartisan Policy Center forum Tuesday that there is a national need to resolve grid reliability and resiliency issues. These issues moved to center stage recently due to record-breaking hurricanes disrupting energy deliveries, cyberattacks targeting grid security, and the grid’s accelerating shift from coal and nuclear to pipeline-dependent natural gas and intermittent renewable energy sources like wind and solar.

At the BPC forum, Sean Cunningham, the executive director of DOE’s Office of Energy Policy and Systems Analysis, said the good news is that Perry’s order “has revived conversation and focused the conversation on timely action.” He said DOE is “delighted by the level of interest that the proposal has received.”

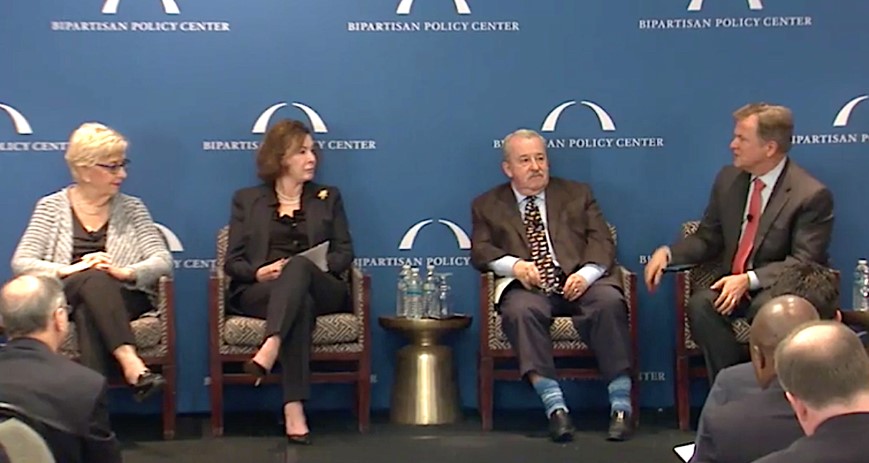

Former FERC Commissioners Betsy Moler, Nora Brownell, Jim Hoeckner, and Pat Wood

Former FERC Commissioners Betsy Moler, Nora Brownell, Jim Hoeckner, and Pat Wood

Defending the DOE proposal, Cunningham said it addresses “reliability and resilience of the grid, national security because it depends on grid resiliency, and pricing issues in the organized markets.” He charged that currently “the FERC-approved markets are not adequately valuing the resiliency attributes that are contributed by coal and nuclear generation.”

Other panelists, however, voiced opposing views, challenging Cunningham’s insistence that DOE has sound policy reasons to provide new support for coal and nuclear.

Representing oil and gas interests, American Petroleum Institute Executive VP and Chief Strategy Officer Martin Durbin pointed to “the grand success of the competitive markets” over the last 25 years. He noted that natural gas “now plays a huge role in power generation” not because of federal intervention but because market forces were allowed to work. He said it was the absence of market intervention that “ended up spurring the innovation and technology that brought us the shale revolution, that brought us natural gas abundance, brought us the opportunity to bring prices down.” He made no mention of federal subsidies that support many types of U.S. energy production.

Along with other panelists, Durbin called for a more deliberative approach based on detailed analysis rather than rushing into place a new pricing structure with potentially harmful consequences.

Former FERC chairman Pat Wood commented that when Perry proposed FERC intervention, this abrupt reversal of Perry’s past outspoken support for market competition seemed “like your best friend drove a truck through your house.”

John Moore, the Natural Resources Defense Council’s Sustainable FERC Project director, said the DOE proposal would “exacerbate climate change by continuing to prop up power plants that are one of the contributors to the extreme weather that ironically was one of the bases for the proposal itself.” He added that “the proposal would cost billions of dollars with virtually no benefit.”

Moore’s final point of irony is that while DOE is touting its proposal as a way to increase grid reliability, the proposal instead threatens reliability “by squeezing out more efficient, newer reliable sources” that include natural gas, wind and solar.

Pat Wood

Pat Wood

But DOE’s Cunningham wasn’t alone in supporting Perry’s proposal. Kathleen Barrón, the power-generating Exelon Corporation’s senior VP for Competitive Market Policy, called for further analysis to attach actual costs to items such as retiring working nuclear power plants prematurely. She called for studies to determine “what’s the replacement cost for losing this amount of carbon-free generation?” Labeling the costs “enormous,” she said “It’s cheaper to pay an existing nuclear station $11.50 a megawatt hour to stay on the system than it is to replace it with an offshore wind contract. It’s just simple math.”

But rather than rushing a controversial new rule into place, Barrón said the first step should be to “collect the data, to determine what we should be designing the market rules to achieve, and then we should work on what the market design should be.”

Several of the former FERC commissioners were sharply critical of Perry’s proposal.

Former FERC Chair Elizabeth Anne (Betsy) Moler reviewed the evolution of FERC regulation of the wholesale electricity markets since her tenure in the 1990s. She explained that at FERC, the commission worked hard to lower wholesale electricity rates and noted that in issuing new rules, “the final rules . . . were issued a year later, not in 60 days.”

Moler said that thanks to past actions, “Competitive wholesale markets are the law of the land” and that today “plants that cannot compete in these competitive markets are being retired.” She said there’s still room for improvement, “But moving forward, favoring specific generation sources is not the way to go. To me, the key to addressing reliability issues and resiliency concerns is finding a solution that works with and is compatible with competitive wholesale markets, not to favor one source of generation or one type over another. We need to build upon success, not abandon competitive markets.”

Another former FERC chairman, James Hoecker, said that for FERC to continue its 25-year “campaign to ensure that we have competitive wholesale markets . . . it’s going to have to take a longer look at this, it’s going to have to marshal evidence, and it’s going to have to engage in some analysis above and beyond what is represented in this NOPR.” He said this need for additional study means that “a final rule is not going to happen this year.” Instead, he suggests the next step could be “technical conferences” to study a wide range of options for improving the nation’s electric grid.

Similarly, former commissioner Wood concluded that Perry’s directive to FERC would take a major step backwards to uncompetitive practices “that have not worked in the past and proposing them for the future.”

But supporters of nuclear and coal are fighting back.

The Nuclear Energy Institute (NEI) recently submitted comments to FERC in response to DOE’s proposal. NEI Vice President Ellen Ginsberg said the proposed Grid Resiliency Pricing Rule is “designed to address two interrelated issues – the premature retirement of power plants that contribute substantially to the resiliency of the electric grid, and the failure of current market pricing rules to adequately value the resiliency attributes that these power plants provide.”

NEI reports that more than 11,000 megawatts of nuclear capacity are on the way out. In DOE’s August grid study, which is a basis for the proposed rule, DOE said there is a “critical gap” in market and regulatory conditions that is leading to premature retirements of nuclear plants. At present, it noted, nuclear plant closures are permanent, as there is no established regulatory process to reverse the decision.

“While there are many factors that contribute to these closures, a key factor for several premature retirements is the failure of regional transmission organization markets to value attributes of nuclear power,” Ginsberg said. “Continuing to ignore these issues will quickly lead to irreversible, long-run, detrimental impacts on both our nation’s resource portfolio and the electric grid that hundreds of millions of Americans rely on daily.”

American’s support for baseload power supplied by coal and nuclear seems to be strong. Fifty-one percent of Americans agree with the premise of the FERC proposal – and just 18 percent oppose it – according to new polling conducted by Morning Consult for the National Mining Association (NMA). Thirty one percent were unsure or did not answer.

“Completely missing from the debate over grid reliability has been the most important perspective of all: that of the American family,” said Hal Quinn, NMA president and CEO. “Americans expect the lights to come on when they flip a switch, not bear the risk of future blackouts or electricity rationing. Today’s poll shows that Americans believe the government should be doing more to ensure a reliable, resilient and affordable power grid.”

NMA points out that, in the past seven years, due to a combination of overregulation and market forces, 108,000 megawatts (MW) of coal-fired generating capacity has retired or has announced plans to retire – enough to power more than 65 million American homes.

Comments FERC has received on the proposal are available on the FERC website under Docket No. RM18-1.

#30