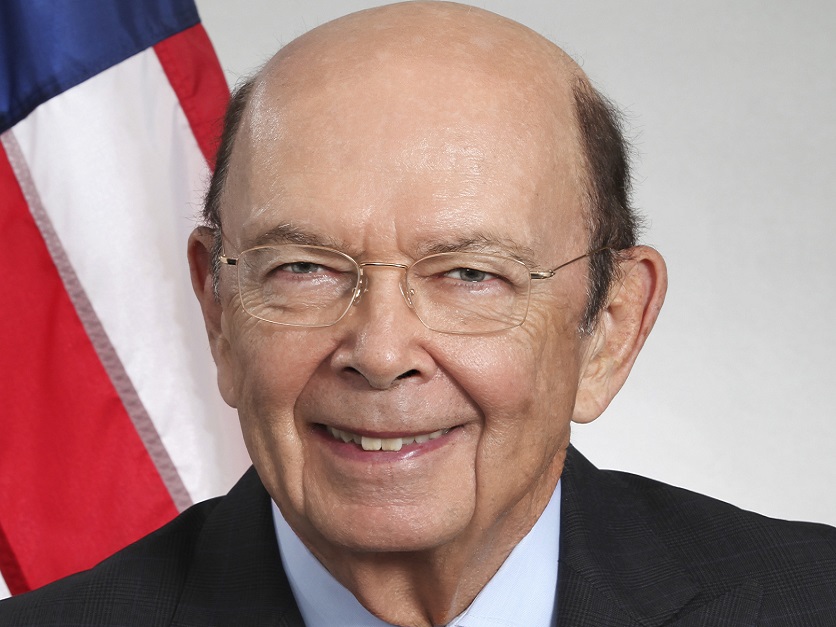

The Commerce Department has solidified its position that subsidies provided by Argentina and Indonesia for biodiesel exports to the U.S. are unfair. Commerce Secretary Wilbur Ross announced the final determination in the countervailing duty (CVD) investigation on Nov. 9.

“The unfair government subsidization of products is something the department takes very seriously,” said Ross. “While the United States is committed to free, fair and reciprocal trade with all countries, the Trump administration will stand up for American workers and companies being unfairly harmed.”

The decision means that importers of biodiesel from Argentina and Indonesia must pay cash deposits to U.S. Customs and Border Protection (CBP) based on the final rates. The department determined biodiesel subsidy rates had ranged from 71.45 to 72.28 percent for Argentina and 34.45 to 64.73 percent for Indonesia.

The case, brought by the National Biodiesel Board (NBB) Fair Trade Coalition, claimed that the two countries’ subsidies violated international trade rules and harmed the American biodiesel industry. Biodiesel imports from Argentina and Indonesia surged by 464 percent from 2014 to 2016, taking 18.3 percentage points of market share from U.S. manufacturers.

“The biodiesel industry has been injured for the past several years due to unfairly traded imports from Argentina and Indonesia. We appreciate that these unfair subsidies are being addressed, so we can fix this particular obstacle to continued growth in the domestic industry,” said Doug Whitehead, NBB’s chief operating officer. “Though not yet over, this is a step forward in ensuring the product that supports nearly 64,000 jobs is not undercut by unfair imports.”

NBB filed not only with the Commerce Department, but also with the International Trade Commission (ITC). The Commerce Department determines whether the imports are subsidized and/or dumped, while the ITC determines whether the domestic industry has been injured due to such unfairly traded imports. Commerce also determines the margin of duties to impose on imports based on the degree of dumping and subsidies found.

On Nov. 9, the ITC held a public hearing in Washington at which coalition members testified. The ITC is scheduled to hold its final injury vote on subsidies on Dec. 5. If that vote is affirmative, the Commerce Department will publish final countervailing duty orders on the question of subsidies.

The coalition filed both antidumping and CVD petitions with the Commerce Department. Antidumping petitions address concerns whether imports coming into the United States are priced below fair value. CVD petitions address subsidies provided by foreign governments benefiting imported product.

Antidumping investigations follow a different schedule than the subsidies question. Commerce is scheduled to issue final antidumping determinations in early January, which would be followed by another ITC injury vote as it relates to dumped imports.