Editor’s note: This is the second in our seven-part in-depth editorial series where we take a long look ahead at “Farm & Food 2040.” We’ll explore the trends shaping not only production agriculture but the supply chain, food companies, exporters, and more. Part two looks at how and why there may be changes to come when it comes to where food is produced.

“Adapt or die.”

That saying, made famous in the early 1970s by then-Agriculture Secretary Earl Butz as he encouraged farmers to look for ways to be more efficient and responsive to market signals, still rings true for many in agriculture today.

Butz, who grew up on a small Indiana farm and graduated from Purdue University during the depths of the Great Depression, understood that farmers would need to change to stay in business. He didn’t advocate for farmers to necessarily get larger but maintained they would need to adopt new business models to be more efficient. During his lifetime (he died in 2008 at the age of 98), Butz witnessed significant advancements in plant and animal breeding, mechanization, specialization, the advent of biofuels and the rise of organic agriculture, as well as increased urbanization and globalization – just to name a few trends.

Indeed, throughout the last century, U.S. farmers have adapted in response to market demands, new technologies, government decisions and the weather.

"Agriculture is getting incredibly more sophisticated," notes Barry Flinchbaugh, Kansas State Professor Emeritus. "You have no choice but to adapt and change with the times if you are going to survive." He also foresees "less and less commodity production" and "more crops grown with specific attributes desired by customers."

Consider just a few key changes in U.S.cropping patterns over the last 100 years:

Oats: One of the first major U.S. crops, oats initially were grown primarily as feed for horses and mules pulling farm equipment. Acreage peaked at 45.5 million and continued in the 35-40 million range until 1955, according to USDA’s National Agricultural Statistics Service. By 2018, growers planted less than 3 million acres.

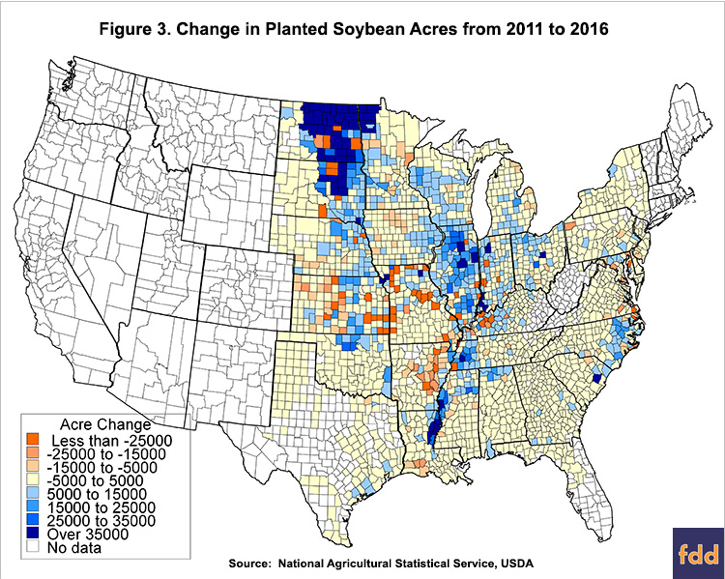

Soybeans: Soybeans were first planted in the U.S. in the early 1920s and reached 1 million acres by 1930. But as interest grew in the plant’s ability to fix nitrogen in the soil and market demand ramped up, growers again responded. Last year, farmers sowed over 89 million acres with the oilseed. At the  same time, new seed varieties have enabled production to move north. North Dakota growers planted almost 7 million acres in 2018, compared to only 44,000 acres in 1950.

same time, new seed varieties have enabled production to move north. North Dakota growers planted almost 7 million acres in 2018, compared to only 44,000 acres in 1950.

Grapes: Before Prohibition made alcohol illegal in 1920, Iowa was the nation’s sixth-largest wine producer. A movement toward the production of more row crops, the development of new herbicides in the mid-1900s, coupled with a severe blizzard in 1940 all knocked down the amount of grapes grown in Iowa, according to the Iowa Wine Growers Association. Now the industry is making a comeback, with about 100 commercial wineries across the state. Still, the majority of U.S. grapes are grown in California, Oregon and Washington.

California changing: Until the 1950s, Los Angeles County was the top agricultural producer in the U.S, with an estimated 10,000 farms raising cattle, wheat and a variety of other crops, according to an oral history of California Agriculture. As the county’s population grew, agriculture moved to other parts of the state. The growth of irrigated farming in the Central Valley and Imperial Valley, watered by the Colorado River, bumped California to first place among all states in value of agricultural products in the 1950s, a position it holds to this day.

Hemp: Used primarily for its fiber and seed oils, hemp was a prominent crop in the early years of the U.S. According to the February 1938 issue of Popular Mechanics magazine, hemp, which is related to marijuana, could be used in 25,000 different products and was on the verge of becoming “the billion-dollar crop.” However, lawmakers proposed prohibitive tax laws in 1937 and hemp production was banned later that year. Lawmakers reversed course in 1942 when they needed hemp for the war effort and released a documentary called Hemp for Victory, encouraging farmers to grow hemp to support the war. This led to over 400,000 acres of hemp being planted during 1942-1945. Last year, hemp production was legalized in all 50 states as part of the 2018 farm bill, and more U.S. growers are expected to enter the market. In 2018, global hemp retail sales reached $3.74 billion, with an annual growth rate of 15 percent, according to New Frontier Data.

These historical trends provide important perspectives on how growers have adapted in the past and will continue to adapt with new crop varieties and production methods as they make room for a new generation in 2040. As the amount of U.S. cropland continues to decline due to urbanization, there will be a focus on growing more on less acreage and doing so in a sustainable fashion.

New technological innovations, like precision breeding, artificial intelligence and robotics offer promise for solving labor and environmental challenges and, increasingly, meeting consumer demands. Public researchers, combined with private investors, seem eager to provide solutions. According to the latest AgFunder annual report, a total of $2.6 billion was invested in agrifood tech startups in 2017.

New technological innovations, like precision breeding, artificial intelligence and robotics offer promise for solving labor and environmental challenges and, increasingly, meeting consumer demands. Public researchers, combined with private investors, seem eager to provide solutions. According to the latest AgFunder annual report, a total of $2.6 billion was invested in agrifood tech startups in 2017.

The need for new research and innovation is a message the current Secretary of Agriculture has also embraced as he looks ahead to the future.

“As a former farmer, agribusinessman, veterinarian, state legislator, and governor – I have always appreciated the value of ag research. Research is an essential tool that allows America’s agriculture and agribusiness sector to create jobs, to produce and sell the foods and fiber that feed and clothe the world, and to reap the earned reward of their labor,” noted Secretary Sonny Perdue.

Of course, making changes in agriculture – whether it’s a move to new types of crops, a transition to organic farming or new alternatives like urban farming – isn’t usually cheap or easy.

But, if Agri-Pulse interviews with six trailblazing farmers in Illinois, Iowa, Kansas, Montana, North Dakota and Washington are any indications, we can expect larger-scale conventional farming by 2040 along with more diversification into new geographic areas along with organic production and more nonconventional approaches like soil-less urban farming.

The six farmers – Allen Williams, Bruce Rastetter, Tim Raile, Doug Crabtree, Gregg Halverson and Dan Albert – all have prepared well in their respective ways, so that their operations can prosper in 2040 and beyond.

The six farmers – Allen Williams, Bruce Rastetter, Tim Raile, Doug Crabtree, Gregg Halverson and Dan Albert – all have prepared well in their respective ways, so that their operations can prosper in 2040 and beyond.

The conventional farmers, who are focusing on economies of scale, market-driven diversification, and incorporating the latest technology, expect to significantly expand their production, efficiency, yields and profitability by 2040.

The urban growers expect their high-tech rooftop, warehouse, basement, high-rise tower, or soil-less shipping-container farms to profit from rapidly increasing demand for fresh produce often grown within a few city blocks from the end-consumer sitting at home or in a restaurant.

The organic producers expect that their production methods will be key to reducing inputs, limiting market volatility, improving environmental performance and sustainability, and increasing their net profit. They also expect that over the next 20 years, a growing number of farmers will make the shift from lower-margin, chemical-intensive conventional production to organic and other innovative practices.

The six farmers, along with the other stakeholders we interviewed about what’s ahead for agriculture in 2040, converged on a single point – they say the best way to cope with a soaring global population and an increasing demand for better diets and more meat is through diversification.

“Traditional producers need to be merchants who keenly analyze customer demand and develop markets and logistics to satisfy what the customer wants – not what we think they need because we have a huge pile of product to sell,” says Clarkson Grain Company President and COO Ken Dallmier. The 2040 winners, he predicts, will be producers with “a diverse operation encompassing conventional production methods and organic or specialty products to capture market value margin.”

For Dallmier, “Going all-in to organics may be just as bad a business plan as remaining stagnant in the current market. Diversity in response to demand pull will be key to thriving in a 2040 economy.”

So, expect large conventional farming operations to get larger and more productive thanks to breakthroughs in precision ag, robotics, and data-driven decision-making. But also expect organic production and other alternative practices to continue to grow significantly in response to consumer insistence on knowing what’s in their food, how it was raised, and which specific farm, ranch or indoor artificially-lighted repurposed downtown warehouse it comes from. At the same time, smaller niche operations selling directly to consumers will continue to thrive.

Allen Williams – Straddling the production fence

Allen Williams certainly diversifies. He divides his 2,000-acre operation between organic farming on the 500 acres that he owns and conventional farming on 1,500 acres of leased land to respect landowners’ preferences.

The Illinois farmer says his long-time commitment to organic is based on “sound historical growth for organic demand” and because “data suggests the demand for organic is among all economic levels.” He notes that organic production has been around since agriculture began but now is better than ever because “organic can utilize most modern techniques in agriculture . . . other than GM (genetically modified) technology and the use of unapproved pesticides and plant foods.”

Illinois corn, soybean and organic grains farmer Allen Williams

After considering other options, Williams says he transitioned one of his farms to organic in 1994 because, “Organic production was generating much more margin than conventional agriculture. I had barely survived the 1980s and was looking for a sound production technique to avoid any future economic downturn.”

The result, he says, is that “organic not only rewarded me with larger net returns but also reduced my footprint towards agricultural pollution and seemed to keep the funds spent closer to my home base than my conventional production system.” He expects more conventional producers to shift toward organics “with hope of increased profits” and with new organic provisions in the 2018 farm bill.

But Williams is no zealot. He says “there should be no animosity between these different groups. From my standpoint, there is no need to claim superiority between methods, and all involved just want the best for their family and farm.”

For 2040, Williams expects to see “huge commercial agriculture because of the economies of scale” along with the continuing growth of organic production. “I don’t see any reason they can’t both survive together,” he says. “They’re just meeting different goals.” He adds that because organic and conventional largely use the same technologies, both are integrating the latest methods “to control pests and problems without expensive commercial inputs.”

Doug and Anna Crabtree – Putting CRP back into production

Montana farmer Doug Crabtree is especially committed to helping other growers transition to organic because he witnessed his parents lose their family farm in Ohio during the 1980s. He’s determined to build a stable base of profitability for the dryland organic operation – Vilicus Farms – he and his wife Anna launched in 2009, taking the name from the ancient Roman word for farm manager.

Crabtree plans to expand his 7,400 acres in organic production to 9,000 acres this spring as more area landowners let their Conservation Reserve Program contracts expire at a time of less attractive CRP payments. “The majority of what we farm was once enrolled in CRP,” he says. As the program became less attractive, he says, it has allowed the couple “expand our stewardship whenever we can.”

Doug and Anna Crabtree (Photo: Vilicus Farms)

He’s also pleased that the 2018 farm bill’s new “Urban, Indoor, and Other Emerging Agriculture Production” provisions will enable innovative enterprises to put neglected urban resources to work and seize market opportunities in the same way that Vilicus Farms is making former CRP land more productive in environmentally beneficial ways.

Those opportunities spring from the same surge in consumer demand for organic products, whether it’s grain from the Midwest or city-based local produce grown without chemicals. “I think agriculture needs to diversify itself,” Crabtree says, “whether that be more crops on a given farm or more production systems or more locations that can produce food” such as urban vertical farms.

Crabtree predicts that by 2040 “we are going to continue to have large-scale commodity production of corn, soybeans, wheat, cotton – the traditional products – and of the traditional livestock . . . The farms that are now 20,000 acres in our neighborhood are probably going to be 50,000 or 100,000 acres and there are going to be fewer of them.”

But Crabtree adds that simultaneously, “we will continue to see an increasingly differentiated type of production that is first and foremost diverse – farms like ours that grow a dozen or more crops, that respond to market demand . . . where people are able to take underutilized resources, meet local demand, and make a living for themselves.”

Gregg Halverson – Optimizing economies of scale

North Dakota’s Gregg Halverson and his three actively engaged children still farm the 10-acre potato field that Gregg’s grandfather started with in 1928. They’re now farming some 25,000 acres, mostly in potatoes, stretching from their home farm near Forest River, N.D., down to Texas and Florida.

Halverson, having passed the CEO baton to his son Eric while John and Leah respectively head up operations and marketing, tells us he expects fourth-generation, family-owned Black Gold Farms, based in Grand Forks, N.D., to continue its steady growth over the decades ahead.

With Frito-Lay as Black Gold’s top customer and diversification as a key risk-reduction strategy, Black Gold delivers chip, seed and table-stock potatoes from its farming and packing operations in 11 states.

Black Gold Farms CEO Eric Halverson (left) and Board Chair Gregg Halverson (right)

Along with geographical diversification to manage risk so that “we can be wiped out in one area and be OK in another,” Halverson says Black Gold also keeps expanding its customer base, its branding, and introducing new products like individually wrapped sweet potatoes for microwaving.

By growing potatoes in 11 states, Black Gold supplies local supermarkets with the 5-pound bags of fresh, locally grown red potatoes that consumers prefer. Committed to growing food “close to where it needs to be,” Halverson predicts that “large scale conventional farming will continue to be a very powerful force in agriculture.” Stressing the importance of constantly improving efficiency, he says that “in many cases, scale equals efficiency” and that he expects consolidation to continue in pretty much all phases of farming.

“I think that’s been going on for years and will continue,” he says.

By 2040, he says, Black Gold “may not be that many more acres, but I’m certain that in order to be efficient, there’s going to be more production per acre.” He concludes that “being efficient will be what separates the really successful producers from the also-rans.”

Black Gold Farms has production in 11 states.

As part of his drive for greater efficiency, Halverson says Black Gold is “integrating the new technologies,” but, with farming’s tight margins, “we really have to look hard at these new technologies to make certain that there is a positive ROI (return on investment).” He already is using new technology like data acquisition on his tractors and predicts that “there will be more electronics and robotics, more sensor-driven technology, as a result of the high cost of labor.”

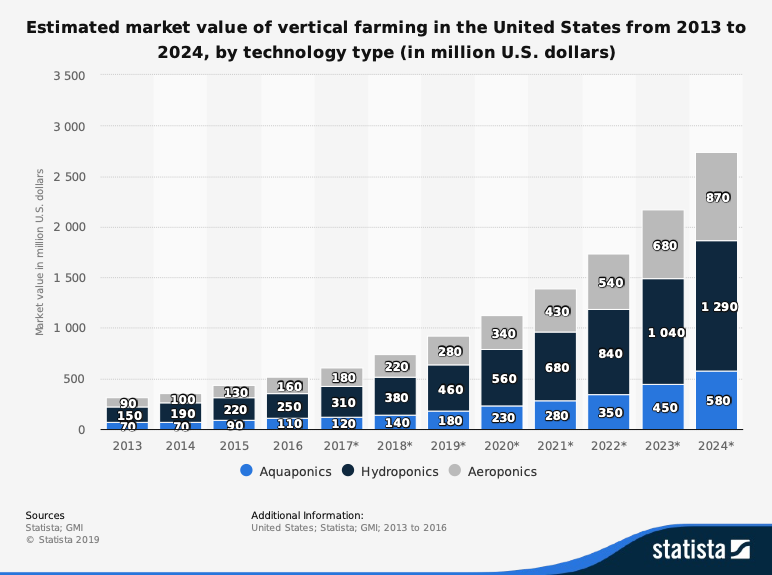

Halverson also expects to see more diversification of the entire ag sector, to include increasing roles for “growing crops on the rooftops of some supermarkets,” urban vertical farming, hydroponics, and high-tech greenhouse ag for “certain very high-value crops” like leafy greens, herbs, tomatoes, and berries. “But to me,” he says, “it’s quite limited as to how many people those farms are really going to feed, so I think you’re always going to need traditional agriculture.”

Tim Raile – Having tried it all, going all organic

“We raised our last non-organic crop this last year,” says dryland wheat farmer Tim Raile. His 8,000-acre operation in western Kansas and eastern Colorado has a third of the acres certified organic with the rest in three-year transition, on track for certification by 2020.

A major blow came this year when Raile’s entire certified organic crop was destroyed by hail. “All we had this year was transitional crops to sell, so it was a tough year.” Fortunately, federal crop insurance softened the blow. Other offsets to the high costs of transitioning came from Clarkson Grain, which provided expert advice on making the transition, and from a contract with Kashi, a Kellogg subsidiary, that provided “premiums on some transitional wheat acres” thanks to guidance from Healthy Food Ingredients.

Raile says he is switching his whole farm to organic because previously “we were in a wheat/corn/sunflower very intensive rotation, with chemicals, herbicides, pesticides. We did that for about 15 years. But we could see that it just wasn’t sustainable. It worked really well for the first 10 years, but then the last five, we could see that the weeds were just evolving as quick as our farm was to be resistant to weeds. It just made it where our expenses were getting out of hand trying to control the weeds and it still wasn’t working so we had to look into something different.”

Wheat farmer Tim Raile, right, with his son and grandsons

Raile says he’s among the first in his area to go organic but that “I’m seeing more and more interest and more and more large farms switching to organic.” He’s points to the “many hurdles to go into organic” – such as having to increase his bin storage from about 100,000 bushels up to 250,000. Also, he says, “You don’t get paid near as quickly… Where in conventional ag, you can deliver to the local elevator and get a check the same day . . . In the organic world, it seems to be spread out over time, so there is a lot more management that’s involved in the organic world.”

Beside organics’ extra record-keeping requirements, Raile says, “from the standpoint of growing crops, that wasn’t a difficult transition at all.” That’s because after his 38 years in farming, he’s returning to the low-input, high-management practices he used in his early years. He acknowledges, however, that for newcomers or for conventional farmers who’ve always depended on glyphosate and other chemical quick fixes from local input suppliers, they may have a steeper learning curve.

Like Illinois farmer Allen Williams, Raile is confident organics will continue to thrive in 2040 but that “organic and conventional can all work together.” He adds that organics’ growth will benefit conventional producers.

“Right now, I can drive to two or three elevators within 20 miles of here and there’s piles and piles of wheat under tarps. I’m no longer putting wheat into that system. I’m delivering into a different pipeline. Where we’re importing almost 70 percent of our organic grains into this country to supply the organic market, it shows you there’s really a demand for organic. In conventional ag, I think it’s just the opposite. They export 70 percent and only 30 percent is used in this country.” He’s convinced organics will help the conventional market by reducing oversupply going into the conventional pipeline.

Bruce Rastetter – Investing in the Midwest and Brazil

Bruce Rastetter is aggressively investing both in the Midwest and in Brazil as well.

As CEO of Summit Agricultural Group based in Alden, Iowa, Rastetter sees the Midwest’s solid track record of steadily increasing yields and Brazil’s opportunities for double cropping and triple cropping as a joint guarantee that these two powerhouses of world agricultural production will be able to meet surging global demand that he expects to double by 2040.

As a firm believer in diversification, Rastetter has established Summit as a leader in grain, beef and pork production, renewable energy and international agribusiness development. His Midwest operations include a base of Summit Farm’s 14,000 acres in row crops, 350,000 head of contract hogs, and “the capacity to feed about 10,000 head of cattle.”

Seeing U.S. and Brazilian ag production as complementary rather than in competition, Summit also has 20,000 acres on its two farms in Brazil, with 10,000 acres of cropland rented out and the other 10,000 under native forest. As well, Summit is more than doubling capacity to 140 million gallons at its first corn-ethanol plant in Brazil. It also broke ground on its second 140 million-gallon plant in the South American country last fall, and will launch a third plant this summer.

Bruce Rastetter, Summit Agricultural Group

Rastetter also sees “a place for more organic production” and other specialty crop operations to cater to people “in the urban areas on the coasts” who “want more all-natural, all-organic” and “want to know where their food was produced, how it was produced, and how (a food animal) was cared for.”

At the same time, Rastetter says he believes that large-scale modern production using GMOs is sustainable.

“If you are going to be in large-scale production, you have to be a low-cost producer” and “you’ll have to be a good marketer.” Low-cost, he adds, “means you’re utilizing the best technology, proven technology, you’re having maximum yields, and you’re an innovator at pushing forward with proven genetics and modern production technology.”

Rastetter says he’s “made a small investment” in developing driverless tractors, although he’s always concerned about maintaining profitability. He says he’s sticking with “proven technology” in Summit’s own operations because “there just isn’t the profitability to try things, to be a test farm” and because it’s hard to figure out “what technology that we can put to work that actually delivers lower cost or greater production.”

Rastetter also concludes that to succeed in 2040 and beyond, large-scale producers will need to “be involved in protein production in one form or another, to help diversify the operation.”

Dan Albert – Returning to his ag roots

After growing up in an upstate New York farming community, Dan Albert had no intention of pursuing a career in agriculture. He earned a graduate degree in Landscape Architecture and became interested in the field of sustainable design. Shortly after graduating, he worked on a project called the Eco-Laboratory which “brought me back to my ag-roots,” Albert says.

In 2011, he and his wife, Lindsay Sidlauskas, started Farmbox Greens - a small farm in a converted office space which was about 200 square feet. When they bought a house in 2014, they moved the business into the garage with about 400 square feet of growing room. Equipped with LED lights, vertically stacked trays and a hydroponic growing system, they started growing arugula, radishes and other microgreens

“It was super tiny-scale but we were able to build our customer base, process and reinvest in the business to the point where we had a fairly substantial operation at our house. We were serving about 60 customers including restaurants, farmers market and retailers in the Seattle area,” Albert says.

Farmbox Greens General Manager Dan Albert with his wife Lindsay Sidlauskas

“We are super local in that we grow our greens and deliver them to you within hours,” Albert explained in a video. “That means longer shelf life. They are fresh and more flavorful. We can do this because we are in a controlled environment system. That means we provide the perfect nutrition for the plants, we provide the right lighting and we are pesticide and herbicide free.”

Albert initially began growing with an aeroponic production system but transitioned to a self-designed vertical farm with LED lighting and recirculating nutrient film technique (NFT) irrigation.

“We are working on becoming the most sustainable farm we can be by minimizing our carbon footprint, reusing and recycling our nutrients, not having waste products and trying to minimize our overall footprint on the environment as a farm,” Albert adds.

Unlike many vertical farm startups, Albert started small and learned the ropes along the way. But as his company grew, retailers took notice. In 2016, he was approached by Charlie’s Produce, one of the largest independent produce distributors on the west coast with distribution centers in Seattle, Spokane, Portland, Anchorage, Los Angeles, and Boise.

Alberts says he basically faced two future paths: “Be a “farmer” and focus on growing products and developing technology and the process to produce it. Or focus on sales, marketing, and a distribution network (in addition to the “farming”) to move the products we were growing.” He decided to focus on the Farmbox road and let Charlie’s focus on produce sales and logistics.

“I started this business with the idea that we are here to ‘Scale to make a difference.’ We chose to scale by acquisition and doing so with the help of Charlie’s made it faster that I could have done it on my own.”

Albert is still in charge of Farmbox, but as part of the move, Farmbox was housed in a much bigger and better facility on the Charlie’s Produce campus.

“Everything from the lights, to the growing system, to the water treatment system has been improved. Perhaps the biggest improvement was to our food safety plan. When I was on my own, I just didn’t have the scale or resources to implement rigorous GAP (Good Agriculture Practices) and GMP (Good Manufacturing Practices) plans.”

Now he’s able to serve thousands of customers instead of the 50-100 customers he could fulfill from inside the garage.

When asked about his top advice for others interested in urban, vertical farming, he admitted that it was tough to boil it down to a sentence or two.

“There’s a lot of optimism with the ability for technology to solve the challenges of agriculture. In reality, it’s still farming and the most important thing to remember is that you need to sell the product at a price for more than it cost you to make it,” Albert advises. “At any scale in agriculture, you must have a strong process and be mindful of how big the market is and set realistic goals and make realistic assumptions about how you can build a business in the overall produce market.

Just because it's vertically farmed doesn’t mean all the other vendors aren’t in the market competing. So, all the marketing hype around vertical farms isn’t going to make the market, grow the product, or sell the produce. There have already been many failures in this emerging industry and its frustrating to watch these companies miss the boat when it comes to the core business, which is still farming.”

The Promise and Pitfalls of Urban Farming

The promise of soil-less indoor Controlled Environment Agriculture has attracted young people enthused about both high-tech and agriculture to venture into CEA. One ag design, production, and marketing consultant with broad experience in advising entrepreneurs, investors, cities like Atlanta, and even countries like Qatar and Saudi Arabia about CEA is Henry Gordon-Smith, the founder and managing director of Agritecture Consulting.

Agritecture Consulting Managing Director Henry Gordon-Smith

Gordon-Smith is encouraged by his fellow millennials’ interest in agriculture, hoping it will solve the problem of the aging U.S. farmer, with an average age of over 58, too near retirement age for a vibrant industry. But he cautions eager beginners that despite the increasing importance of high-tech precision ag, automation, and data-driven decision-making to agriculture, these new tools “won’t allow a non-farmer to run a farm independent of a true farmer, and I don’t think we’ll be there by 2040.”

Gordon-Smith also warns that despite vertical farming’s success in attracting investment as a rapid growth, high-tech play, vertical farming still faces steep cost hurdles that have caused some major ventures to fail. “Vertical farming is not the solution,” he says. “It is part of a toolbox of solutions” that must be sorted through carefully to pick the combination that’s the right fit for each specific farm venture and each specific market.”

Picking the best new practices is tough, Gordon Smith says, and requires expert coaching. So, he hopes USDA will offer increasing support for beginning farmers including urban farmers. He also predicts that “every farm in 2040 will need a clear automation plan.” With labor costs and availability already major concerns for U.S. agriculture as a whole, he’s advising his clients to “invest in automation now” and finalize plans for where they need to be with automation within the next five and 10 years.

Gordon-Smith adds that the new technology already in place in high-cost urban vertical farms and in high-return marijuana operations has begun to “trickle down to more traditional farmers,” benefiting the ag sector as a whole. That’s great news, he says, because “obviously you can’t grow everything with urban agriculture.”

Gordon-Smith sees “urban agriculture as a gateway to the agricultural system” and says one reason USDA should encourage urban agriculture “is that it can create a new pathway for young farmers to get into traditional agriculture.” He points out that even a small urban farm is an important training ground, teaching basics like food safety, maximizing production, marketing to the customer, and managing waste in innovative ways.

So, he says, urban ag today may create a new generation of ag sector winners by 2040.

For more news go to: www.Agri-Pulse.com