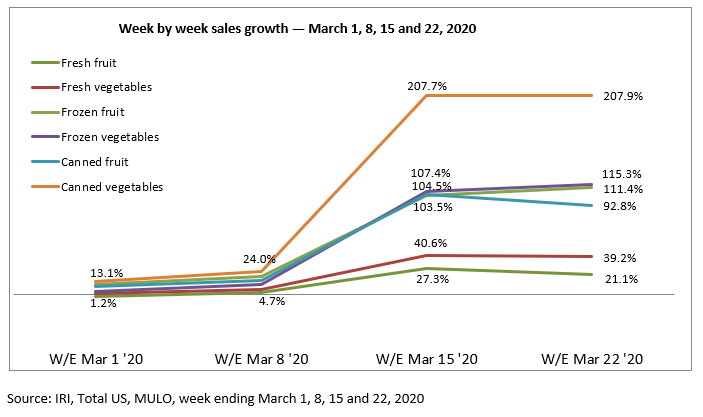

During the first week of March, the produce industry watched sales stay pretty much in line with prior year – even as shoppers started to stock up on non-edible items like toilet paper in the wake of the growing COVID-19 pandemic. But by the second week, fresh produce purchases started to increase slightly, followed by a 33.9% increase the week ending March 15, noted Anne-Marie Roerink, President, 210 Analytics.

Her firm, along with IRI and the Produce Marketing Association (PMA), partnered up to understand how produce sales would be impacted by more people working from home, cooking more often and staying away from all but take-out restaurants. In general, Roerink found that fresh, frozen and canned produce continued to move at unprecedented volumes, making it difficult for some suppliers, distributors and grocers to catch up.

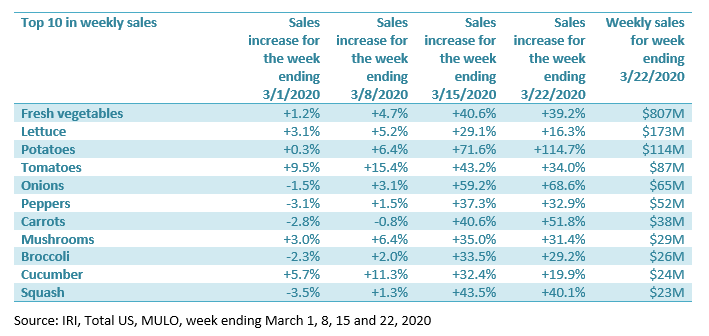

For the week ending March 22, IRI showed vegetables up 39.2% —adding $227 million versus the comparable week in 2019. Fruits gained 21.1% over the week of March 22, which translated into an additional $116 million.

For the week ending March 22, IRI showed vegetables up 39.2% —adding $227 million versus the comparable week in 2019. Fruits gained 21.1% over the week of March 22, which translated into an additional $116 million.

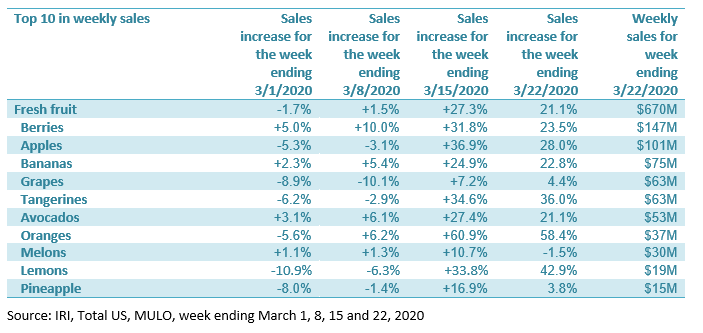

Sales increases extended across fresh produce items. In absolute dollars, the biggest fresh produce winners for the week of March 22 were once more potatoes that gained $61 million, or +114.7% over the comparable week in 2019, according to IRI data.

Berries were second, with a gain of $28 million, or 23.5%. Onions closed out the top three, with gains of $27 million, up 68.6%. Others that gained big were lettuce, apples, tomatoes, tangerines, bananas, oranges and carrots. Several retailers remarked that items with longer shelf life as well as packaged items moved faster, perhaps due to consumer safety perceptions.

Fresh fruit sales saw a slightly bigger uptick during the week of March 22 than the week prior — no doubt to address the many more at-home consumption occasions, from more -home breakfasts, lunches and dinners to snacking and smoothies, Roerink noted. On the fruit side, berries generated 22% of fruit sales, yet grew 23.5%. Similarly, apples generated more than 15% of all fruit sales and grew 28%.

Fresh vegetables

On the fresh vegetable side, shoppers are stocking up on items with longer shelf life, in particular, Roerink said. Beyond potatoes, other impressive growth categories were onions, carrots and squash.

Consumers were buying fresh produce at a rapid rate, but also seemed to be in stock up mode, Roerink points out. Canned vegetables saw the highest percentage gains, at 207.9%, followed by frozen vegetables and frozen fruit.

Consumers continued to split their produce dollar three ways during the week of March 22. Fresh produce generates the bulk of total produce sales during regular times and it still does today,” said Jonna Parker, Team Lead, Fresh for IRI.

However, she said “consumers remained in a stock-up mindset the week of March 22 and that drove high interest in frozen and shelf-stable fruit and vegetables. The share of total cross-store produce sales for shelf-stable, for instance, is up from 10% during 2019 to 19% during the week ending March 22, 2020.”

In part, these spikes can be attributed to the combination of panic buying and freezer stocking. “We are finding that among consumers who stocking up, the top goal is having a two-week supply,” said Parker.

With many restaurants closed around the country, IRI found that for the week of March 22, 56% of consumers ate more meals at home versus at/from a restaurant.

Parker said it’s important to remember that universities and schools are closed, which means many students moved back home. In Florida, for instance, 350,000 students live on campus. Consider their added three meals per day plus snacks at home — that is one million more meals consumed at home per day, for Florida students alone.

Next, consider the people working from home and all the elementary and high school students being at home. That means many more breakfast, snack and lunch occasions that moved to at-home.

“We found that among households with kids, 69% have kids staying home from school or daycares versus 38% the week prior and 47% are doing fewer activities and sports,” said Parker.

In addition, Parker said consumers are looking to boost their nutritional intake and build their immune systems. “From their buying patterns, it certainly appears produce matters during times of crisis. These are all drivers of increased everyday demand of the grocery channel versus foodservice.”

For more news, go to: www.Agri-Pulse.com