One by one, oil refiners hoping to ride the wave of demand for renewable diesel created by California’s low carbon fuel standard have announced ambitious plans for their own plants. But, the surge will likely come at a cost to biodiesel producers, who often rely on the same soy-based feedstocks to create their product in much smaller plants.

Renewable diesel, a hydrocarbon, is chemically identical to petroleum and can be dropped into diesel engines without needing to be distilled or mixed. It's become popular in California, thanks to its ability to qualify for three different incentives: Renewable Identification Number (RIN) credits through the federal Renewable Fuel Standard Program, credits through California's Low Carbon Fuel Standards program and tax credits through the federal Biodiesel Tax Credit Program (BTC).

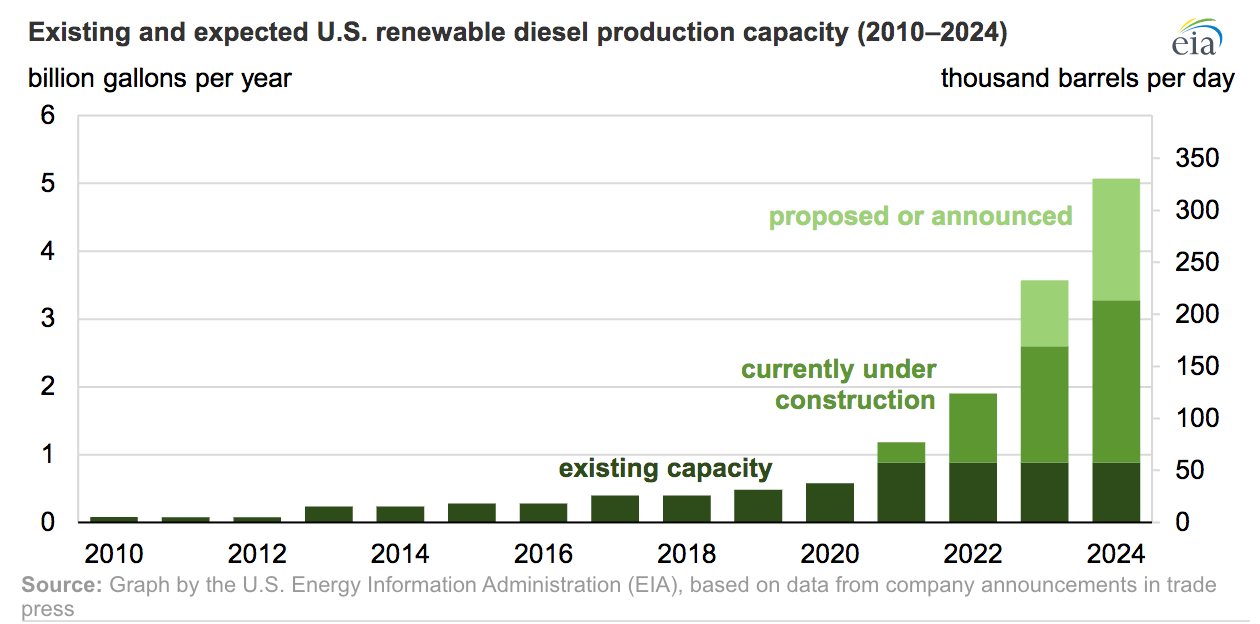

According to the U.S. Energy Information Administration (EIA), the United States had the capacity in 2020 to produce about 600 million gallons of renewable diesel per year. But a slate of upcoming projects from major refiners like Chevron, Love’s, Marathon and Phillips 66 could bring that total up to a capacity of 5.1 billion gallons per year.

“We're in the midst of a true boom in renewable diesel production, whose full dimensions are still to be determined,” said Scott Irwin, an economist at the University of Illinois who has been tracking the biofuel industry. “Renewable diesel is clearly eating into the market share of traditional FAME (Fatty Acid Methyl Esters) biodiesel, but so far FAME is hanging in there better than I expected.”

Because biodiesel, unlike renewable diesel, is a fatty acid methyl ester, it typically is blended with petroleum-based diesel. According to the U.S. Department of Energy, pure biodiesel (B100) can be used in some biodiesel-compatible engines, but is sensitive to cold weather and more often is used as a blendstock to produce lower blends.

Usually, it is blended at rates between 2% and 20% of diesel fuel by volume, according to the EIA.

Both biodiesel and renewable diesel are often made using soybean oil, which is currently selling for high prices. Soybean oil was priced at $0.62 per pound on Oct. 26. At the same time last year, it cost $0.34 per pound.

Irwin said he’s seen it reach as high as $0.70 per pound; so far he’s been shocked that biodiesel plants have been able to stay open with prices as high as they are.

Chart by U.S. Energy Information Administration

Chart by U.S. Energy Information Administration

“My models suggest that the financial losses for FAME biodiesel at these feedstock prices should be pretty much putting them out of business and they're not going out of business yet,” Irwin said.

Scott Gerlt, the economist for the American Soybean Association, told Agri-Pulse both types of fuels can get similar credits under the U.S. and California’s Renewable Fuel Standard programs, but renewable diesel tends to sell at higher prices, at least in California.

“The credits they can get are close to the same, but at the end of the day, the renewable diesel sells for a higher price in that California market, which gives it an advantage whenever competing on the marketplace for soybean oil,” he said.

According to Gerlt’s calculations, the average size of a biodiesel plant — based on both the facilities currently operating and the plans that have been announced — is 224 million gallons per year, almost 10 times the size of the average biodiesel plant, which can process 29 million gallons per year.

The closure of one Houston plant operated by Renewable Energy Group was announced by the company last month. Additionally, Darling Ingredients Inc. sent out a press release in March stating its intent to close two of its plants, one in Montreal, Quebec, Canada, and the other in Butler, Kentucky,

“We made the decision to shut down operations of our two biodiesel plants due to unfavorable biodiesel industry economics and there are no current plans to resume biodiesel production at these facilities in the future,” Randall Stuewe, the chairman and CEO of Darling Ingredients, said in the release. “The closure of the facilities will create additional feedstock for growth of renewable diesel in our DGD Joint Venture.”

However, some biodiesel plants with capabilities to use non-soy feedstock sources are finding ways to weather the period of high prices.

Interested in more news on farm programs, trade and rural issues? Sign up for a four-week free trial to Agri-Pulse. You’ll receive our content — absolutely free — during the trial period.

Western Iowa Energy is located in Wall Lake, Iowa, and can produce 45 million gallons of biodiesel every year. The facility is set up to use a variety of other feedstock sources: camelina, corn oil, vegetable oil, pork fat, poultry fat and beef tallow. Bill Horan, chairman of the company’s board of directors, said no matter where it comes from, a fat molecule is a fat molecule.

Paul Winters“There is competition and there may be more competition,” he said. “That's why it's important to have a multi-feedstock plant, so you can switch back and forth and keep your cost of inputs low.”

Paul Winters“There is competition and there may be more competition,” he said. “That's why it's important to have a multi-feedstock plant, so you can switch back and forth and keep your cost of inputs low.”

The effects of the increasing competition, along with trade disruptions and COVID-19, have not been uniform across the industry. Because biodiesel producers can use different feedstocks, some have been more heavily impacted than others, said Paul Winters, the director of public affairs and federal communications for the National Biodiesel Board, which will soon be rebranding to Clean Fuels Alliance of America.

“It's a very complicated picture,” Winters said. “Producers who specialize in certain feedstocks are going to feel it differently from other producers that are integrated and have their own supplies of either cooking oil or soybean oil.”

Winters also noted that some of the renewable diesel production facilities have not built out the capacity to refine and degum soybean oil, and, as a result, impact a different segment of the market. These processors, he said, look for refined, bleached and degummed oil.

According to both Irwin and Gerlt, it’s unlikely that all of the planned renewable diesel projects will get built. But, even if half of the projects are completed, Irwin said it’s still an enormous increase in renewable diesel production that could come at a cost to some biodiesel producers.

“It's hard for me to see much of a significant place in the renewable energy space for FAME biodiesel in the future,” Irwin said. “It will be much diminished, whatever it is.”

For more news, go to www.Agri-Pulse.com.