In this installment:

- Biofuel boom sparks rush for cover crop options

- Carbon payoff hinges on fledgling markets

- Easy money: Farmers find quick benefits from grazing

This is the third part of a four-part series examining the promise of cover crops, the potential for them to meet the nation’s environmental goals that rest on their success, and the possible pitfalls facing policymakers. Previous installments on the management and promotion of cover crops as well as the underlying economics of the practice can be viewed on Agri-Pulse.com.

For all their environmental and agronomic benefits, the cost of growing cover crops is one barrier that stops many farmers from even trying them.

Enter entrepreneurs like Mike DeCamp, CEO of CoverCress Inc., a company that developed a variety of pennycress, a weed in other parts of the world, that could double as a cover crop and a feedstock for the trucking and airline industries’ growing appetite for low-carbon biofuels.

“You get all the best soil health and other ecosystem benefits of a cover crop planting CoverCress. In addition, you get this economic opportunity to be able to harvest and get paid for the production,” DeCamp told Agri-Pulse.

CoverCress has the financial backing of two agribusiness giants, Bayer and Bunge, as the industry searches for new ways to incentivize farmers to grow cover crops.

Whether cover crops can pay off as biofuel feedstocks remains to be seen. But many advocates of the practice say getting widespread, long-term adoption will require proving that farmers can make money from planting cover crops long after any government incentives run out.

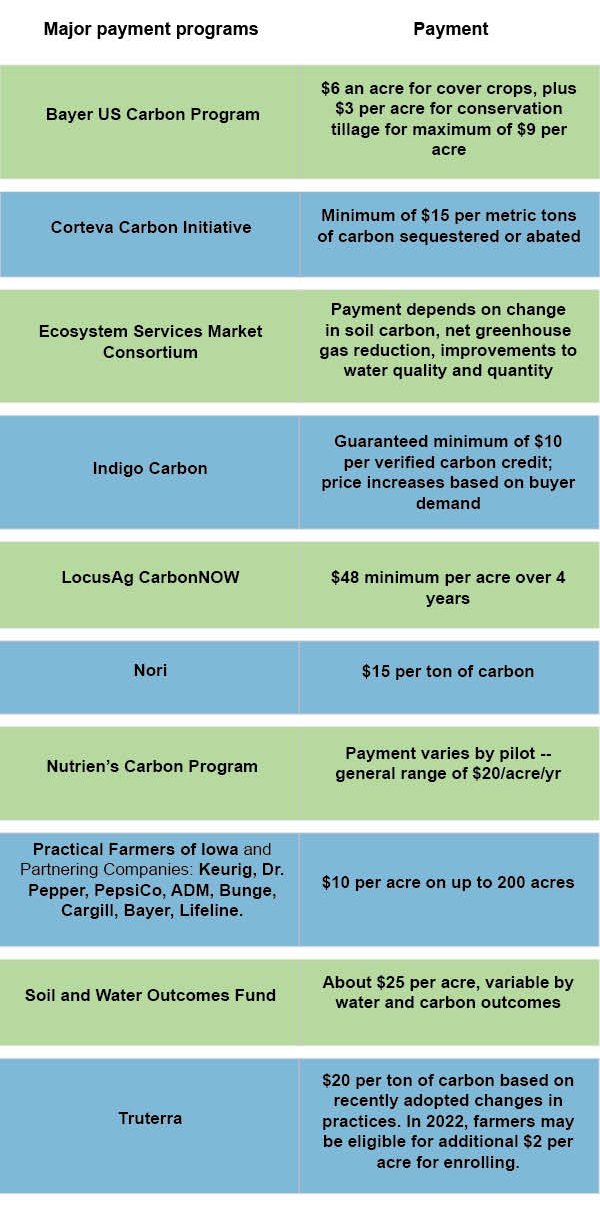

Some farmers already are generating revenue, a few by grazing the cover crops or cutting them for hay. Others are participating in the emerging carbon markets and ecosystem payment programs that pay anywhere from $6 to $30 an acre, but are still very much in the experimental stage.

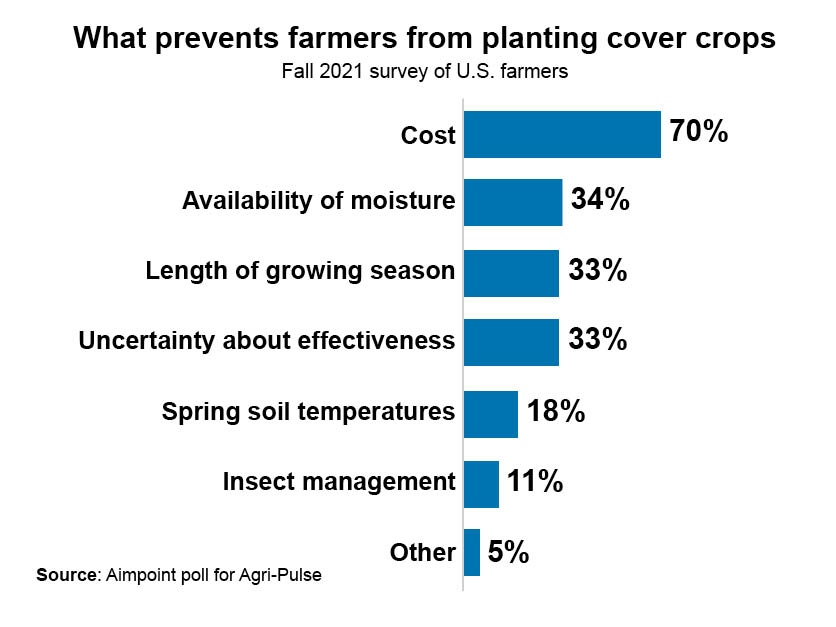

According to an Agri-Pulse poll conducted this fall by Aimpoint, large majorities agreed that cover crops can improve soil health and prevent soil erosion, but 70% of farmers said cost was the biggest reason they wouldn’t plant cover crops. The next most important impediment, cited by 34%, was the availability of moisture and for 33% of farmers, the length of the growing season and uncertainty about effectiveness.

"In dryland agriculture, since we're only 6 inches of rain and the driest area in the world, growing cover crops is not a practice that really anybody uses," says Nicole Berg, vice president of the National Association of Wheat Growers, who farms near Paterson, Wash. "We basically let the land sit fallow for a year and so we plant every other year because of the moisture issues. If I were to put in a cover crop, it would take all my moisture. You need to do everything you can to keep moisture in the ground.”

Success with cover crops depends on a variety of environmental conditions and economic factors.

"I think it's important that people understand that there is an economic cost to the farm to do these things and we can do different things, but we need to factor in the economics of it,” said Cannon Michael, president and CEO of Bowles Farming Co., a diversified, 11,000-acre farming operation in California’s Central Valley.

Despite the potential profit from harvesting cover crops, plants aren’t considered cover crops under USDA rules if they are harvested. As a result, they would also be ineligible for incentive payments under existing conservation programs.

Winter wheat is considered a great cover crop on the High Plains, keeping some protection on the ground over winter. But if harvested in the spring, it would not qualify for any government incentives. Cover crops need to be terminated in time for the following cash crop to properly grow.

According to a 2014 report by USDA’s Economic Research Service, double cropping occurred on about 2% of U.S. cropland for most years between 1999 and 2012. The report noted that double cropping can provide many of the same benefits as cover crops, such as reducing the need for fertilizer and protecting soil from wind and water erosion.

Here is a look at these three ways that farmers could cash in on their cover crops:

A biofuel bonanza? Soaring soy demand puts focus on novel oilseeds

Soybean oil prices are skyrocketing on the rapidly growing market for renewable diesel, and the squeeze will get far worse if the planned production capacity comes online in the next few years. Then, there is the airline industry’s pledge to use at least 3 billion gallons of biofuel by 2030 and go carbon neutral by 2050.

Soybean oil production would have to double by 2024 just to meet the needs of the renewable diesel production capacity that’s planned or coming online, says economist Dan Basse, president of AgResource Co. That would require farmers to increase soybean acreage by 40 million acres, an impossible target given that that land is needed for corn and other crops.

But the feedstocks for biofuels will have to come from somewhere, hence the interest in oilseed cover crops.

“With the societal push and drive towards the carbon-reducing technologies, I think that creates a bright future for any technology, in this case a biofuel, that has a significant reduction in terms of carbon, which would apply for biodiesel, renewable diesel and sustainable aviation fuel,” said economist J. Alan Weber, a senior adviser to the National Biodiesel Board who joined the CoverCress board in May.

A 2020 study by McKinsey and Co. and the World Economic Forum estimates that 10 billion gallons of sustainable aviation fuel, known as SAF, could be produced globally each year from cover crops such as camelina, carinata and pennycress. By comparison, aviation used 95 billion gallons of fuel worldwide in 2019.

“If the end goal is to displace every drop of aviation fuel in the world, and it is, then we're gonna have to go well beyond existing feedstocks, but that's gonna be a generational effort,” said Gene Gebolys, president of World Energy, a longtime biodiesel producer that is now producing SAF from animal fats and restaurant grease at a refinery in California.

“Cover crops are going to be an important part of increasing yields on existing land. We can get a lot more value out of each acre of land that we have … not only in the U.S. but around the world.”

A group backed by the airlines and aircraft manufacturers, the Commercial Aviation Alternative Fuels Initiative, sees cover crops as a way to avoid the concerns about using food crops for fuel. "Because cover crops don’t interfere with traditional food crop production and provide additional production of crops on existing land, they are anticipated to have no effect on local food availability or prices and low or no induced land-use change, an important factor in the life cycle emissions calculation," the group says.

Because much of the land in one-cropping systems sits idle for part of the year, there’s lots of land available for producers in certain regions to plant oilseed cover crops. The warm climate of the Southeast makes it an ideal place to plant carinata, or Ethiopian mustard, in the wintertime. CoverCress, an oilseed developed from pennycress, has a lot of potential in the southern Midwest. And winter camelina, a hardy brassica, is being eyed as an option for parts of the upper Midwest that have a short growing season and cold winters.

"As with any crop, various cover crop solutions are better suited to different locations based on soil health/biome, growing hours/days, temperature profiles, precipitation, herbicide residues, biomass residue, etc.," Steve Csonka, executive director of the aviation fuel initiative, said in an email to Agri-Pulse. He said there is breeding work going on to develop pennycress and carinata that yields oils more suitable for jet fuel.

Puneet Dwivedi, a University of Georgia scientist who is developing carinata with $15 million in research funding from USDA, says there’s a big future market for biofuel feedstock for airports in Southeast cities such as Atlanta and Miami.

“It is putting more money into the pockets of farmers,” Dwivedi told Agri-Pulse. “In the winter months, they don't make any money. The land is sitting there doing nothing … But with carinata coming in it's a win-win for the environment, a win-win for carbon climate change and definitely win-win for farmers.”

Carinata seed can be used as a feedstock for renewable fuels. Photo: North Florida Research and Education Center, University of Florida Institute of Food and Agricultural SciencesOne company that has been working to develop a carinata seed for biofuel cover crops is Nuseed, which has distributors in several different countries. Nuseed Carinata is in its third year of commercial sales in Argentina.

Carinata seed can be used as a feedstock for renewable fuels. Photo: North Florida Research and Education Center, University of Florida Institute of Food and Agricultural SciencesOne company that has been working to develop a carinata seed for biofuel cover crops is Nuseed, which has distributors in several different countries. Nuseed Carinata is in its third year of commercial sales in Argentina.Alex Clayton, the Nuseed Carinata global business development leader, said the company is currently doing research on land in Georgia, Florida and Texas, and hopes to launch commercial programs in the U.S. within the next three years. The company has also been lobbying Congress on “the use of cover crops for advanced biofuels,” according to disclosure records.

“We would like to see biofuel policy in the U.S., in the EU and worldwide that fully recognizes the potential for Nuseed Carinata to reduce emissions, remove atmospheric carbon and restore soil carbon and health,” Clayton wrote in an email to Agri-Pulse.

“Our independently certified program requires Nuseed Carinata not displace food production, and instead contributes to it through its co-product traceable source of plant protein, or require additional farmland when it’s grown. Both are very critical to maximizing our impact on carbon reduction with minimal impact on food production.”

Meanwhile, CoverCress is targeting farmers in the Midwest. In 2021, the first year of commercial plantings for CoverCress, producers from Missouri and Illinois have planted about 500 acres of the crop.

“We can be a really important solution to this feedstock deficit that the industry faces, and we're never going to be the solution,” said DeCamp, the CoverCress president and CEO. “But our work is complementary to everything else.”

CoverCress has gained the attention of investors like Leaps by Bayer, the company's corporate venture capital group that invests in companies that “create significant breakthroughs that have a high return for society.” Derek Norman, the vice president for venture investments at Leaps by Bayer, told Agri-Pulse that he sees CoverCress as a way to help drive cover crop adoption while filling the need for renewable fuel feedstocks.

“I think that is a challenge with cover crops in general, the extra work and time cost of planting a cover crop that probably does provide longer-term agronomic benefits,” he said. “It becomes much easier, much easier to justify when you're also getting that shorter term.”

Camelina — which is similar to pennycress, but native to the colder climates of Northern Europe — is considered a good candidate for production in states with cold winters and shorter growing seasons, such as Montana, North Dakota, South Dakota and Minnesota.

In Montana and northwest North Dakota, federal crop insurance is even available for camelina.

Sustainable Oils is a subsidiary of Global Clean Energy, a company that has recently converted a refinery in Bakersfield, California, to a renewable diesel operation. Sustainable Oils has partnered with Cenex Harvest States to encourage Montana farmers to plant camelina when they otherwise would be fallowing land between crops.

Mike Karst, president of Sustainable Oils, says in Montana camelina can be planted in April and harvested in August so farmers can “come back in and plant winter wheat in behind us that same year and then have a winter wheat through the next winter season.”

Sustainable Oils had 15,000 acres in camelina in Montana last year, and Karst says he expects that figure to be “substantially higher” in 2022. Exxon Mobil has signed an agreement with Global Clean Energy to buy 5 million barrels of renewable diesel per year for five years.

Scientists with the Forever Green Initiative at the University of Minnesota project a camelina and soybean relay cropping system can produce around 130 gallons of oil per acre, compared to about 60 gallons per acre for a sole full-season soybean crop.

According to scientists with the USDA Agricultural Research Service in Ames, Iowa, the combined yields of winter camelina and soybeans were equal to or exceeded the yields of growing soybeans with no camelina.

But there are some potential downsides to planting camelina. Rob Malone, one of the ARS scientists on the project, says the soybean-camelina system can use more water, which could pose difficulties in years of water stress. Plus, the ARS research so far shows the system doesn’t reduce the loss of nitrogen from fields.

“One of the real critiques of these relay systems or double-cropping systems is they use more water, at least a little bit more water and in some years that little bit is enough to cause some water stress,” Malone said.

Meanwhile, Bayer rival Corteva Agriscience is doing research on winter canola, another oilseed that has biofuel potential in the U.S., as well as winter peas, which contain a lot of protein and can be used in livestock feed or plant-based meat products.

Research scientist Sarah Lira has been working on these projects for Corteva and said she’s heard a lot of producers express interest in the idea of adding winter crops as a second profit source.

“Diversifying their potential sources of income and having some nimbleness in reacting to the markets — that's of tremendous value to them,” she told Agri-Pulse. “They're very excited. The market needs to exist and they've also told me that, but they really like that idea.”

Bewildering array of private payment programs lure farmers to cover crops

Big corporations and entrepreneurs also are combining to drive the development of programs that will pay farmers adopt cover crops or, in some cases, buy credits for the carbon their cover crops and other practices can sequester in the soil.

Not all of these programs are the same — in fact, these programs vary drastically across the landscape. Some are specifically geared towards cover crops, while others may require producers to not only add cover crops, but several other practices like no-till.

Some programs pay farmers simply for undertaking a practice such as cover crops. Other programs pay based on the amount of carbon that they store, or sequester, in the soil. All of these programs are pointing to a future when energy companies, airlines, food companies and other sectors will routinely buy ag carbon credits to offset their own greenhouse gas emissions.

Research has found that cover crops could sequester anywhere from 0.16 to 0.77 metric tons of carbon dioxide equivalent per acre, according to a report by the American Farmland Trust. When combined with no-till and strip-till practices, the carbon sequestration potential rises to a range of 0.76 to 1.13 tons per acre.

Several major companies, including PepsiCo, ADM, Bunge, Bayer, Cargill, Unilever, and Lifeline, have already partnered with a farmer-led organization, Practical Farmers of Iowa, to pay farmers specifically for planting cover crops. These programs are offered to producers through the companies and grain elevators they sell to and though they vary somewhat, almost all of them offer farmers a $10-per-acre payment on up to 200 acres.

Don’t miss a beat! It’s easy to sign up for a FREE month of Agri-Pulse news! For the latest on what’s happening in Washington, D.C. and around the country in agriculture, just click here.

“It doesn't cover everything,” Lydia English, strategic initiatives coordinator at Practical Farmers of Iowa, told Agri-Pulse. “But it helps lower the economic barrier for sure, which can be great, especially for those folks that might be newer and haven't recouped costs in any other way yet.”

Research has shown that it can take up to eight years for the agronomic benefits of cover crops to start to cover the costs, said Shalamar Armstrong, a Purdue University economist.

“If these farmers can have some kind of resources coming back … that’s going to ease the risk,” he said.

Producers enrolled in these programs can also receive funding from government programs and can stack these payments to help cover their expenses. However, participating producers are not allowed to enroll in other private incentive programs.

Additionally, producers are required to follow various rules like attending soil health field days, participating in surveys, providing documentation of the cover crop acres they farmed and discussing a cover crop plan with a PFI agronomist.

“We're flexible on what they seed and when they seed it, how they do it, whether it's an overwintering species or a winter kill species,” English said. “We just want them to do cover crops and to be happy with that system.”

Other programs are broader and incentivize several practices, including cover crops, based on a specific environmental goal. Some of the clearest examples of this are carbon capture programs, which pay producers with the intention of sequestering carbon.

These programs have become increasingly more prevalent as talk of the need to sequester carbon to counter the effects of climate change has become more prominent. Companies like Bayer, Indigo Ag, Corteva and the Land O’ Lakes subsidiary Truterra, have launched their own carbon programs to pay producers for carbon sequestration practices.

Truterra’s 2021 program, launched in February, paid farmers $20 per ton of carbon they have sequestered by adding management practices like reduced tillage, no-till or cover crops, which they measured through crop modeling and in-field sampling. The program has distributed more than $4 million in cash payments and, on average, participating farmers received $20,000 in the program.

“The carbon program is based on a measured and a model approach where we use actual soil samples to calibrate [our model],” Anthony Robertson, a supply chain manager at Truterra, told Agri-Pulse.

The 2022 iteration of the program will also feature a second approach that will pay farmers looking to implement practices like cover crops for the first time by providing them with one-time payments of up to $2 per acre and offering them support services to help with the transition.

“It's going to be a market access program where we're working with growers to, one, help them find the financial assistance and support that they need [and] two, we're trying to make sure that they have the right conservation agronomy support,” Robertson said.

Nick Smith, who farms with his dad and brother in Epworth, Iowa, told Agri-Pulse that their farm is enrolled in the Truterra program. Through the program they are getting a total of $5,000.

Smith said he’s still a little “green” on the program because this is the first year the farm is enrolled.

“I think the intention is good and the goals are good,” he said. “I don't know where their money comes from, but again, I think that the intention's a good one for sure.”

Corteva is another company that has become actively involved in the carbon market. Corteva’s Carbon Initiative pays farmers a guaranteed $15 per carbon credit for practices like reduced tillage, cover cropping and reduced applications of nitrogen, though the company says on its website that it projects most farmers to receive about $30 per credit. These credits are measured and verified through sampling and certification conducted by program partners Corteva and Indigo Ag.

“We pay on outcomes, we pay per ton. Which means that if for some reason you need to change your agronomic plan to not include a cover crop ... that's just fine,” said Ben Gordon, the carbon and ecosystem services global portfolio leader at Corteva. “You're not going to get paid, but there's not going to be any penalty.”

The credits are then sold to buyers in Corteva’s network. Producers in the program do sign a 5-year contract, but they can opt out of the program at any time. However, doing this means that they forfeit any unvested payments.

A similar program headed up by the Soil and Water Outcomes fund exists; however, this program is not just targeted towards sequestering carbon. It also aims to improve water quality.

Adam Kiel, the executive vice president of AgOutcomes and a co-administrator of the program, said it has the same principles as a carbon program and the payments that are distributed to farmers are based on environmental outcomes.

“Farmers need to add something new to their operation,” Kiel said. “That could be a cover crop, that could be no-till, it could be something else. We collect a fair amount of data from farmers about what they do in those fields, we model that to come up with estimates of what the environmental benefits are and then we structure a customized payment to that farmer based on what those outcomes are.”

Outside of cover crops, the program also incentivizes farmers to add an extended rotation, convert a field into a perennial crop, and implement no-till. According to the fund’s website, participating farmers sign one-year annual contracts and can re-enroll if they are willing to continue or include more practices.

According to Kiel, about 120,000 acres of land in the United States were under contract in the program this year, with the average farmer payment at around $35 per acre. There is also no acre cap per farmer, though enrollment does close once the acre goal for the year is reached.

“I feel like the Soil and Water Outcomes Fund is the closest thing to an environmental market,” Kiel said. “The more bushels of corn they produce, the more potential revenue there. Think about it, what we're doing here, the more environmental benefit there is, the more financial gain there is.”

Cover crops as cattle feed can pay off quickly

According to the USDA-funded Sustainable Agriculture Research and Education Program, grazing cover crops is one of the best ways to provide a positive first-year return.

In a cover crop budget model, SARE estimates that producers could bring in an extra $49.23 per acre per year from grazing a cereal rye cover crop instead of hay when assuming that hay is valued at $80 per ton and that the grazer already has a fence and water access in their grazing area.

“Whether grazing cover crops pays back the first year depends on the amount of cover crop growth, the length of the grazing period and the costs for fencing and a water supply, if those are not already in place,” SARE researchers said in an article on the organization’s website. “Where grazing infrastructure is present, even a modest amount of grazing from cover crops will normally pay for seed costs while also providing some soil improvements.”

A study conducted by Practical Farmers of Iowa calculated a profit of $71.81 for every 1,000-pound animal unit that producers could gain. South Dakota State University researchers found utilizing cover crops for grazing would increase the profit of a farm by $17.23 per acre in the first year of planting and $43.61 per acre in the second year.

Texas A&M University research found grazing summer cover crops could increase net return by as much as $38 to $44 per acre, compared to non-grazed cover crops.

A farmer who will attest to the benefits of mixing cattle and cover crops is Kent Wasson, who grows wheat and raises about 500 head of Black Angus cattle near Whitehall, Montana. He uses a multispecies mix of cover crops that includes legumes, vetch, radishes, turnips, cowpeas, chickpeas and several brassicas.

Wasson said that in 2016, one of his most successful years planting cover crops, some of his calves weighed around 450 pounds when he moved them to the field to graze cover crops in mid-September. By Halloween, he said some of them weighed up to 662 pounds, an increase of about four pounds per day that Wasson said he doesn’t even see in a feedlot.

While he hasn’t seen a year quite as successful as 2016, Wasson said the 200 calves he has grazing cover crops this year have likely gained around two pounds based on his own eye.

“You get a payback way quicker with the cattle in the same year,” he said. “If you can gain a half a pound a day on the calves on cover crops, you're gaining 80, 90 cents a day per calf. I think that's the way that we recover our money quicker.”

Ben Dwire, who follows a corn-soybean-small grain crop rotation on land west of Marshall, Minnesota, usually seeds two-thirds of his acres with cover crops. He said in a normal year, he can save between 70 cents and $1.50 per head per day if he grazes cover crops instead of buying hay. In addition, the manure the cows leave behind helps reduce the amount of fertilizer needed later on.

“When I graze the cattle out here, everything they eat gets deposited right back,” Dwire said. “They're probably only going to walk off 5% of the nutrients that they consumed as animals. 90 to 95% of it's deposited right back on the field.”

However, Dwire said the economic benefit grazing cover crops provides him varies from year to year. Cover crops require water to grow, so during periods of drought when there is less growth, there will be less for the cattle to eat.

“It is fully dependent on how much rain you get,” he said.

Cattle graze in a cover-cropped field. Photo: Ben Dwyer

Cattle graze in a cover-cropped field. Photo: Ben Dwyer

Dwire also rents out some of his cover crop acres to his neighbor for grazing, which brings him an extra $35 to $40 per acre. Plus, since he charges roughly $1.30 per pair, it can help save his neighbor some money as well.

“He's saving anywhere between 70 cents and $1.50 per cow by grazing on the cover crops and I'm getting a little extra money off of my cover crops,” he said. “It helps pay for the seed for me.”

Previously, RMA reduced prevented planting payments by 65% if producers hayed, grazed or chopped cover crops before Nov. 1, but the agency changed the rule this year and opened up the program to allow producers to receive 100% of the payment, even if they hayed, grazed or chopped before the deadline.

“We are dedicated to responding to the needs of producers, and this flexibility is good for agriculture and promotes climate-smart agricultural practices,” Richard Flournoy, the acting RMA administrator at the time. “We are glad we can better support producers who use cover crops.”

In semiarid and arid regions of Texas where water is scarce, Texas A&M soil scientist Paul DeLaune said planting cover crops for grazing is how cover crops “make the most sense” for producers in the region.

“I believe if done correctly, it can provide a soil health benefit as well as economic incentive to producers,” he said.

However, many factors impact the moneymaking potential of that system. Cattle producers need to consider how many cattle they put on cover crop acres and for how long they graze because too intensive of grazing can diminish the amount of biomass in the soil, which, in turn, eliminates some of the soil health benefits of cover crops. Additionally, the costs of fencing and providing water for the cattle can reduce the economic viability of cover crop grazing in expansive and dry regions.

Producers “need to make money if they're integrating cattle and sometimes that takes some time,” DeLaune said. “So it kind of goes back to the logistics of not only fencing, but water sources. You have to work within the environment that you have.”

Amy Mayer contributed to this report.

Next: A look at the policy barriers facing cover crops, the current and potential government incentives that farmers could claim, and how planned policy changes could backfire on farmers and the government.

For more news, go to www.Agri-Pulse.com.