The Biden administration is looking to farmers to help alleviate global food shortfalls by planting winter wheat this fall on ground that’s coming out of the Conservation Reserve Program, but much of the acreage lies in states that are suffering from prolonged drought.

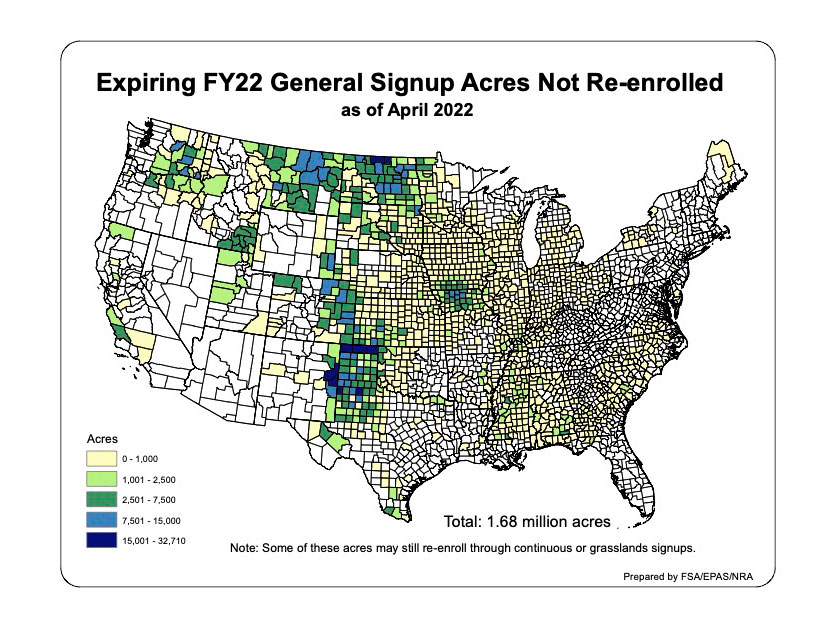

About 1.7 million acres of CRP land are under contracts that expire Sept. 30 and aren’t being renewed by the landowner. That could make it available for planting as soon as this fall if Agriculture Secretary Tom Vilsack follows through on plans to allow landowners to start preparing the land for planting before the contracts formally expire.

Texas has the largest share of those expiring CRP acres, 300,113 acres, while 111,357 are in Colorado, 90,395 in Kansas and 82,083 in Oklahoma, all states affected to varying degrees by the ongoing drought, according to data obtained by Agri-Pulse.

Those four states accounted for nearly half the U.S. production of winter wheat that was harvested last year.

Recent USDA reports have only heightened concern about U.S. wheat production.

Last week, USDA forecast winter wheat production would drop 8% this year, largely because of the drought, and USDA reported Monday that only 39% of the spring wheat crop had been planted by the end of last week. The five-year average planting pace at this point in May is 67%. Only 17% of North Dakota’s crop and 5% of Minnesota’s spring wheat crop has been planted.

Of the 10 counties with the largest number of acres coming out of CRP, seven are located in Oklahoma, New Mexico and Texas and are rated as in either “extreme” drought, which is designated as D3, or “exceptional” drought (D4). More than two-thirds of the 50 counties with the largest amount of acreage leaving CRP are rated in D2 drought or worse.

Curry County, New Mexico, which has 32,710 acres leaving the program, the most of any county, is rated D4, while No. 2 Quay County, New Mexico, is rated as D3 with 28,547 acres.

Across the border in the Texas panhandle, Bailey County has the third-largest number of acres leaving the program with 27,017 and is also rated as D4. Next are Beaver County (D3), Oklahoma, with 21,587 acres and Floyd County (D4), Texas, with 19,058 acres.

David Cleavinger, who farms in Oldham County west of Amarillo, Texas, says there's been no measurable rainfall in his area since last fall, and livestock feed prices are so high he's planning to cut his winter wheat crop for feed. He said he doesn't expect much of the exiting CRP acreage to be planted to wheat this year, partly because it takes two to three years to make the soil productive again after it's been in grass for an extended time.

While high wheat prices may induce some farmers to increase winter wheat plantings, the Ogallala aquifer that supplies the region's irrigation water is already depleted, making it difficult for farmers to irrigate more land than they already are, he said.

"I don’t see anybody much going out of their regular (crop) rotations. The drought has had a big impact," Cleavinger said.

North Dakota has the second-largest amount of expiring CRP acreage that wasn’t re-enrolled in the program with 234,137, but farmers there produce spring wheat — not winter wheat — so that state’s CRP acreage likely won’t be planted before the spring of 2023.

Montana and Washington could help make up some winter wheat production. Montana has 126,285 acres of CRP land leaving the program, while Washington has 58,126. The two states harvested about 3.4 million acres of winter wheat in 2021 of the 25.6 million harvested nationwide.

Another state that could help is drought-free Missouri, which has 130,661 acres leaving CRP but little recent history of growing the crop; producers in the state harvested just 490,000 acres last year, less than 2% of the U.S. total.

Economist Dan Basse, president of AgResource Co., estimates that 350,000 to 400,000 acres of the expiring CRP acreage will be planted to wheat. That’s “not much of a help,” he said, and most of that additional acreage is likely to be planted to white wheat varieties, which are used for products such as noodles, cookies and crackers.

Joe Glauber, a former chief economist at USDA who is assisting the UN Food and Agriculture Organization in tracking the impact of the war on global food supplies, said the biggest deterrent to wheat production isn’t drought but the high cost of fertilizer, as well as high prices for corn and soybeans that make those crops more appealing to growers.

Looking for the best, most comprehensive and balanced news source in agriculture? Our Agri-Pulse editors don't miss a beat! Sign up for a free month-long subscription.

Still, Glauber said, “Rain would certainly help improve conditions.”

Former USDA Chief Economist Joe Glauber

Former USDA Chief Economist Joe Glauber

July futures for Kansas City hard red winter wheat closed at $13.68 a bushel on Tuesday, up from $7.88 on Feb. 1. But corn futures are up from $6.28 to $8.01 a bushel over the same period, and soybean futures closed at $16.78 a bushel on Tuesday.

Agriculture Secretary Tom Vilsack also hopes to spur more winter wheat planting by expanding the number of counties where double-cropping soybeans after winter wheat is insurable. USDA’s Risk Management Agency is considering approving the insurability of double cropping in as many as 681 additional counties, which would bring the total eligible counties to 1,935.

RMA hasn’t said what additional counties are under consideration.

Missouri had at least 285,000 acres of insured, double-cropped soybeans in 2021, but most of that was concentrated in the southeast and southwest corners of the state, according to RMA data provided to Agri-Pulse.

Missouri’s expiring CRP acreage, on the other hand, is concentrated in the north-central portion of the state. Blake Hurst, former president of the Missouri Farm Bureau, told Agri-Pulse most of that land would likely be planted to corn and soybeans next year.

Kansas had more than 609,000 acres of double-cropped soybeans, with the vast majority concentrated on the state’s eastern side. The state’s expiring CRP acres are concentrated on the western side.

The administration also is planning to help farmers maintain crop production and cope with soaring fertilizer costs by enhancing incentives in the Environmental Quality Incentives Program and Conservation Stewardship Program.

The Natural Resources Conservation Service hasn’t provided any detail on how those changes will work. In a statement, the department said increased use of nutrient management, pest management conservation systems and conservation tillage can “help save farmers money and also address resource concerns.”

“For the 2023 crop year NRCS will be rolling out new strategies and streamlined options to increase utilization of these tools, expedite the enrollment process, reach new producers, and prioritize key practices,” the statement said.

Both programs are already heavily oversubscribed. USDA only approved 27% of the 33,701 farmers who applied for contracts in 2020, according to statistics compiled by the Institute for Agriculture and Trade Policy, while USDA awarded CSP contracts to 25% of the 27,110 applicants that year.

Cover crops were by far the most popular practice used by farmers in the EQIP program in 2020, with 79,014 contracts being awarded to fund them. Nutrient management practices were covered by 22,415 contracts,

In concert with the administration's initiative, the House Agriculture Committee on Tuesday advanced a bill sponsored by Rep. Josh Harder, D-Calif., that would authorize the appropriation of $750 million to USDA to cover the full cost of nutrient management practices under EQIP in 2022 and 2023.

For more news, go to Agri-Pulse.com.