More than 1,200 exhibitors pitch products, solutions and ideas every year at the World Ag Expo in Tulare. Tucked within the booths of the farm show’s enormous dairy pavilion, agriculture associations and economic development councils from Midwest states are promising something potentially more valuable: fewer regulations. But that may not be enough to attract younger dairy farmers who are adopting more innovative approaches to survive in California's changing and costly business climate.

“We pride ourselves on the fact that we're an ag-friendly state,” said Nikki Pfannenstiel, who serves on the board of the Western Kansas Rural Economic Development Alliance. “One of the things we're really proud of in the state of Kansas is that we've been managing our water resources for a long time.”

About 30 years ago, western Kansas had no large dairies but today boasts 22 operations. Nebraska is also developing its dairy industry, though its representatives at the expo held more hope in partnering with California dairy farmers on new warehouses or a second facility, rather than relocating entirely to the cornhusker state. Like Nebraska, Iowa is increasingly playing host to new processing facilities for California dairies, building on many family connections that dairy farmers in northwestern Iowa maintain with California—while also capitalizing on lower energy rates. Water and feedstocks have been the top concerns shared with Brian Tapp, vice president of value-added agriculture at the Iowa Area Development Group.

Marv Post, a dairyman and president of South Dakota Dairy Producers, told Agri-Pulse the number of dairy cows is growing in his home state along with dairy processing and infrastructure along the 1-29 corridor, which borders the eastern side of the state.

According to the National Agricultural Statistics Service, total milk production in South Dakota in November 2022 was pegged at 348 million pounds, up 11% from November 2021. the number of dairy cows increased 19,000 from the previous November.

California farmers approaching Kurt Olsen, chairman of the Missouri Dairy Growth Council, typically ask about water availability first, then wonder if state policies are supportive of the industry and where the dairy markets exist for the region.

“We have a very standard open policy,” Olsen told Agri-Pulse. “We welcome animal agriculture. We have complete legislation that has one set of rules and regs for every livestock sector to adhere to.”

He added that the state has a net water surplus, averaging about 43 inches of rainfall per year, which propels plenty of livestock feed. And Missouri has more consumers than available milk. Olsen has observed the farmers who reach out to him today tend to be younger.

Yet younger producers offer the most opportunity for California to remain a top dairy state. According to Western United Dairies CEO Anja Raudabaugh, new leaders are striving for creative and often technologically advanced ways to open new dairies in the Golden State. California’s strategic coastal position, with exports to Pacific Rim countries, has kept demand profitable and high.

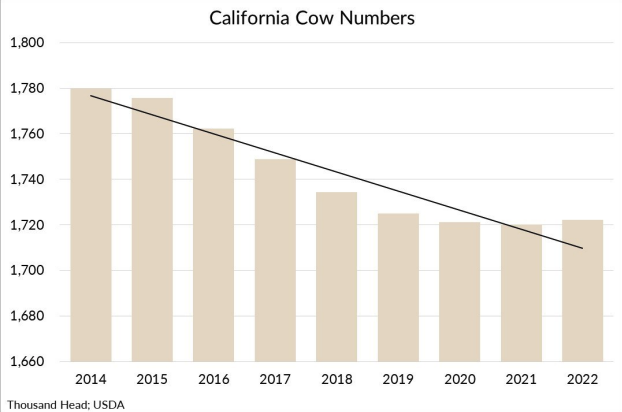

California's dairy herd has declined even though productivity gains resulted in higher milk production. (graph: Western United Dairies)

California's dairy herd has declined even though productivity gains resulted in higher milk production. (graph: Western United Dairies)

At $7.5 billion in cash receipts for milk production, the state continues to dominate the dairy industry, accounting for more than 18% of the nation’s supply. Milk remains the state’s leading commodity. New advancements in genetics and feed have increased the output. Since the pandemic, demand for fluid milk has tripled, owing to state policymakers adopting the nation’s first school program for free and reduced breakfasts and lunches for any child in the home up to age 21. Global dairy consumption, meanwhile, is up 400% since consumers began shifting away from restaurants and to home cooking and fast casual in 2020.

To Raudabaugh, the issue is much more complex than dairies simply moving to other states. California has long garnered a reputation as a difficult state to do business. While some dairy farmers have left the state, many others have retired or not reinvested in their business, leading to sweeping industry consolidation. While overall revenues have increased, the size of California’s dairy herd has dropped by about 30,000 cows over the last decade, according to USDA statistics. South Dakota’s herd has nearly doubled in that time and Texas farmers have purchased many of California’s cows over the years, noted Raudabaugh.

The water crisis has taken a mental toll on farmers as well. Many told Raudabaugh last fall the situation was the worst they had ever seen, extending beyond the “horror stories” of 2009. The drought has sent feed prices soaring, and another bad water year would have raised costs even further. Without the record precipitation last month, many farmers would be retiring right now, she explained. Farmers are now expecting two or three wheat crops this year.

Yet the state is still trending towards fewer dairies and more consolidation. The herd will stay about the same size, while the number of dairies will eventually drop well below 1,000, she surmised.

Along with water shortages, farmers face a bevy of environmental regulations, ranging from limits on nitrate contamination in groundwater to the world’s first mandate on reducing methane emissions.

“California has generally adopted a broadscale policy that really is antagonistic to what people deem as polluters,” she said. “You have a lot of pressures, especially on dairies, that not everybody faces across the West or even in the United States.”

Don’t miss a beat! It’s easy to sign up for a FREE month of Agri-Pulse news! For the latest on what’s happening in Washington, D.C. and around the country in agriculture, just click here.

But the greatest threat is urban development, with California losing about 50,000 acres of farmland per year, according to the California Strategic Growth Council. As the most populous state in the union, it has been ground zero for the affordable housing crisis. In response, the Legislature mandated in 2019 that every municipality increase housing 30% by 2030, adding millions more homes in a short time span.

Western United Dairies CEO Anja Raudabaugh

Western United Dairies CEO Anja RaudabaughRaudabaugh worries that will force coastal cities to expand further into agricultural regions, adding more pressure on land values, water constraints and air quality litigation from environmental justice organizations. She cited Chino in western San Bernardino County as a case in point, describing how large dairies there have moved to remote—and cheaper—land parcels in Kern and Tulare Counties. She thinks the same will happen to Bakersfield, Modesto and Merced in the San Joaquin Valley.

Those larger dairies, however, have pumped more groundwater during the drought to support their new dairy digesters and local agencies are setting new restrictions on pumping to balance aquifers under the Sustainable Groundwater Management Act. Yet those with strong surface water rights, particularly in the northern end of the valley, are seeing their land values rise astronomically.

Raudabaugh and other dairy advocates have been heavily lobbying the Newsom administration on the role of dairies in reducing greenhouse gas emissions. The livestock sector has nearly achieved the state’s goal of reducing methane emissions 40% by 2030. Since setting that target in 2016, the state has invested $385 million in digesters and alternative manure management practices. But if more milk production moves out of state, those digesters could shutter and the state could fall behind on its goal, Raudabaugh and others have warned. The Air Resources Board, meanwhile, is recommending the state remove dairies from the Low Carbon Fuel Standard by 2030, despite documented achievements in reducing pollution.

Yet Raudabaugh is cautioning farmers to do their homework before expanding into states like Arizona and Texas.

“Their legislatures are working on adopting groundwater mandate laws and adjudications,” she said. “As usual, what starts in the West continues to spread east. There is no silver bullet here.”

For more ag news, go to www.Agri-Pulse.com.