The controversial idea of requiring farmers to update the base acreage that they use to qualify for commodity payments has gotten a fresh boost with the endorsement of the National Corn Growers Association. Members of the group believe the savings from a mandatory base update could be used to fund increases in commodity program reference prices, a top priority for many farm groups.

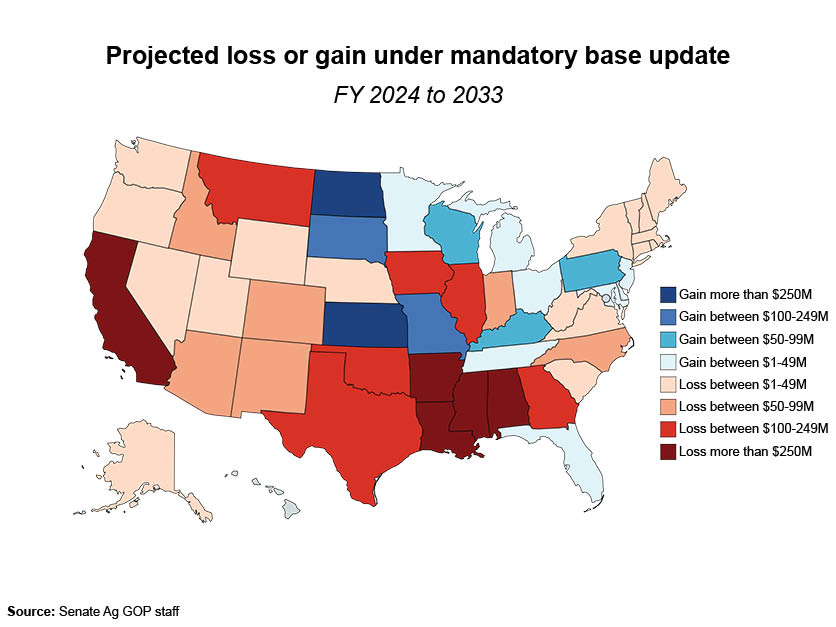

However, an analysis by the Senate Agriculture Committee’s Republican staff shows a mandatory base update would have a widely disparate impact on states and commodities.

According to the analysis obtained by Agri-Pulse, farmers in 34 states would miss out on a combined $3 billion in farm program payments over 10 years, reflecting changes in cropping patterns over the past two decades since the current allocation of base acreage was largely fixed. Sixteen states would collectively gain $1.1 billion, leaving a net savings of $1.9 billion over 10 years that could be reallocated in the farm bill.

The biggest change of all would be in California, where farmers have cut back dramatically on program crops such as cotton, rice and wheat that were grown between 1998 and 2001, the period in which base acreage was originally allocated. California would lose $457 million, followed by Louisiana at $329 million. Arkansas, the home state of Senate Ag’s top Republican, John Boozman, would lose $314 million, and Mississippi would drop $271 million.

Kansas would be the biggest winner, gaining $286 million in payments, followed by North Dakota ($258 million), South Dakota ($133 million) and Missouri ($131 million). But the results are otherwise mixed across the Midwest and Plains. Illinois farmers, for example, would lose a net $181 million, while Iowa growers could see $176 million less.

A mandatory base update would be a virtual wash for Michigan, home state to Senate Ag Chairwoman Debbie Stabenow. Michigan would gain an estimated $7 million, or just $700,000 per year.

Boozman told Agri-Pulse he considered the possibility of a mandatory base update for the savings it would generate but now believes it is a “non-starter for most of agriculture.”

“There are some winners, but there are some big losers, and those are not red states, those are red and blue states,” Boozman said, referring to the potential loss of payments to predominantly Democratic states such as California as well as Republican states. There also would be winners and losers within states, depending on the mix of crops and base acreage in a particular area, he noted.

Commodity payments have been tied to a farmer’s base acres since the 2002 farm bill. Tying payments to base acres, rather than planted acres, is supposed to ensure that farmers make planting decisions based on market prices rather than on prospects for government payments. But cropping patterns have shifted significantly since that bill was enacted.

In 2022, USDA reported that farmers planted or were prevented from planting 87.5 million acres of soybeans, but there were only 53.2 million soybean base acres enrolled in ARC and PLC. Farmers planted or were prevented from planting 48.6 million acres of wheat, far short of the 62.5 million acres of wheat base. Similarly, while farmers hold 4.6 million rice base acres, growers planted or were prevented from planting just 2.8 million acres of rice.

In California, for example, cotton has all but disappeared over the past two decades as farmers switched to almonds and other crops, and producers can continue getting payments on their base acreage.

Don't miss out sign up for a FREE month of Agri-Pulse news! For the latest on what’s happening in Washington, D.C. and around the country in agriculture, just click here.

In 2000, California farmers planted 940,000 acres of cotton. This year, that figure dropped more than 90% to 83,000, according to USDA. Wheat plantings in California fell from 600,000 acres in 2000 to 355,000 this year, and rice acreage dropped from 550,000 in 2000 to just 256,000 acres last year before rebounding to 478,000 this year.

California has 1.7 million base acres, 28% of which are in rice, 25% in wheat and 21% in cotton, according to a recent University of Illinois analysis conducted by Jonathan Coppess, an administrator of USDA's Farm Service Agency during the Barack Obama administration and former Democratic aide to the Senate Ag Committee.

Meanwhile, many farmers in the northern Plains are growing significantly more corn and soybeans than they did two decades ago.

Farmers in North Dakota, for example, seeded 3.9 million acres of corn this spring and less than 6.5 million acres of wheat, compared to 10.4 million acres of wheat and only 1.1 million acres of corn in 2000.

North Dakota has 17.6 million base acres, 53% of which are in wheat and 16% are in corn, according to the Coppess analysis.

The National Corn Growers Association’s new position on a mandatory base update originated with the South Dakota delegation to NCGA’s annual Corn Congress in July.

Dave Ellens, president of the South Dakota Corn Growers Association, told Agri-Pulse the ultimate goal of an update is to produce savings that could be plowed back into commodity programs. The resolution was adopted overwhelmingly.

A base update would especially help farmers with acreage that isn’t eligible for program payments because it lacks base.

“Thanks to better genetics and some tillage practices, we've been able to grow more corn,” Ellens said. “There's guys that are planting corn on these fields, and there's no corn base for protection.”

South Dakota has 11.7 million base acres, 43% of which are in corn, 28% in soybean and 25% in wheat, according to the Coppess analysis. Farmers there planted 6.2 million acres of corn this year, up from 3.6 million acres in 1999 and 4.3 million acres in 2000. South Dakota wheat plantings, meanwhile, have fallen from 3.1 million acres in 2000 to fewer than 1.7 million this year.

The ultimate impact on states and individual farmers would depend on the modifications lawmakers make with the savings to the formulas for the Price Loss Coverage and Agriculture Risk Coverage programs. PLC triggers payments when the average market price for the year falls below the commodity’s reference price. ARC provides payments when county revenue for a commodity falls below a five-year average for local revenue.

Texas A&M University economist Bart Fischer, who was a top GOP aide to the House Agriculture Committee when the 2014 and 2018 farm bills were enacted, said the impact of a base update could vary widely even within a single county. And lawmakers would have no way of knowing ahead of time who the winners and losers would be among their constituents.

For that reason, Fischer thinks lawmakers will be wary of doing anything other than a voluntary base update, which would likely increase the cost of commodity programs. Lawmakers presumably would only change their base acreage allocation if they believed it could increase their payments.

“If you force a base update, a mandatory base update, there'll be winners and losers everywhere,” Fischer said. “Members of Congress don't like voting on things where they don't know how people are going to be impacted.”

Other commodity groups have held to the position that a base update should be voluntary, including the American Soybean Association, which has been one of the outspoken groups advocating for an increase in reference prices.

Otherwise, requiring soybean growers to update base acreage could cost them base for a commodity such as wheat for which they are much more likely to get payments than they are with soybean base under current policy.

ASA's request for a voluntary base update “is paired with other improvements in Title I to remove the disincentives to enrolling soybean base,” said ASA economist Scott Gerlt. “The reference price for soybeans has never been effective, and ARC benefits are capped at low levels.”

The National Association of Wheat Growers wants to retain historical base acreage while allowing farmers to obtain new base.

“One of our concerns with a mandatory base acre update is that it pits commodities and growers against each other and does not get at the root need in the next farm bill: strengthening the farm safety net to protect all farmers and commodities more effectively and better adjust to market conditions," said NAWG CEO Chandler Goule.

For more news, go to Agri-Pulse.com.